Myth Of Money: Stay Focused.

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

This week was characterized by the crypto-native term “FUD” - Fear, Uncertainty, and of course, Doubt.

Bitcoin dropped a staggering 23% to a low of $43,000, and everyone looked at their friends said - “is the bull market over?”

Let’s take a look at what caused the market drop:

Elon Musk tweeting non-sense, threatening to sell his coins.

Over-hyped and over-inflated altcoin markets with a series of doggy coins.

A cooling off from a nearly straight-line upward trajectory.

So much of the currently fears and euphoria are caused by one man’s tweets. And the truth is - he is playing all of us.

Reuters put together a neat timeline of Elon’s antics:

Nov. 27, 2017: Musk denies a theory he is Satoshi Nakamoto, the pseudonymous creator of bitcoin, tweeting, "Not true. A friend sent me part of a BTC a few years, but I don't know where it is."

Feb. 22, 2018: Musk tweeted: "I literally own zero cryptocurrency, apart from .25 BTC that a friend sent me many years ago."

Oct. 22, 2018: Musk temporarily lost Twitter access after tweeting, "Wanna buy some bitcoin?"

Feb. 19, 2019, Musk called bitcoin's structure "quite brilliant" on a podcast with ARK Invest's Cathie Wood. "But, I'm not sure it's the best use of Tesla's resources to get involved in crypto. We're really just trying to accelerate the advent of sustainable energy, and it's like, quite energy intensive."

April 2, 2019, Musk tweeted: "Dogecoin might be my fav cryptocurrency. It's pretty cool."

April 29, 2019, Musk tweeted: "Ethereum," and, "jk."

May 15, 2019, Musk tweeted, in response to "Harry Potter" author J.K. Rowling, "... massive currency issuance by govt central banks is making Bitcoin Internet money look solid by comparison," and, "I still only own 0.25 Bitcoins btw."

July 2, 2020, Musk responded to "Star Trek" actor William Shatner with, "I'm not building anything on ethereum. Not for or against it, just don't use it or own any."

July 17, 2020, Musk tweeted a meme implying Dogecoin would become the standard of the global financial system, "It's inevitable."

Dec. 20, 2020, Dogecoin soared after Musk tweeted, "One word: Doge."

Dec. 20, 2020, in a Twitter exchange with MicroStrategy Inc Chief Executive Michael Saylor, Musk asks about converting "large transactions" of Tesla's balance sheet into bitcoin.

Jan. 29, Bitcoin spikes after Musk adds #bitcoin to his Twitter bio, tweeting, "In retrospect, it was inevitable."

Feb. 1, Musk says on social media app Clubhouse he supports bitcoin, which was "on the verge of getting broad acceptance" and that he was "a little slow on the uptake." read more

Feb. 4, Dogecoin surged more than 60% after Musk tweeted "Dogecoin is the people's crypto." read more

March 2, Musk tweeted, "Scammers & crypto should get a room."

March 12, Musk tweeted, in reference to his tunneling company, "BTC (Bitcoin) is an anagram of TBC(The Boring Company) What a coincidence!"

March 24, Musk tweeted: "You can now buy a Tesla with Bitcoin," and "... Bitcoin paid to Tesla will be retained as Bitcoin, not converted to fiat currency."

April 1, Musk tweeted: "SpaceX is going to put a literal Dogecoin on the literal moon."

April 15, Musk tweeted: "Doge Barking at the Moon."

April 28, Musk tweeted: "The Dogefather SNL May 8," ahead of hosting Saturday Night Live.

May 7, Musk tweeted: "Cryptocurrency is promising, but please invest with caution!"

May 9, Dogecoin tanked after Musk called the cryptocurrency "a hustle" on SNL. Musk tweeted: "SpaceX launching satellite Doge-1 to the moon next year – Mission paid for in Doge – 1st crypto in space – 1st meme in space To the mooooonnn!!"

May 11, Musk tweeted: "Do you want Tesla to accept Doge?"

May 12, Musk tweeted Tesla would no longer accept bitcoin as a payment, and "Energy usage trend over past few months is insane."

While retail investors are freaking out riding Elon’s rollercoaster of Tweets, whales are continuing to accumulate. Don’t give into the manipulation. On-chain analytics continue to show significant scarcity in supply. As Bitcoin becomes a widely accepted finite store of value, we haven’t even begun to approach its fair market value.

Be like Tom Brady. Put on your laser eyes and stay focused.

Keep Your Eye On… Waka.Finance 👾👾👾

A community led DeFi project on Fantom, Waka.Finance will hold their IDO this week. Regarded as UniSwap meets YearnFinance for Fantom, the highly anticipated platform will allow yield faming for Fantom Ecosystem pairs like FTM/BTC, FTM/ETH, FTM/USDT and FTM/ATRI.

Web: https://waka.finance/

Twitter: https://twitter.com/WakaFinance

Telegram: https://twitter.com/WakaFinance

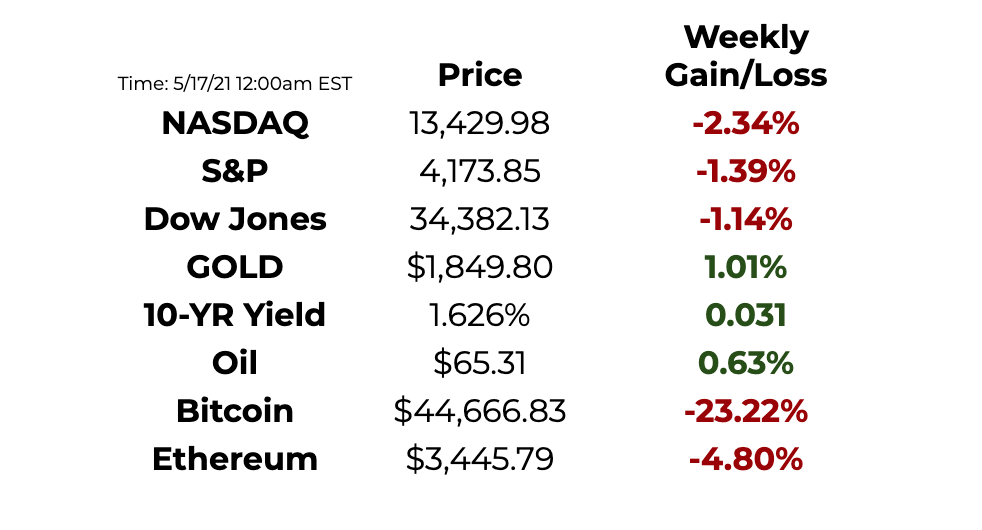

This Week By the Numbers 📈

💰 VIP Investor Opportunity: Carta Pre-IPO

This week I’m sharing an opportunity from my friends at Jaguar Capital in Silicon Valley. Founded in Palo Alto in 2012, Carta (eShares, Inc.) is the first ever system of record for private asset ownership, modernizing how assets are tracked, valued and exchanged, with the goal of creating more transparency for and liquidity between shareholders.

Carta’s customers include the majority of the most valuable private tech companies and venture capital funds. Today, 17k+ venture-backed companies use Carta, representing 35% of the U.S. market, or $1T+ in asset value.

Carta is backed by Andreessen Horowitz, Lightspeed Ventures and Goldman Sachs. Current pre-IPO shares are available through a private allocation at preferential terms. Detailed financial terms and projections are available upon request.

[Respond to this email with a request for an introduction to the deal team.]

Top Stories 🗞

FTX and Blockfolio Integrate With Circle, Add USDC Settlement Layer

Crypto derivatives exchange FTX and retail subsidiary Blockfolio plugged into Circle’s payments infrastructure on Friday, allowing users to fund their accounts with the USDC stablecoin. Users can settle bank transfers and credit card transactions in the dollar-pegged crypto, the second-most popular stablecoin by daily trading volume, FTX and Blockfolio said. Crypto traders use stablecoins like USDC and the far-larger Tether as a popular trading pair. Using stablecoins – which are digital currencies that are pegged to a relatively stable asset like the U.S. dollar – may be faster than trying to fund trading accounts with bank transfers or other fiat tools. Read Full Story.

NFL Superstar Tom Brady Adds “Laser Eyes” Teasing Support Of Bitcoin

Earlier this year Tom Brady announced he will be launching an NFT platform, Autograph, which will allow celebrities to create and list digital collectibles. NFTs, or non-fungible tokens, are digital representations of content maintained on a blockchain or decentralized ledger. Brady’s foray into NFTs would suggested a coinciding interest in cryptocurrencies, like Bitcoin (BTC) and Ether (ETH), which are the native assets used for settlement on a blockchain. Brady’s interest in the crypto space is in good company among pro footballers. NFL tackle for the Carolina Panthers, Russell Okung, announced he would be converting half of his $13 million salary to Bitcoin late last year. Okung regularly expresses his passion in Bitcoin and recently invested in Fold, a Bitcoin-based rewards app with a Visa debit card. Read Full Story.

Warren Buffett And Tim Cook Snub Blockchain As Corporate Giants Embrace

Of the world’s 10 largest publicly traded companies, eight are blockchain bulls — building a wide range of products that use the distributed ledger technology first popularized by bitcoin. Hugely absent from those blockchain fans: Warren Buffett’s Berkshire Hathaway and Tim Cook’s Apple. Revered Berkshire CEO Warren Buffett has called bitcoin “rat-poison squared,” and in May, his right-hand man Charlie Munger said he “hates” bitcoin’s success, calling it “contrary to the interest of civilization.” Read Full Story.

Product of the Week: GDA Lending

This week I’m giving a shout out to my friends at GDA Lending. Having recently worked on a loan with them, I can say that they offer the best rates for collateralized crypto loans at 4.5%, with the lowest counter-party risk. If you are looking to borrow against your BTC or ETH, ping me for an intro here.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.