Myth Of Money: The Rise of PolkaDot

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

This week I had the pleasure of sitting down with the team at Clover.Finance, building the next generation of DeFi applications on PolkaDot. Our conversation was technical and enlightening. PolkaDot has been a sleeping beast

TL;DR: We are about to see an entire wave of new projects on the PolkdaDot network, and likely price appreciation on the network as a result.

Summarizing my findings in Forbes:

DeFi or Decentralized Finance has been one of the biggest catalysts of the recent crypto bull market. From stablecoins, lending, trading, financial derivatives, and insurance protocols, DeFi projects have created new business models to innovate on the financial system. The total market value of current DeFi projects has grown exponentially from nearly US$700 million in early 2020 to more than $60 billion USD today.

The traditional financial system, however, remains hesitant to adopt many of these projects because the blockchains they operate on are either too slow, too expensive, or too centralized. Ethereum, for example, has an average transaction fee of $15 to $50 USD, and can go up to $300 during busy periods. This makes running daily financial applications impractical. There are centralized alternatives, but centralization poses challenges in building trusted financial instruments.

A new set of offerings is set to hit the market this month to build DeFi that is both decentralized and affordable, based on the Polkadot network, as well as its ‘sister’ test network, Kusama.

Polkadot, created by Ethereum Co-Founder Gavin Wood, aims to solve the problem of high gas fees by providing a heterogeneous multi-chain interchange and translation architecture, enabling customized side-chains to connect with public blockchains. As a sharded multichain network, Polkadot is able to process many transactions on several chains in parallel, eliminating the bottlenecks that occurred on legacy networks that processed transactions one-by-one. The PolkaDot ecosystem includes a range of DeFi applications, allowing all existing layer one solutions and applications to communicate with each other.

Of the upcoming PolkaDot network projects, there are three infrastructure projects that have received that have received the greatest investor attention: Acala Network (a DeFi Hub on PolkaDot), MoonBeam (a Smart Contract platform on PolkaDot) and Clover (an Operating System parachain on PolkaDot).

Keep reading on Forbes: Meet Clover, The Next Generation Of DeFi On PolkaDot And Kusama

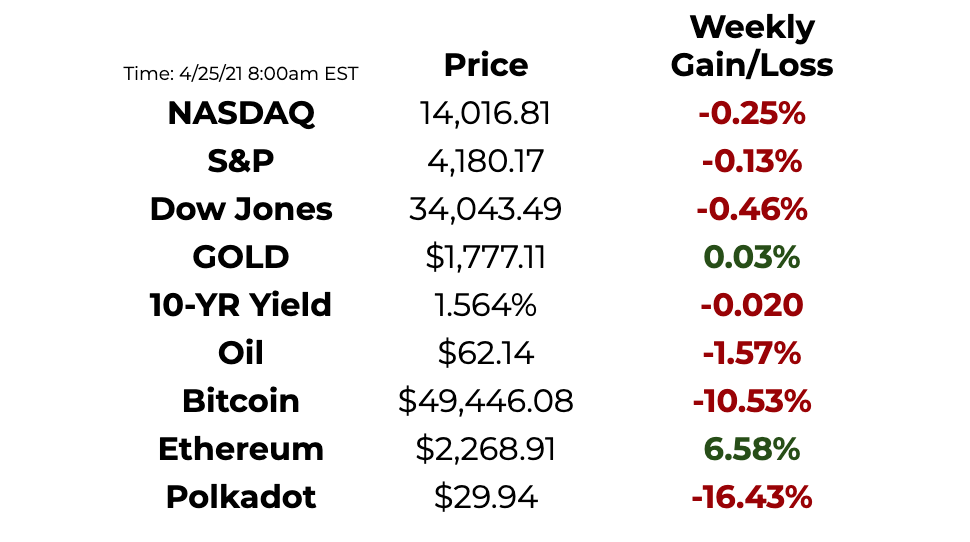

This Week By the Numbers 📈

The crypto markets took a beating this week as Bitcoin plummeted from $65,000 down to $47,500. A correction as overdue was most predicted a rough April. Not to worry, experts say the crypto bull market is far from over, as institutions continue to accumulate at record speed.

Major US indexes barely moved this week, despite investor fears over an upcoming Biden proposal to hike the capital gains tax on the wealthy as high as 43.4%.

Top Stories 🗞

Clubhouse closes new round of funding that would value app at $4 billion

Audio-chat app Clubhouse closed a new Series C round of financing valuing the company at $4 billion. The social media app said the new round of financing was led by Andrew Chen of venture capital firm Andreessen Horowitz with major investors like DST Global, Tiger Global and Elad Gil. The San Francisco-based company, whose app allows people to discuss varied topics in audio chatrooms, has seen its popularity surge after appearances by billionaires Elon Musk and Mark Zuckerberg. Bloomberg earlier this month said Twitter Inc was in discussions to buy audio app at a $4 billion valuation. Read Full Story.

City Comptroller Candidate Says Blockchain Is in New York’s Future

Reshma Patel unveiled a proposal to have New York invest in blockchain businesses and cryptocurrencies. New York City needs to think creatively about its post-pandemic recovery, says a candidate for city comptroller. This includes investments in the city’s blockchain industry. Under Patel’s plan, New York’s five retirement systems would invest up to 3% of their funds into cryptocurrencies, the city itself would invest in funds with blockchain exposure to help support fintech startups and New York would utilize a blockchain-based system for its procurement contracts. Patel also wants to work with the New York Department of Financial Services to streamline the BitLicense. Read Full Story.

Bitcoin Mining Hash Rate Drops As Blackouts Instituted In China

Local news outlets have tied a recent dip in the bitcoin mining hash rate to government-instituted blackouts in China. Regional blackouts instituted in Northwest China may be the cause of a drop in hash rate from several China-based bitcoin mining operations. The hash rate of several major bitcoin mining pools has dropped significantly. As of yesterday, Antpool’s hash rate had crashed by 24.5% in a 24-hour period, Binance Pool by 20%, BTC.com by 18.9% and Poolin by 33%. The blackouts were necessitated because of a “comprehensive power outage safety inspection” in Xinjiang. Read Full Story.

💰 VIP Investor Opportunity: Last GameBoard

This week I completed my Seed investment into Last Gameboard, alongside TVC, Riot Games and SOSV. The company is led by an incredible female founder Shail Mehta, with a hardware gaming product designed by Rob Wyatt, co-creator of X-Box. Analogous to a ‘Peloton’ or a ‘Kindle’ for gaming, Last Gameboard uses proprietary patented sensor technology to allow uses to play any board game, anywhere. Current partnerships include Catan, Game of Thrones, Carcassone and 100+ other games.

At a $20M valuation the round is oversubscribed, with some room carved out for influencers and celebrities. Send me a note if you would like an intro :)

Product of the Week: GDA Lending

This week I’m giving a shout out to my friends at GDA Lending. Having recently worked on a loan with them, I can say that they offer the best rates for collateralized crypto loans at 4.5%, with the lowest counter-party risk. If you are looking to borrow against your BTC or ETH, ping me for an intro here.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.