Myth of Money: The Fed is moving too slow.

Government innovation in the U.S. is nowhere near on par with its global competitors. We have seen this in America’s COVID-19 response, lack of green initiatives, and America’s inability to keep up with our financial innovation.

In stark contrast, while China methodically partners with its best and brightest in their private sector such as Alibaba and Tencent, America holds antitrust hearings to threaten further innovation in Big Tech.

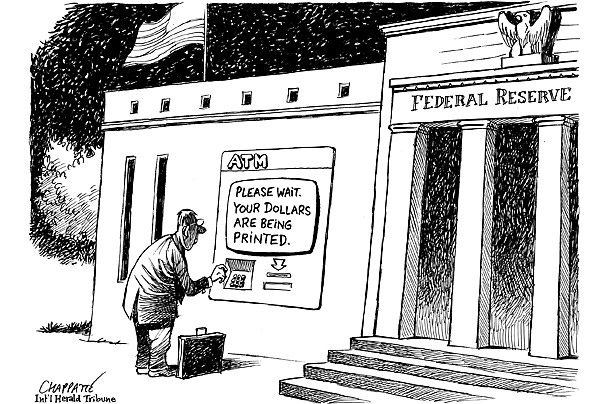

The inability for the public and private sector to efficiently work together is perhaps America’s greatest flaw and will be its downfall. This is most evident in the government’s lack of progress towards digitizing the U.S. dollar. While China continues to roll out its bank-led digital yuan through technology partners like WeChat and AliPay, the American Federal Reserve is still “looking into” creating a global competitor.

On August 13, Federal Reserve Governor Lael Brainard made an “Update on Digital Currencies” via webinar. The full text of the announcement can be found here.

Some highlights include Brainard acknowledging that China has lapped America in digital currency innovation:

“More broadly, banks, fintech companies, and technology firms are all exploring the use of innovative technologies to enhance payments efficiency, expand financial inclusion, speed up settlement flows, and reduce end-user costs. Digital currencies, including central bank digital currencies (CBDCs), present opportunities but also risks associated with privacy, illicit activity, and financial stability. The introduction of Bitcoin and the subsequent emergence of stablecoins with potentially global reach, such as Facebook's Libra, have raised fundamental questions about legal and regulatory safeguards, financial stability, and the role of currency in society. This prospect has intensified calls for CBDCs to maintain the sovereign currency as the anchor of the nation's payment systems. Moreover, China has moved ahead rapidly on its version of a CBDC.”

The Fed will partner with researchers at MIT for a “multi-year effort”:

“To enhance the Federal Reserve's understanding of digital currencies, the Federal Reserve Bank of Boston is collaborating with researchers at the Massachusetts Institute of Technology in a multiyear effort to build and test a hypothetical digital currency oriented to central bank uses. The research project will explore the use of existing and new technologies as needed. Lessons from this collaboration will be published, and any codebase that is developed through this effort will be offered as open-source software for anyone to use for experimentation.”

The need for a new policy and legal framework to work with digital currencies:

“Separately, a significant policy process would be required to consider the issuance of a CBDC, along with extensive deliberations and engagement with other parts of the federal government and a broad set of other stakeholders. There are also important legal considerations. It is important to understand how the existing provisions of the Federal Reserve Act with regard to currency issuance apply to a CBDC and whether a CBDC would have legal tender status, depending on the design. The Federal Reserve has not made a decision whether to undertake such a significant policy process, as we are taking the time and effort to understand the significant implications of digital currencies and CBDCs around the globe.”

This is a particularly lengthy approach to take on, when the American government has access to Facebook, an American company that has done all of the digital currency research necessary to design Libra. Libra’s latest proposal conceded to making a USD-based digital currency, rather than creating a new competing unit of account, and Facebook’s leadership has repeatedly expressed their desire to work with the U.S. government.

Sure, there is a risk of giving too much power to a private company. But the alternative is riskier. China and Russia have decreased their trade in dollars by 50%. Countries with unstable currencies such as Venezuela no longer wish to be tied to the U.S. dollar. Lebanon is facing a severe dollar shortage and the people are actively looking for alternatives. These alternatives become evident - Euro, Bitcoin and China’s digital yuan. Backed by the largest economy in the world and easy to send with a click in a chat app, why wouldn’t it become the currency of choice?

The Dollar’s reserve currency status is no longer guaranteed, and neither is America’s position as the leader of the free world. America is at war, and it will continue to lose, unless it learns to work with Big Tech to compete globally.

This Week By the Numbers

Markets continued to move upwards across the board, with the exception of Gold. It is unclear what caused the major sell off, but all indicators continue to point to Gold remaining in a position of power amid global turbulence. U.S. productivity grew 7.3% last quarter, while the number of hours actually worked fell 43%, in a the biggest decline ever.

Top Stories

Berkshire Makes a Bet on Gold

Warren Buffett’s Berkshire Hathaway Inc. added Barrick Gold Corp. to its portfolio in the second quarter, sending shares of the world’s second-largest miner of the metal surging. Berkshire took a new position in Barrick, buying 20.9 million shares, or 1.2% of the company’s outstanding stock, with a current market value of $565 million, according to a regulatory filing on Friday. In the past, Buffett, the billionaire chairman of Berkshire, cautioned against investing in the metal because it’s not productive like a farm or a company. Now, gold miners are benefiting from surging bullion prices that are boosting profit margins as costs of production have steadied, making them increasingly attractive investments. Read Full Story.

Facebook Financial Formed to Pursue Company’s Payments Plans

Facebook Inc. unveiled a new group to pursue payments and commerce opportunities and put David Marcus, co-creator of its Libra cryptocurrency project, in charge of the initiative. Called F2 internally, short for Facebook Financial, the team will run all payments projects, including Facebook Pay, the company’s universal payments feature that it plans to build inside all of its apps. Marcus will continue running Novi, the division that is building a digital wallet to hold the Libra cryptocurrency. He will also be involved in WhatsApp’s payments efforts in countries like India and Brazil. Read Full Story.

MicroStrategy Buys $250M in Bitcoin, Calling the Crypto ‘Superior to Cash’

Publicly traded business intelligence firm MicroStrategy purchased 21,454 bitcoin on Tuesday, effectively pouring all $250 million of its planned inflation-hedging funds into the digital currency. Disclosing its bitcoin buy alongside an equivalent stock buyback in a Tuesday Securities and Exchange Commission filing, MicroStrategy, a Nasdaq-listed software firm worth over $1.2 billion, said the cryptocurrency provided a "reasonable hedge against inflation" in a press statement shared with CoinDesk. Read Full Story.

Enjoyed your reading experience?

Thank you for reading this week’s edition of the Myth of Money.🚀As always, reach out with feedback and ideas.

Best,

If you enjoyed your reading experience, say thanks here:

BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.