Myth of Money: The Fall of an Empire

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Empires do not last forever.

Just when we thought we saw everything this presidency had to offer, the unthinkable happened. On Wednesday, a mob of Trump supporters broke into the Capitol building, entering offices and chambers, vandalizing government property, and chanting “hang Pence.” For those who missed this, Mike Pence refused to stand behind Trump’s ‘rigged election’ narrative, so Trump directed the mob directly at him, as well as the Democrats. Trump supporters even erected wooden gallows to make good on their chant.

Aside from the physical destruction, the death toll is now 5. That’s 1 more than the 2012 Benghazi attack, the last time someone stormed a U.S. government building.

Could this be the fall of the American Empire?

A quick review of history shows 5 major empires across human history:

The Persian Empire was the first true empire. It settled, civilized and populated the world, dominating the Middle East, North Africa, Central Asia, India and Europe, ruling over a greater percentage of the world than any empire in history (49.4 million people or 44% of the world at the time) and ushering peace in the Middle East. The Persian Empire’s legacy to the world includes the use of a network of roads, a postal system, a single language for administration, autonomy for various ethnicities, and a bureaucracy.

The Roman Empire was truly one of history’s greatest empires, with an ability to conquer and hold large swathes of territory for hundreds or even thousands of years. But it was not held together by brute force alone - people aspired to become Roman, which meant participating in a sophisticated, urbane, classical culture. Roman Law also influenced all subsequent legal and governance systems in the West.

The Caliphate (Arab Empire) founded by the Muslim Prophet Muhammad, encompassed most of Arabia by the time of his death in 632 C.E. The Arab Empire was extraordinary - a loosely organized, tribal people on the fringes of world civilization defeated the Byzantine Empire and overthrew the Persian Empire, both of whose populations and resource dwarfed the Arabian Desert. The Arab conquests are a good example of how ideological zeal can make up for technological and organizational deficiencies. The ultimate legacy of the Arab Empire is the religion of Islam, followed by more than a billion people today.

The Mongol Empire was another empire that against all odds defeated enemies much more powerful and populous. It was the world’s largest contiguous land empire, one that struck terror into all its enemies. Although there were only about two million Mongols in the whole world, they subsequently conquered most of the Middle East, Russia, and China under Genghis Khan’s descendants. In the long run, however, the Mongols proved inefficient at administering their empire, which eventually split into four khanates before each one eventually fell apart or further split.

The British Empire essentially made the modern world. The main characteristics of the United States— a commitment to liberalism, the rule of law, civil rights, and trade— were inherited from the British and spread throughout the world. At its peak in the early 20th century, the British Empire stretched across almost a quarter of the world— the largest of any empire in history. This feat was made possible more because of England’s organizational feats and financial prowess rather than through a huge army. For example, the British conquest of India was mostly undertaken by Indian troops in British pay who chose to serve the British because of the regular salaries and benefits offered by them.

It is without question that we are living in an age of the American Empire, established in 1944 by the Bretton Woods Agreement, when the western world willingly shipped its gold to America and joined the newly formed IMF and World Bank.

The United States is the world’s most militarily powerful nation ever. It combines the British ingenuity for trade with a more deeply held liberalism and continent-sized resources. Like the Romans, it has an attractive culture. Like the Mongols, it can wield total destruction. Like the Arabs, it has spread a universal ideology across the globe. Like the Persian Empires, America combines different cultures and links together regions.

The fact is, no matter how unthinkable it seems in the moment, empires do fall. No one empire has ruled human history forever. Even though Trump is leaving office in 10 days, the cracks he created in America are long-lasting. With over 70 million supporters, and much of the population lacking quality education, what we saw in the Capitol this week is only a symptom of a much larger disease - a distrust in the system, a desire for something different, a rumbling of a revolution.

Internal divisions and squabbling can kill even the most powerful empires. Despite its overwhelmingly strong military, Rome fell. The Persians were conquered not because they were weak but because their leadership failed. Although the Mongols could win wars, they could not win the peace and ultimately they failed to establish themselves permanently anywhere. The Arabs spawned a successful civilization, but the positive aspects of it were taken over by newcomers. And finally, the British empire was exhausted upholding its interests, global order, and European system, trying to do too many things at once.

America is facing all of these challenges and more. China is actively vying to become the next empire with a highly organized and educated population, superior technology and infrastructure, climate change initiatives, deliberate expansion into emerging markets, the launch of its own digital currency and even its own internet (the Blockchain Services Network).

And yet, there is another potential empire candidate brewing - the Modern Middle East. A decade after the Arab Spring, the region is moving forward with a new message of unity and innovation-focused thinking, including UAE peace with Israel and, most recently, with Qatar. It is also notable how organized this part of the world remained during COVID with frequent testing, regulated tourism, and early vaccinations. UAE is attracting businesses and new residents from all over the globe, seeking greater opportunity and reprieve from a mishandled pandemic.

How does Bitcoin fit into this global shift?

I used to say that people from the West didn’t understand the need for Bitcoin, because unlike those in developing countries, our systems were not fully broken.

America broke this week, and investors can’t unsee it. Capital is coming into Bitcoin at record speed both by institutional and retail investors.

In an article I wrote in Forbes back in June, I discuss the notion of Bitcoin as a silent protest against corrupt governments. Some highlights include:

America is not immune to a financial revolution.

America is unique in that it has not experienced a major economic upheaval besides the Great Depression and the last financial crisis in 2008, creating a trust in the system. But America’s fiat currency is only about 50 years old, since Nixon abolished the gold standard in 1971, a relatively unproven experiment. Fiat has already failed in other nation states like Venezuela and Zimbabwe.

Bitcoin was born out of protest against the financial system in 2008. Against monetary stimulus in particular.

History has shown us that a sudden influx of ‘new’ money without any corresponding economic growth leads to inflation: a rise in prices coupled with a fall in the purchasing power of that currency. This is considered a hidden taxation on citizens - prices rise, but wages stay the same.

A global world wants a global currency.

Charles de Gaulle, one of France’s former Presidents, addressed the nation in 1965, saying: “We consider it necessary that international trade be established as it was the case before the great tragedies of the world, on an indisputable monetary base and one that does not bear the mark of any particular country.”

Experts have long foreseen the emergence of another revolutionary financial system.

Nobel-prize winning economist Friedrich Hayek was quoted in 1984: "I don't believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can't take it violently out of the hands of government: all we can do is, by some sly roundabout way, introduce something that they can't stop."

Bitcoin allows for separation of money and state.

What is the role of government? It is there to enforce a social contract we all inherently enter into just by being born and raised under its jurisdiction. It is there to create order, and to provide basic services such as roads, schools and hospitals. If the government were a corporation we paid to provide these services, there would be no reason for them to also have control over our bank account.

Many argue that money should not be politicized. The wealth you work so hard to create should be intact regardless of the decisions of your government - whether it is to start a war, issue a bailout or make a bad trade agreement. Money backed only by the authority of governments jeopardizes its value. In fact, the entire thesis behind the traditional investment industry is to prevent the erosion of value through inflation.

And so, Bitcoin allows us the opportunity to opt-out of the current system - all without lifting a weapon or raising our voice. A silent, but effective protest.

This Week By the Numbers

The U.S. economy lost 140,000 jobs in December, making it the worst year for job losses since 1939. Unemployment rate held steady at 6.7%, as states continued to impose restrictions on businesses. Congress passed a $900 billion stimulus last week which will include another round of PPP and added unemployment benefits.

Tech stocks continued to move forward, while Bitcoin had a third record-breaking week in a row. Experts agree that stock markets will continue to move in a positive direction post inauguration of Joe Biden, largely due to additional stimulus.

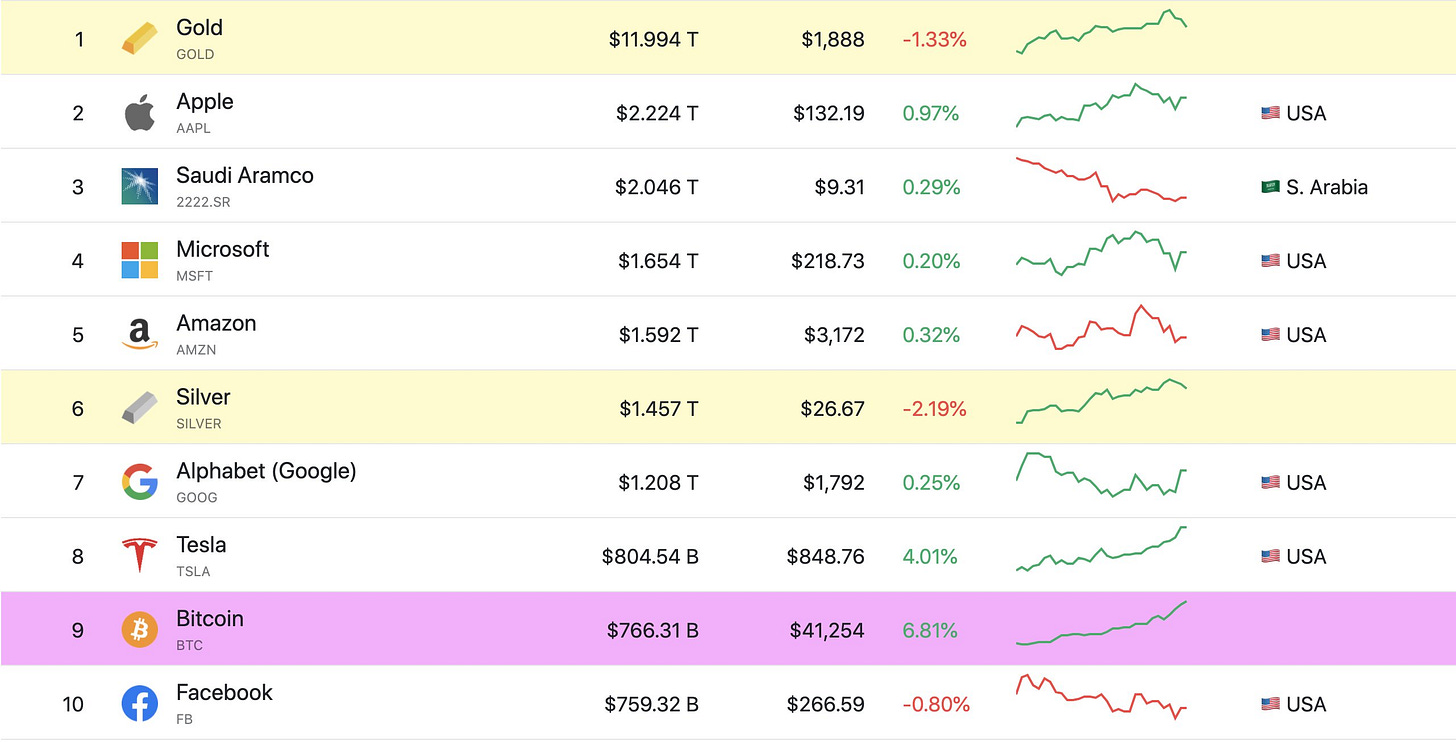

Bitcoin’s Market Cap is 🔥

After rising more than 300% in 2020, the price of bitcoin is still climbing at an astonishing rate, having gained more than 40% in the last eight days.

An interesting chart floating around the Twitter-sphere today is comparing Bitcoin to the biggest companies in the world by market cap. It seems Bitcoin continues to edge its way upwards, gaining on Tesla’s prestigious #8 spot and has just surpassed Facebook.

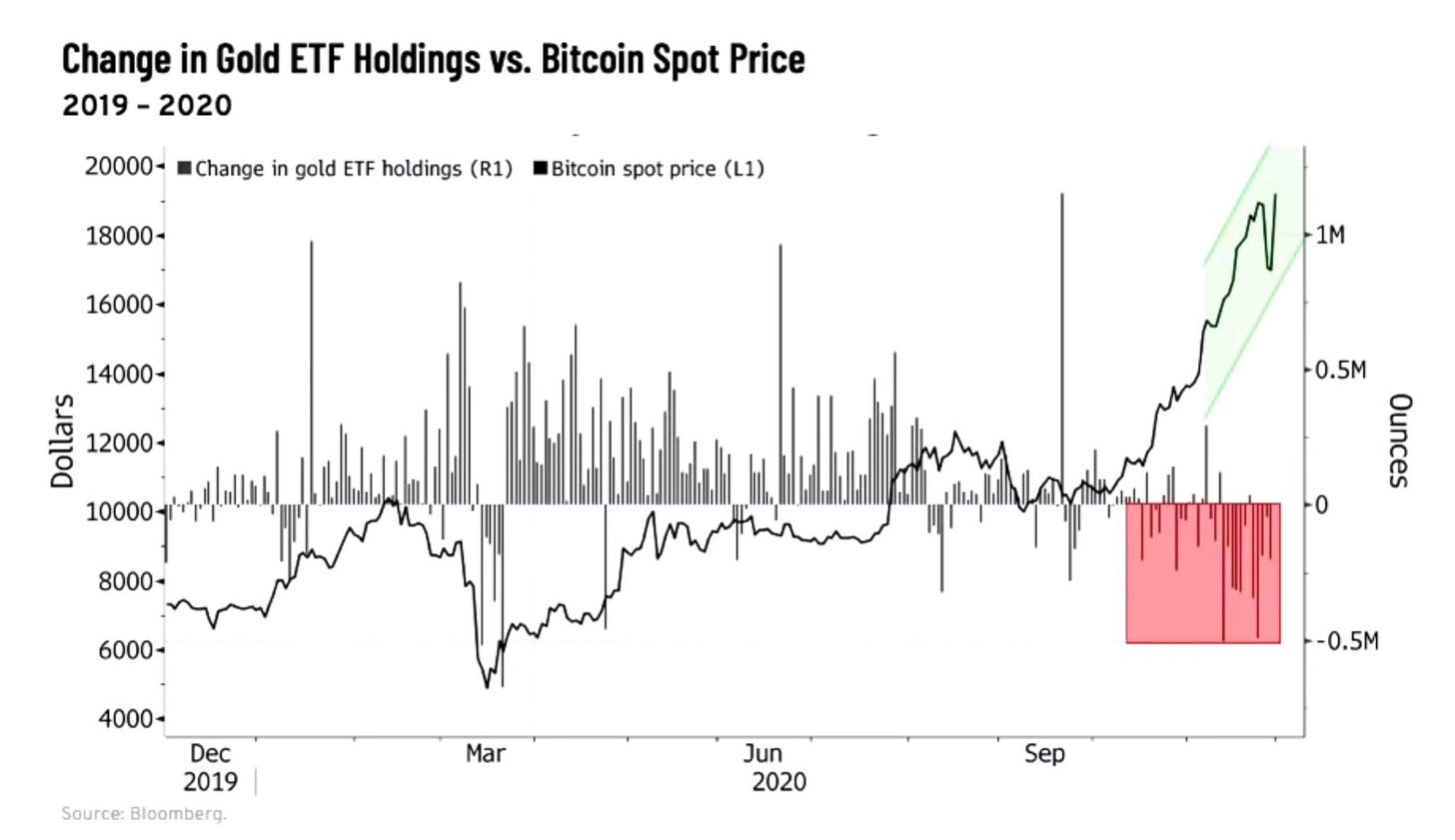

In another unexpected turn of events, Gold struggled this week, as some investors moved their ‘hedge’ investments over to Bitcoin.

VIP Investor List

I will start sending out occasional investment opportunities to those on my VIP investor list. Some of these will be fund investments, start-up investments, pre-IPO deals, crypto and digital assets opportunities, exclusive allocations… you get it. If you are an accredited investor and want to be on this list, send me a note.

Featured Products

SafePal offers a crypto cold-wallet wallet solution with software level convenience, backed and invested by Binance. The SafePal S1 offers access to built in Binance Spot Trading, DeFi DApp support for UniSwap, 1inch Exchange, Compound, Aave & Curve. Currently priced at $39.99, it is also one of the most affordable hardware wallets on the market as well as the 1st tokenized crypto hardware wallet solution.

Lolli.com lets you earn Bitcoin while you shop at your favorite online retailers like Bloomingdales, Nike, Expedia and thousands more. Check it out here and start accumulating Bitcoin today. [Available only in the U.S.]

Interested in joining the Myth Of Money as a sponsor? Reply to this email to learn more :)

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.