Myth of Money: SEC Investigates NFTs

Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 12,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your research.

Dear Investors,

Yuga Labs, the founding company behind the Bored Ape Yacht Club NFTs is being investigated for an unregistered sale of securities.

What does the Web3 community think of this? The below tweet summarizes it all.

According to Coindesk:

At issue … is whether some of Yuga’s non-fungible tokens are closer to stocks and thus should follow the same disclosure rules. The key legal question at the center of the probe … is whether NFTs are securities – a question the SEC has reportedly been investigating since March. People familiar with the matter said at the time that NFT creators and crypto exchanges were being looked at.

The SEC is also reportedly looking into how ApeCoins, the Ethereum-based governance and utility tokens used within the APE ecosystem, were distributed to holders of Bored Ape Yacht Club, Mutant Ape Yacht Club and Bored Ape Kennel Club members. The tokens were first announced in March with the establishment of the community-driven ApeCoin DAO and the Ape Foundation. Sixty-two percent of the fixed one billion supply of ApeCoins was allocated to the ApeCoin community, including 15% airdropped to existing NFT holders. Additional percentages of tokens were allocated to Yuga Labs and the Jane Goodall Legacy Foundation, alongside launch contributors and the four founders of Bored Ape Yacht Club.

The SEC has investigated several projects this year, as the regulatory body responsible for protecting investors’ funds, and maintaining fair and orderly markets.

In the case of Yuga Labs, the SEC’s interest was peaked by the resemblance of these NFTs to investment contracts.

“It’s well-known that policymakers and regulators have sought to learn more about the novel world of Web3. We hope to partner with the rest of the industry and regulators to define and shape the burgeoning ecosystem,” Yuga Labs told Bloomberg in a statement. “As a leader in the space, Yuga is committed to fully cooperating with any inquiries along the way.”

Yuga Labs has not yet been accused of any wrongdoing and the investigation may not necessarily lead to charges.

In justifying the recent crackdown on digital assets, SEC Chair Gary Gensler has cited several laws and precedents, including the Securities Act of 1933; the Investment Company Act of 1940; and the 1946 Supreme Court case SEC v. Howey, in which the bench found that financial transactions qualify as “investment contracts” if a person puts money into a common asset with the expectation of turning of a profit.

Under this framework, Gensler has argued, NFTs, cryptocurrencies, and other digital assets qualify as securities.

TL:DR on BAYC

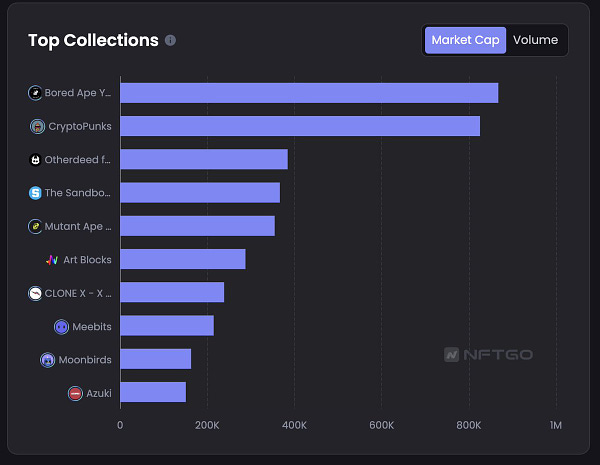

Bored Ape Yacht Club is one of the most successful NFT projects to date, with the main collection of 10,000 NFTs initially selling to the public at $190 a piece (ethereum equivalent). That sale yielded Yuga roughly $1.9 million. Follow-up and spinoff projects, the Mutant Ape Yacht Club and the Otherside metaverse game, then raked in $96 million and $319 million, respectively. BAYC has also generated nearly $2.5 billion worth of secondary trading volume. Mutant Ape Yacht Club and Otherside have added another $3.35 billion worth of secondary trading volume to that tally. Yuga Labs earns a 2.5% royalty fee on each of those sales.

Officially, ApeCoin was not created or launched by Yuga Labs—it was issued by the Ape Foundation, which is fronted by a board that includes prominent Web3 builders like Reddit co-founder Alexis Ohanian and FTX Ventures head Amy Wu.

That approach was apparently chosen due to regulatory concerns, although the SEC is still investigating the launch and distribution of the token. Yuga Labs and its founders have benefited greatly from the launch of ApeCoin, which has a current price of about $4.75 per token and a market cap of over $1.5 billion.

This Week By the Numbers 📈

The annual U.S. inflation rate came in higher than expected in September, hitting 8.2% year over year compared with August's 8.3% reading as prices continue to rise, causing continued pain for most American households. High prices for food, shelter, and medical care sent the consumer price index for September up by 0.4%, compared to August's 0.1%, according to data the Bureau of Labor Statistics.

Leading the food price increases over the past 12 months: margarine, up 44%; flour and prepared flour mixes, up 24.2%; frozen and refrigerated bakery products like pies, tarts and turnovers, up 20.4%. While the collective category of meats, poultry, fish and eggs rose by 9% compared to September 2021, the price of eggs by itself is up 31% year over year.

But Europe has had it worse than the United States. According to Lyn Alden:

With Russia eliminating their gas flows to Europe, it resulted in skyrocketing natural gas prices, and by extension, electricity prices.

Due to this, the Netherlands currently has 14% official inflation, which is higher than any point they reached in the 1970s.

Poland has 17% year-over-year inflation. Germany’s inflation is 10% and climbing, and Italy’s is 9% and climbing.

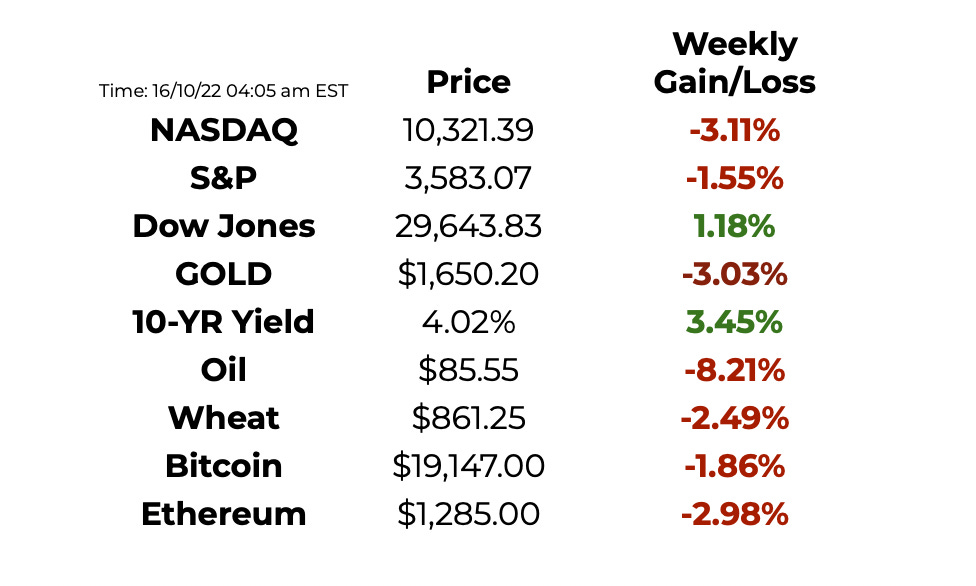

Markets remained relatively stable this week across the board, with Oil facing the most notable correction of -8.21%.

Top Stories 🗞️

Academy Award winner Anthony Hopkins sells out his NFT collection in minutes

Oscar award-winning actor Sir Anthony Hopkins has sold out his debut NFT collection “The Eternal Collection” in under 10 minutes. The collection, created in partnership with Orange Comet Inc, an NFT, and Web3-focused design agency, features 1000 original cinematic art pieces inspired by different performances within the actor’s long career. According to the collection’s description on OpenSea, the body of work “conceptualizes an interpretation of the vast character archetypes Sir Anthony Hopkins has portrayed over his illustrious film career, drawing its potent energy from his stimulating body of art.”

Uniswap Labs raises $165M as attention shifts to NFTs, Web3

Decentralized exchange Uniswap Labs has raised $165 million in a Series B funding round that had participation from some of blockchain’s biggest venture firms, putting the company on track to expand into other crypto-focused domains. The funding round was led by Polychain Capital with additional participation from several existing investors, including Andreessen Horowitz, Paradigm, Variant, and SV Angel. The funding round confirms earlier reporting from Cointelegraph that Uniswap was looking to raise between $100 million and $200 million. Uniswap said the funding would go toward expanding its existing product offerings and improving the user experience through new web applications, developer tools, and a shift toward mobile. The company also plans to launch future nonfungible tokens (NFTs) projects.

Tether Says USDT Stablecoin Now Backed by T-Bills

Tether reports it has eliminated commercial paper from its stablecoin reserves, ending a years-long relationship with the investment vehicle that had partially backed its crypto. The issuer said Thursday it has replaced the paper with US Treasury Bills — short-term government-issued debt securities — as part of ongoing efforts to increase transparency. Tether also said the move would help shore up trust in its stablecoin (USDT) while demonstrating its commitment to backing its tokens with more secure assets. Controversy over the use of its commercial paper, as well as the certainty of assets backing USDT, has dogged the issuer ever since its inception almost a decade ago.

UK Finance Minister Kwarteng Fired

U.K. Finance Minister Kwasi Kwarteng has been fired by Prime Minister Liz Truss after the tax cuts he announced in September sent financial markets into a tailspin. In a resignation statement posted on Twitter, Kwarteng said it had been an “honor to serve,” albeit he did so for only 38 days. His departure leaves the fate of draft laws to regulate stablecoins in the hands of former Foreign Minister Jeremy Hunt, who was named to replace Kwarteng shortly after.

Binance Pool’s $500M initiative to aid Bitcoin Mining Industry

In a recent blog post, Binance Pool revealed that it formulated a $500 million lending project for Bitcoin miners. This included both private and public miners. Through this initiative, the exchange intends to provide loans to these miners. However, the miners will be required to present security to attain the loan, which will last between 18 and 24 months, in the form of tangible or digital assets. In addition to this, these loans will entail interest rates ranging from 5 to 10 percent. This wasn’t the only thing that was part of Binance Pool’s latest initiative. The blog post noted that the exchange intends to roll out cloud mining products.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I believe in empowerment closing the financial education gap and creating equal opportunity for the next generation. I have invested in 20+ companies and funds. Check out my portfolio here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.