Myth of Money: The Future of GameFi

Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 12,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your research.

Dear Investors,

Even as markets continue their downturn, one of the strongest trends we are seeing from investors is a demand for new and investable gaming projects.

The reason is simple - gaming remains the easiest conduit for blockchain adoption.

New data from DappRadar suggests that the gaming sector accounts for approximately 50.51% of industry usage month-over-month (MoM). According to the surveyor, around 847,230 gaming-related Unique Active Wallets are active daily with nearly $698 million in transactions.

According to a recent BGA Blockchain Game Report, there were over 804,000 unique blockchain game users in July 2021 (which represents 121% growth since June).

According to Fabian Friedrich, CEO of Blockchance,

I believe there’s a good reason why people are taking to blockchain games. Make that two good reasons. First, during the lockdown period in the heat of the Covid-19 pandemic, a lot of people grew bored and started to try their hand at different things. Games likely served as a distraction for people — and an enjoyable one at that. Microsoft reported that its Xbox content and services revenue increased 40% year over year in quarter two of 2021.

So, yes, boredom may have kick-started blockchain gaming’s popularity, but I think what made blockchain gaming a home run was when the developers of these games started using a play-to-earn approach. Gaming, for a long time, has been a centralized activity; the makers of the games have controlled assets, game data and in-game currencies. But now that blockchain has become a part of the industry, that has changed. Gaming can now be decentralized, and players are finding that they can not just play the games but can also make money (that they can convert to real-life fiat currencies) in many cases.

Top 5 Blockchain Games

Here are just a few popular examples of blockchain games in the market today.

Alien Worlds

Alien Worlds is an extensible, decentralized play-to-earn metaverse where users participate in intergalactic exploration missions. It was founded by Michael Yeates, Rob Allen, Sarojini Mckenna . Gamers are incentivized to use Trilium tokens (TLM), the platform's in-game currency, which they collect during their planetary quests. TLM is a cross-chain token that exists on Ethereum (ERC-20), Binance Smart Chain (BEP-20), and WAX. You can easily teleport your TLM between each blockchain through the use of MetaMask. Alien Worlds was created in 2020. Dacoco is based in Zug, Switzerland, which is deemed Switzerland's ‘crypto valley’, due to the number of blockchain and crypto companies based there. They claim to be decentralized autonomous community organizations experts and also act as guild validators on WAX. Alien world has a total funding amount of $2M with 11 investors including X21 Digital and LongLing Capital.

Splinterlands

Splinterlands is an online collectible card game using blockchain technology with cards that are owned as non-fungible tokens (NFTs). Splinterlands is a “play-to-win” crypto game. Players can win real money in the game through tournaments, ranked play, and quests. As of July 2022, the game has paid out more than $6 million in prizes to tournament winners, according to the game’s official website. Collectors can also make money selling the cards they get through the game in marketplaces like OpenSea. If you win a rare card, it may be valuable to another player. In a private token sale round, Jesse Reich, splinterland’s co-founder and CEO told Cointelegraph that the game surpassed 100,000 users in June, 3 years and a month after launch. Investors such as Mask network (lead investor), Polygon (lead investor), Animoca Brand (lead investor), and 14 others are partners with the program. Splinterlands has raised a total of $3.6M in funding over 3 rounds. Their latest funding was raised on Jul 27, 2021, from an Initial Coin Offering round.

Gameta

Gameta is a platform that allows users to play different casual games in the same place. Its goal is to migrate as many people as possible from Web2 to Web3. Gameta targets a wide audience and believes it can merge the products we used in the Web2 era, such as music, games, and media, into a new Web3 experience.

Farmers world

Developed in Japan by G. JIT JAPAN and built on the Worldwide Asset eXchange (WAX) public chain, Farmer's World has gained popularity in the crypto, play-to-earn gaming space. It's a passive, mining game with three in-game tokens: Food, Wood, and Gold. Each has its own use and can be exchanged within the game. It's been less than a year since Farmers World officially launched. In that time, it amassed over 150,000 players worldwide and has over 80,000 members on its Discord. Farmers World arrived in early July but really kicked off on the 1st of August as active wallets jumped up to over 1,700. This moment was the official launch of the game. From this point, the dApp maintained a good level of growth, steadily climbing to where it now sits with around 2,000 unique active wallets a day. These user wallets have been responsible for 1.44 million transactions as every action in Farmer’s World gets registered on the blockchain.

Upland

Upland is a blockchain-based game in which users can buy, sell, and trade virtual properties mapped to the real world. By becoming a “digital landowner,” users can build properties and earn UPX coins. The project utilizes blockchain to tie each property within the Upland platform to an NFT. Perhaps unique from many new rising blockchain-based games, Upland is seeking to create a market-based digital economy that blurs the lines between the real world and the digital world. Upland has raised a total of $20M in funding over 3 rounds. Their latest funding was raised on Nov 2, 2021, from a Series A round. Major investors are Global Founders Capital, Michael Ronen, and 13 more.

Security Challenges In GameFi

One of the main challenges in the blockchain gaming industry today is SECURITY.

In a recent report, Hacken, a blockchain cyber security auditor, said that data indicates that GameFi projects, often “put profits above security” by releasing products without taking appropriate precautions against hackers. Hacken researchers found that there were severe deficiencies in GameFi cybersecurity in particular, finding that out of 31 GameFi tokens studied, none received a Triple-A security ranking while 16 received the lowest score.

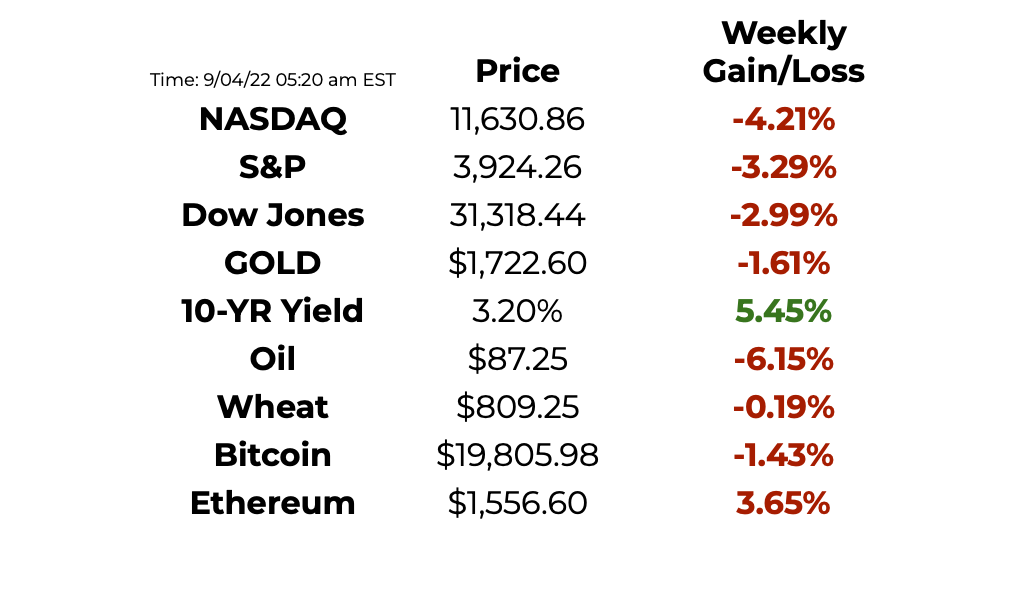

This Week By the Numbers 📈

Top Stories 🗞️

Crypto users push back against dYdX promotion requiring face scan

Many users on social media have been criticizing decentralized exchange dYdX over the identification verification process to receive a signup and deposit bonus of $25. In a Wednesday blog post, dYdX announced that new users who deposited 500 USD Coin (USDC) for their first transactions could receive a bonus promotion of 25 USDC, provided they were willing to do a “liveness check.” According to the exchange, the verification process accessed a user’s webcam and “compares if your image has been used with another account on dYdX.” Though the giveaway was completely voluntary, many on Twitter implied the checks were tantamount to invasions of privacy. Defi Watch founder Chris Blec accused the exchange of “bribing users to allow their faces to be scanned & disguising it as a ‘promotion,'” hypothesizing that dYdX and other platforms could offer greater incentives in return for clients giving up more information.

CFTC and SEC open comments for proposal to amend crypto reporting rules for large hedge funds

The United States Securities and Exchange Commission, or SEC, and the Commodity Futures Trading Commission, or CFTC, have called for comments on a proposal that would require large advisers to certain hedge funds to report exposure to crypto. In a joint proposed rule published to the Federal Register on Sept. 1, the SEC and CFTC established a 40-day comment period for amendments to Form PF, the confidential reporting document for certain investment advisers to private funds of at least $500 million. The proposal suggested qualifying hedge funds report exposure to crypto in a different category other than “cash and cash equivalents,” as the current iteration of Form PR does not specifically mention cryptocurrencies. Members of the public have until Oct. 11 to submit comments regarding the proposed changes, which the two regulators first introduced on Aug. 10. Among the suggested changes to Form, PF included a definition of “digital assets,” potentially requiring certain hedge funds to report earnings based on investments in “virtual currencies,” “coins” or “tokens,” depending on the framework.

Crypto.com backs out of $495M sponsorship deal with UEFA Champions League: Report

According to a Wednesday report from SportBusiness, Crypto.com pulled out of a $495-million agreement with the Union of European Football Associations, or UEFA, which was close to being signed due to its legal team citing regulatory concerns with the exchange’s licenses in the United Kingdom, France, and Italy. Had the deal gone through, Crypto.com’s branding would have been present for the UEFA Champions League for five seasons at a cost of roughly $100 million per season, ending in 2027. The sports news outlet reported that Crypto.com had stepped in as a potential sponsor after the Champions League dropped Russian state-owned energy firm Gazprom in response to the country’s invasion of Ukraine.

Mayo Clinic taps into blockchain technology for clinical trial design

On Thursday, Dutch blockchain startup Triall announced that it has partnered with American nonprofit medical center Mayo Clinic to optimize clinical trial design and the management of study data. Starting this September, Triall's eClinical platform will support a two-year multi-center pulmonary arterial hypertension clinical trial that includes 10 research sites and more than 500 patients across the United States. The software will support activities such as data capture, document management, study monitoring, and consent. As told by Triall, the purpose of the collaboration is to demonstrate an immutable public ledger audit trail through its blockchain technology to boost the integrity of clinical trials. Investigators, regulators, and stakeholders can then review and assess such trial-related data with trust, knowing that no one can modify the records.

Social Media Giant Snap Disbands Web3 Team Amid Mass Layoffs

Snap (SNAP) is disbanding its Web3 team in a move to slash costs in the face of sharply reduced growth. Jake Sheinman, the co-founder of Snap’s Web3 team, revealed the social media giant’s plans in a tweet announcing his departure from the company on Thursday. “As a result of the company restructure, decisions were made to sunset our Web3 team,” the tweet read. Snap CEO Evan Spiegel revealed executives were worried about the company’s underperformance in July after the company released its second-quarter earnings. “Our financial results for Q2 do not reflect the scale of our ambition,” the company acknowledged in a note to investors. “We are not satisfied with the results we are delivering.” Snap’s Q2 revenue of $1.11 billion, up 13% from the same quarter last year, came in far below the company’s previous guidance of 20% to 25% and was below analyst estimates.

Rosenzweig & Co: The Best Partner For Your Recruiting Needs

Rosenzweig & Co., led by social impact entrepreneur Jay Rosenzweig (Bio), is an expert at designing, building, and attracting world-class teams. Clients include public and private companies, including large global corporations; emerging growth to mid-sized businesses; professional services firms; and private equity and venture capital firms. The firm has recently emerged as the leader in placing C-Suite Talent for the Web 3 industry. Clients include CryptoSlam and Sturdy Exchange. Rosenzweig & Company was cited by Hunt Scanlon as the leading high-end search boutique internationally. The firm is a great asset to fill any senior roles you might need.

Jay is also an angel and advisor to 50+ tech companies including Hyperloop, Community, Drop, and many more, making his network invaluable to new and mature companies. Reach out for a direct introduction.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I believe in empowerment closing the financial education gap and creating equal opportunity for the next generation. I have invested in 20+ companies and funds. Check out my portfolio here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.