Myth Of Money: The Only Bitcoin Resources List You Will Ever Need

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

The Only Bitcoin Resources List You Will Ever Need

I have received several requests for Bitcoin resources. I find that in this case - less is more. Here are a few of my favorites to help you make your investment decision.

Institutional Reports

Fidelity: Bitcoin As An Alternative Investment

The Great Monetary Inflation by Paul Tudor Jones

Videos

“Bitcoin in the Boardroom” with Michael Saylor, CEO of MicroStrategy

Introduction to Bitcoin by Andreas Antonopoulos

Books

Other

I will continue to expand this list, so please send me your favorites! If you are struggling understanding this new field, feel free to reach to me directly for a virtual coffee and some digital asset basics.

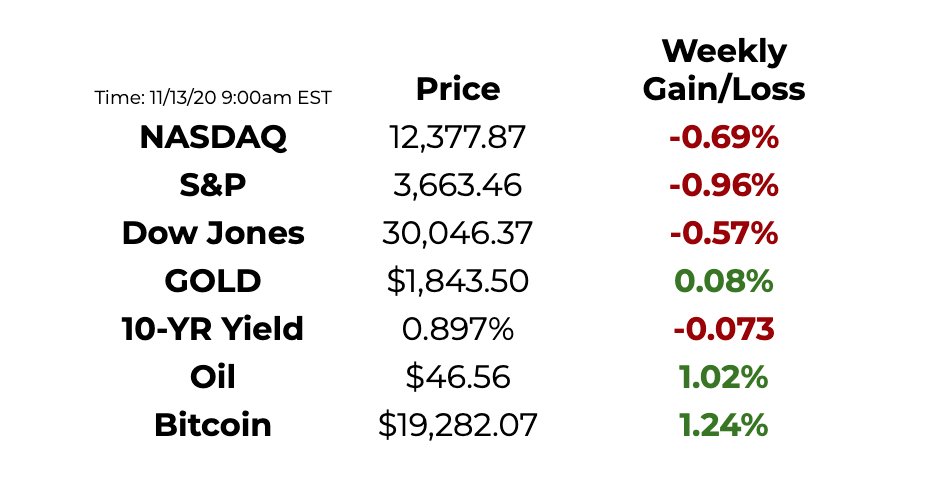

This Week By the Numbers

Markets remained relatively flat this week amid mixed news of delayed stimulus in the U.S. and the promise of COVID-19 vaccines being administered imminently. Oil prices continue to recover, preparing for a potential rally in Q1 of 2021.

The 2020 housing bull market driven by ultra-low mortgage rates continues. An estimated 11.4 million Americans are currently behind on rent, while a collective $1 trillion has been added to homeowner’s equity ($17,000 per household).

Top Stories

MicroStrategy to Raise $550M In Debt to Fund Purchase of More Bitcoin

Business intelligence software company MicroStrategy said Wednesday it would raise $550 million by the way of debt instruments to buy bitcoin, an increase of $150 million over its Monday announcement. The 0.75% convertible senior notes would be sold in a private offering to qualified institutional buyers, the company said. The institutional buyers would have an option to purchase an additional $100 million of notes within 13 days of the date of issue of the notes. On Tuesday, Citi analyst Tyler Radke downgraded Microstragey to “sell,” touching on CEO Michael Saylor’s “disproportionate focus” on the apex cryptocurrency. Read Full Story.

Apple Co-Founder Wozniak’s New Venture Lists Token to Help Fund Energy Efficiency Projects

The company aims to be a marketplace to streamline the process of financing and undertaking such projects by enabling them to receive crowd contributions from investors via its token, WOZX, which was listed on Thursday through HBTC. Efforce claimed the listing has increased its market value tenfold to $950 million. According to Efforce, energy services companies (ESCOs) tend to have limited access to capital since they often are unable to turn to traditional banking channels, as banks lack the technical expertise to properly assess the return on investment. There will be a smart meter on the company’s blockchain to measure each project’s energy savings and turn them into energy credits that are saved in investors’ profiles for use or sale. Read Full Story.

Trading app Robinhood hires Goldman Sachs to lead IPO

Stock trading app Robinhood Markets Inc has picked Goldman Sachs Group Inc to lead preparations for an initial public offering (IPO) which could come next year and value it at more than $20 billion, people familiar with the matter said on Tuesday. Robinhood was valued at $11.7 billion in its last private fundraising round in September. Such a jump in valuation would underscore the growth of its platform, which has helped popularize trading among millennials and fueled amateur stock picking during the COVID-19 pandemic lockdowns. Read Full Story.

Binance Expects to Earn From $800M to $1B This Year

Cryptocurrency exchange Binance will likely earn between $800 million and $1 billion this year, as market uncertainty drives interest – and trading – in cryptos. That’s up from about $570 million in 2019. Launched in 2017, Binance is one of the world’s largest crypto exchanges by trading volume. Read Full Story.

Conference Spotlight

Waves Enterprise Conference is Russia's leading blockchain event that is centered on enterprise implementation of innovative blockchain technologies by showcasing real-life use cases. The annual conference gathers key experts on developing blockchain-based solutions and representatives of businesses and government agencies, involved in the digital transformation of companies and entire industries. This year's conference will focus on blockchain implementations in the corporate and government sectors in Russia and China, as well as on successful projects executed in various industries in 2020. Waves Enterprise Сonference will run online on December 15, 2020, from 9am CET to 5:30pm CET.

Product of the Week

One of my favorite shopping hacks is Lolli, a user friendly rewards widget that allows you to earn #Bitcoin while you shop across thousands of retailers. Check it out here and start accumulating Bitcoin today :) [Available only in the U.S.]

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

✓

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.