Myth of Money: The Cold War of Crypto

Welcome to this week’s edition of Myth of Money, a weekly newsletter on all things crypto read by 10,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

After a couple years of alternating its stance, the Russian government is prepared to regulate crypto as a currency.

Russia is already a big player in the crypto ecosystem; one government study estimated its citizens own 12% of the global crypto market, and another concluded that 12% of Russians, or 17 million people, own crypto assets. The Kremlin’s plan, published Tuesday, functions as guidelines rather than law, and still requires Russia’s Parliament to pass new legislation. Its call for clear regulation, however, stands in stark contrast to prior calls from Russia’s Central Bank for an outright ban.

Banning crypto would put Russia in the company of China, which has taken the strongest regulatory stance among the world’s leading powers by seeking to eradicate cryptocurrency from within its borders. China is ‘all in’ on its Central Bank Digital Currency (CBDC), the digital Renminbi, which could offer potential benefits of crypto such as lower transaction costs and more financial efficiency and inclusion, but without the benefits of privacy and decentralization. In addition to China, only a handful of Caribbean countries and Nigeria have launched a CBDC, with likely several more launching this year.

Russia has indicated a strong interest in issuing a digital Ruble, which would exist alongside any private cryptocurrency alternatives. This path is the direction favored by India as well, the world’s second-most populous country and 5th-largest economy, and by some accounts home to the largest number of cryptocurrency investors. India’s Finance Minister announced plans last month to tax what the country is calling “virtual digital assets” at a rate of 30%, and continued to tout plans for issuing a digital Rupee as soon as this year. Echoing the debate in Russia, however, India’s central bank Governor emphasised his institution’s skepticism of cryptocurrency.

As the world’s superpowers crystallize their regulatory positions, the United States is lagging behind. The White House is expected to issue an Executive Order that calls for a thorough review of and recommendations for crypto regulation. The Federal Reserve Bank of Boston released a summary last week of its ongoing work with MIT to explore how to operationalize a digital dollar. Additionally, the U.S. Federal Reserve released a white paper last month on the pros and cons of issuing a CBDC, but offered little indication of how it would do so, other than “if one were created, (it) would best serve the needs of the United States by being privacy-protected, intermediated, widely transferable, and identity-verified.” The default for most users has been Coinbase-led USDC.

Businesses and entrepreneurs dislike uncertainty.

Governments want their countries to host the economic activity that is tied to the crypto industry. There’s a lot of money within the industry, which in turn can spill over and multiply across a region’s economy. Hostile regimes will miss out on this economic growth; China went from leading the world in crypto mining activity to becoming a virtual non-entity after instituting its ban. On the flip side, certain states in the U.S., particularly Georgia, Wyoming, and Texas, have positioned themselves as crypto-friendly regimes and have increasingly enticed miners to set up shop.

Governments are also concerned with the risks associated with a bustling private crypto industry. Central Banks and political officials in Russia, the U.S., and elsewhere have called out several concerns:

Losing control of monetary policy: A decentralized currency system defuses a central bank’s ability to influence macroeconomic health with levers like moving interest rates and growing or shrinking the money supply.

Exposing citizens to financial risks: The high volatility of cryptocurrency prices has limited its use and rendered it primarily a speculative asset.

Illicit uses: The anonymity and disintermediation of blockchain can enable illegal activity.

High energy usage: The proof-of-work consensus mechanism pioneered by Bitcoin and replicated by numerous other chains notoriously uses a great deal of energy, all the more worrying as countries grapple with global climate pledges.

It makes sense that governments would want to balance these risks and rewards with a thoughtful regulatory regime, if not totally quash them by banning private markets altogether and controlling digital currencies themselves.

Launching a CBDC carries its own risks, however. Namely a potential invasion of privacy. In the same way that anonymity on a distributed ledger is a two-sided coin – on the one hand, it enables criminal activity, but on the other, it could offer a lifeline to people living under oppressive regimes – so is the direct relationship between citizens and their central bank via a digital wallet. On the one hand, a CBDC could increase financial inclusion and save hundreds of billions of wasted dollars by making the financial system more efficient. On the other, it could expose citizens to undue surveillance risk – something that Chinese citizens have evidently come to accept, but which is anathema to many others around the world, especially in the U.S.

If CBDCs proliferate, there will be winners and losers. With several independent stablecoins on the market (USDC, USDT, UST, etc.), CBDC’s may prove redundant. But to the extent that regulated, private crypto markets exist alongside CBDC’s, the two could very well be complementary, with a rising tide of clear rules and usability lifting all boats.

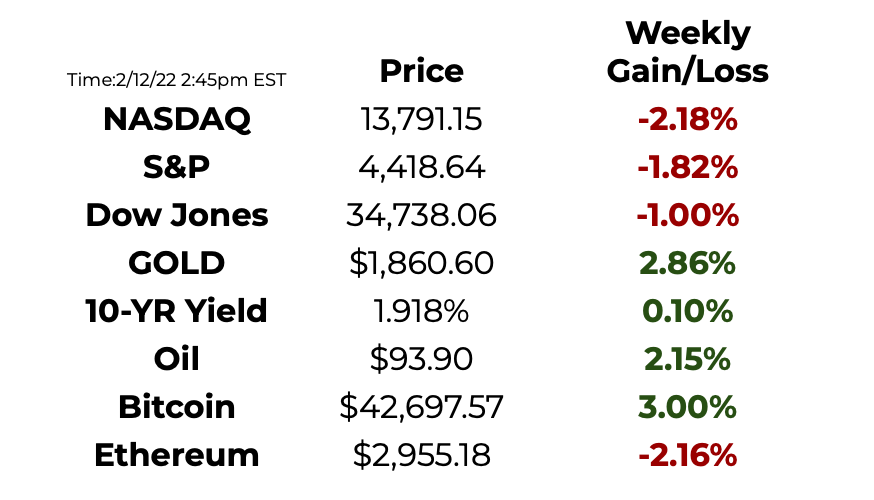

This Week By the Numbers 📈

Annual CPI numbers (inflation) came in at 7.5%, the fastest increase in about 40 years. Food, electricity and housing prices were the main drivers. This further pressures the Fed to cool off the economy by raising interest rates, but it must find a way to do so in a way that doesn’t cause an economic downturn. According to The Economist, the last time America’s inflation fell from above 5% without causing a recession was 70 years ago.

Meanwhile, capital markets are watching closely, as Russia prepares to invade Ukraine with 100,000 troops stationed at the border.

Top Stories 🗞

A $4.5 Billion Crypto Crime Stars an NYC Couple, Stolen Bitcoin and Rap

Two thirty-somethings were arrested for conspiring to launder 119,754 Bitcoin, today worth about $4.5 billion. The funds stemmed from a 2016 hack of crypto exchange Bitfinex; it is unclear the extent to which the culprits were involved in the hack itself. “None of this could have happened 20 years ago. Or 10. Or maybe even five. The couple’s audacious plan, as laid out by federal authorities, as well as the brazen lifestyle that plan supposedly afforded, seemed tailored to these times, and these times alone.”

Crypto Lender BlockFi to Pay $100 Million In Settlement with SEC, States

New Jersey-based BlockFi, “is poised to pay $100 million to settle allegations from the Securities and Exchange Commission and state regulators that it illegally offered a product that pays customers high interest rates to lend out their digital tokens…The penalties, which could be announced as soon as next week, are among the toughest levied on a cryptocurrency firm amid a U.S. clampdown on the industry.”

Upcoming Apple iPhone feature to give merchants a way to accept crypto payments

“According to Apple, the soon-to-be-launched Tap to Pay feature will extend support to ‘Apple Pay, contactless credit and debit cards and other digital wallets.’ It basically means that unless Apple places a direct barrier for it, customers who are using Coinbase Card, Crypto.com Visa Card, or a similar payments card would be able to use their cryptocurrency holdings to make payments via Tap to Pay.”

Robinhood Reveals Dogecoin Powered 34% of Its Crypto Revenue

The free trading app announced that 17% of its transaction-based revenue in the first quarter came from crypto, up from 3% in the same period in 2020. “Robinhood said it allows customers to trade seven cryptocurrencies on the platform, but 34% of that revenue came from Dogecoin, which originated as a joke but has soared in value.”

Binance to Invest $200 Million in News Publisher Forbes

“Binance Holdings Ltd., parent of the world’s largest cryptocurrency exchange, is making a strategic investment of $200 million into the more than 100 year-old news publisher Forbes.”

Deal of the Week - CoinMARA💰

***This deal is now 90% subscribed and is closing March 1.***

CoinMARA is building a centralised exchange, lending platform and NFT marketplace for the African region, the next outsized opportunity to create sustainable financial infrastructure over the next decade. Based in Kenya, the founder and the project have a strategic alliance with SafariCom (M-Pesa), as well as several high profile individuals in the region.

CoinMara has confirmed investment from Distributed Global, FTX, Coinbase Ventures, DIGITAL (Steve Cohen), TQ Ventures (Scooter Braun), Mechanism Capital, Woodstock, Day One Ventures, GDA Capital, Nexo, DAO Jones (Disclosure, Mike Shinoda, Steve Aoki) and others.

Direct participation - email for more info tatiana@tatianakoffman.com.

Syndicate - MyAsiaVC is running a syndicate with low minimums on Angellist [CLICK HERE TO PARTICIPATE IN THE SYNDICATE].

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.