Myth of Money: The Greatest DeFi Hack in 'History'

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

This week crypto-investors had their ears to the ground following the greatest DeFi hack in crypto’s short-lived ‘history.’

Here’s what you missed:

Defi platform Poly Network was hacked and $600M were stolen.

The stolen assets included $273 million of Ethereum tokens, $253 million in tokens on Binance Smart Chain and $85 million in USDC on the Polygon network.

This was the biggest hack since Mt Gox.

The attacker has started returning the funds after the attacker’s ID information was reportedly obtained by blockchain security firm Slowmist. They have now sent back $256 million in tokens out of the haul so far.

Seven minutes prior to sending the first transaction returning some of the funds, the hacker created a token called "The hacker is ready to surrender" and sent this token to the designated Polygon address.

What can we learn from this?

DeFi is still a risky asset class. If you are allocating a significant amount of capital, it is good to have an independent audit conducted of the smart contract. Furthermore, as the DeFi space continues to grow ($84B+ total value locked today), hacks like this will prevent institutional acceptance of alternative cryptocurrencies.

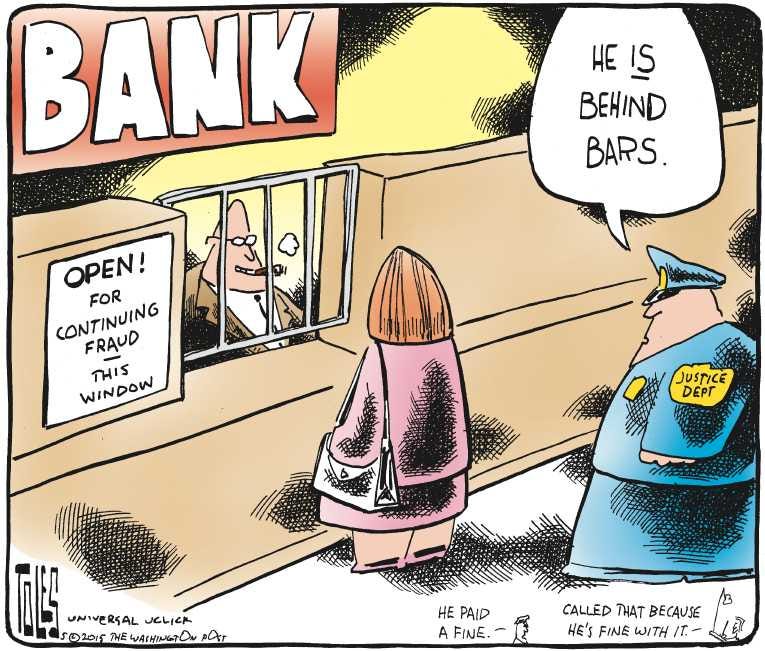

The trade-off in crypto is security vs. decentralization, with anonymous or pseudonymous actors harder to persecute.

The question we have to answer as a society is:

Are we ready to accept the risks of crypto in exchange for sovereignty over our capital?

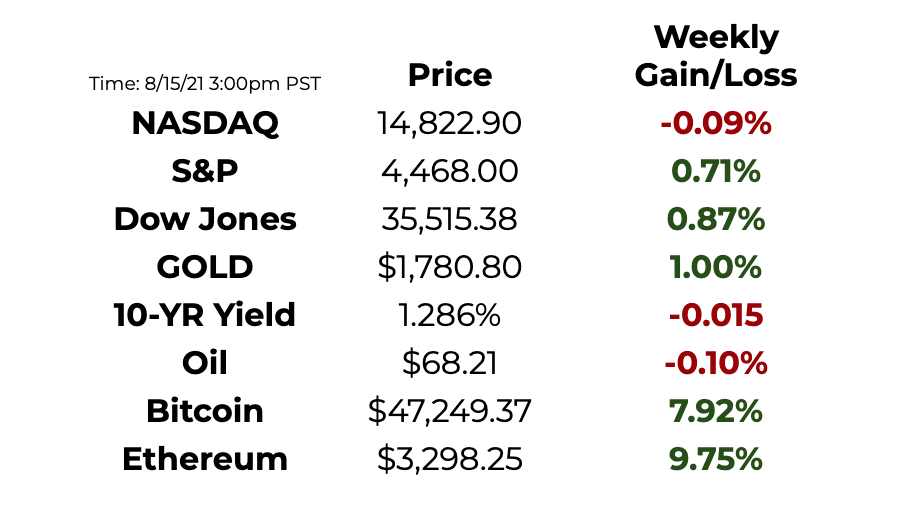

This Week By the Numbers 📈

Crypto Picks of the Week 💰

We are going to try something new here. I will start sharing coins that I’m watching and sharing my reasoning to help all of us invest better. Feel free to send tips :)

As always - crypto markets can be unpredictable so #DYOR.

A lot of great coins like Solana and LUNA had a strong run this week, so I would not recommend entering those today. This is potentially a good time to take profits.

Bitcoin - still has more room to run and I expect a strong positive news cycle imminently.

Ethereum - I increased my position today after Uniswap tried to charge me $200+ USD for a transaction. This type of gas spike reminds me of the doggy shit coin boom causing ETH to move from $2500 to $4500, and I’m willing to bet ETH will surpass $5K this month.

Cardano - take profits. I’m a fan of the team and the goals of the project, but not necessarily the current price action.

BNB and FTT - if you can’t invest in an exchange, invest in an exchange coin that reflects the growing crypto-user market.

Top Stories 🗞

Coinbase Stock Up More Than 8% After Record Quarter

The U.S.’s largest cryptocurrency exchange posted $1.9 billion in transaction revenue, outpacing the expected $1.57 billion. Its take rate – or retail trading revenue divided by retail trading volumes – was 1.24%, up from 1.21% and the first increase in the metric in the past four quarters. But the company noted in its guidance that monthly transacting users (MTUs) in July had declined significantly to 6.3 million, and trading volume was only $57 billion in the month. While August’s numbers were slightly higher than this, Coinbase warned that MTUs and trading volume would be lower in Q3 compared to Q2. Coinbase shares are now up about 17% from their reference price of $250, but down around 28% from their opening trading price of $381 in mid-April.

Venmo is letting its credit cardholders convert cash-back to crypto for free

The development is part of the broader crypto strategy of Venmo parent PayPal. The company launched a business division dedicated to cryptocurrencies earlier this year after introducing crypto trading to its customers last fall. This latest step gives it an opportunity to usher in a wave of new cryptocurrency holders. The new Venmo feature isn’t quite crypto-back, but it’s one step away from it. There are a number of credit cards getting ready to hit the market, like those from BlockFi and Gemini, that’ll offer spending rewards in cryptocurrencies, hoping to put crypto in people’s hands without making them invest in it. Instead, Venmo lets cardholders set an auto-purchase for the cryptocurrency of their choice to be made as soon as they receive their cash-back reward upon making a purchase with the card. That conversion is free of transaction fees to customers, and they’ll get the price of the cryptocurrency at the time of the conversion.

Neuberger Berman Greenlights Indirect Crypto Investments for Commodities Fund

Asset management firm Neuberger Berman has given its $164 million commodities-focused mutual fund the go-ahead to invest indirectly in bitcoin and ether. “Neuberger Berman Commodity Strategy Fund” added crypto derivatives, bitcoin trusts and exchange-traded funds (ETFs) to list of permissible investment strategies, the $400 billion manager said in Wednesday regulatory filings. The fund, which as a mutual fund would be widely available to investors, has been on a tear this year as commodity prices surged, according to a fact sheet. Its top holdings were gold, corn, heating oil and Brent crude at the end of June.

Democrats’ divisions could still derail infrastructure bills

Joe Biden’s economic vision has taken a major step toward becoming reality after the US Senate passed two infrastructure measures, but widening political divisions within the Democratic party could yet derail the entire legislative package. The Senate last week advanced a sprawling $3.5tn budget blueprint for “soft” infrastructure projects to tackle climate change and health care, a day after approving a $1tr bipartisan infrastructure bill to rebuild the nation’s crumbling roads and bridges. But even as Senate Democrats congratulated themselves on pushing through both measures, the fate of Biden’s economic priorities rests on House Democrats clearing several more looming hurdles as well as uniting the party’s left and right.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.