Myth of Money: The SuShi Rollercoaster🎢

They say, the next big thing often starts out looking like a toy. And this just may be true of DeFi.

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ subscribers.

If you received this email by accident, click here to unsubscribe.

Now let’s dig in…

This week, traders are seeing corrections in both traditional and crypto markets.

One area experiencing a sharp drop is the #DeFi markets.

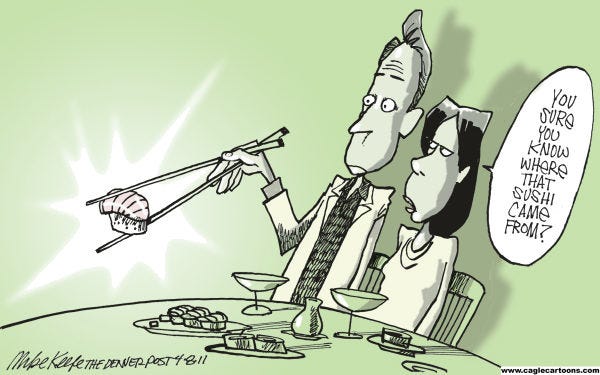

DeFi investments have generated 3,000%+ year-to-date returns for some, while others experienced losses this week amid rumors of scams. One such project was the $SUSHI protocol, founded by animated character Chef Nomi, which promised incredible upside to participants. Subsequently, the founder of $SUSHI withdrew $15M in founder tokens from the network, leading to a price drop of 88% in 5 days. Confused? Hungry? Lost?

If this sounds like a video game to you, it’s not. At the time of writing, the total value locked in DeFi contracts is approximately $8 Billion. Both institutional and retail money is flowing into DeFi projects at record speed.

They say, the next big thing often starts out looking like a toy. And this just may be true of DeFi. For those of us unfamiliar with this hot new trend, this week I took to Forbes to answer some of the most commonly asked questions.

So what is DeFi?

DeFi stands for “Decentralized Finance,” which aims to recreate the traditional financial system with less, well, middlemen. Many of the traditional actions in the markets such as lending, borrowing, structuring derivative products, and the buying and selling of securities, can now be done through a decentralized open-source network. The vast majority of these applications are currently created on Ethereum, but in principle, other platforms with smart contract capabilities could work too.

What are some common functionalities of DeFi?

To start off, DeFi would not exist without stablecoins. Unlike common cryptocurrencies like Bitcoin which are known for their volatility, a stablecoin is pegged to a fiat currency such as the USD or the Chinese Yuan. Recreating lending contracts and other financial products in a volatile asset is impractical, therefore most DeFi contracts incorporate stablecoins at the core of their functionality. Common types of stablecoins in the market today include USDT, USDC, TrueUSD, Dai and Paxos.

There are a few main categories dominating DeFi today.

1. Borrowing and Lending

DeFi allows a user to programmatically take out a loan, without an applications review or even a bank account. In some DeFi applications, the borrower does not need to go out and find a lender. Instead, the lender is the smart contract itself and interest rates are calculated algorithmically based on supply and demand. In other applications, a fixed interest rate is guaranteed in exchange for loaning your coins to the contract.

2. Decentralized Exchanges

Trading of securities and cryptocurrencies is typically done through platforms run by a third party. But what if a machine could seamlessly create a fair exchange through a smart contract? DeFi exchanges eliminate middlemen and can act as a custodian of funds and digital assets in a peer-to-peer exchange.

3. Asset Management Protocols

A recent category of DeFi products creates frameworks for users to pool funds for investments akin to robo-advisors, automated funds, and asset aggregators.

4. Decentralized Prediction Markets, Options and Insurance

This next category is all about betting on something happening or not happening in the future, and includes decentralized prediction markets, on-chain options and insurance, in a fully automated matter. Today, these platforms are often used to insure against a bug in a smart contract. In the future, these platforms will be used to insure against accidents and natural disasters.

5. Synthetic Asset Bridges

This is a really popular one! Assets like Bitcoin may be great for a certain functionality such as store of value, but are difficult to use as collateral. Think of it as gold stuck in a vault, difficult to move, secure and collateralize. Creating a digital representation or right to Bitcoin allows it to be used in financial contracts. These platforms are becoming so popular that Bitcoin is currently being tokenized faster than it is being mined.

DeFi also promises to combine different smart contracts with ease. For example, you could invest $100,000 at 5% interest, and then automatically reinvest that interest into another asset through a DeFi robo-advisor, or use it as collateral for a loan.

This Week By the Numbers

Markets experienced losses across the board. The U.S. unemployment rate fell to 8.4% from 10.2%, but Wall Street didn’t care. Bloated tech stocks began selling off, with Apple becoming one of the biggest losers in the process, shedding $300M in market cap in two days. The crypto space also experienced significant sell-offs by speculators. Investors are eagerly awaiting new announcements from the Fed next week, hoping for a rebound in the markets.

Top Stories

Softbank identified as the ‘Nasdaq whale’ that bought billions in stock options

Japan’s SoftBank was reportedly the “Nasdaq whale,” that bought billions of dollars in individual stock options in big tech companies over the past month, driving up volumes and contributing to a trading frenzy. Investors have been watching extraordinary activity in out-of-the-money calls which some analysts had seen as a contrarian warning about a pending Nasdaq sell off. Some of the names with high amounts of activity, include Apple, Tesla, Zoom, and Nvidia. The Wall Street Journal said SoftBank bought $4 billion in options on stocks it owned, like Amazon and Microsoft, but also in other names. Read Full Story.

US trade deficit surges in July to highest in 12 years

The U.S. trade deficit surged in July to $63.6 billion, the highest level in 12 years, as imports jumped by a record amount. The Commerce Department reported that the July deficit, the gap between what America buys and what it sells to foreigners, was 18.9% higher than the June deficit of $53.5 billion. It was the largest monthly deficit since July 2008 during the 2007-2009 recession. The July deficit increase was driven by a record 10.9% increase in imports which rose to $231.7 billion. Exports were also up but by a smaller 8.1% to $168.1 billion. When Donald Trump campaigned for president in 2016 he pledged to sharply lower the country’s large trade deficits, especially with China, which for years has been the country with the largest trade surplus with the United States. Read Full Story.

Amazon to hire 10,000 additional employees in Bellevue, Washington

Amazon on Friday said it will create 10,000 jobs in the Seattle suburb of Bellevue, on top of the 15,000 jobs it already planned to create there over the next few years. Earlier this month, Amazon announced it is planning to create 3,500 jobs across Dallas, Detroit, Denver, New York City, Phoenix and San Diego. Of the new roles, 2,000 will be based in New York, which is in addition to the thousands of jobs it has already committed to creating there. Read Full Story.

Tesla to sell up to $5 billion in stock amid its incredible rally

Amid Tesla’s incredible rise that has seen shares soar to new highs, the electric auto maker said Tuesday it will sell up to $5 billion in new stock. “We intend to use the net proceeds, if any, from this offering to further strengthen our balance sheet, as well as for general corporate purposes,” Tesla said. The stock briefly traded in the green on Tuesday, but moved lower throughout afternoon trading and ended the session 4.67% lower. The decline hardly dents shares’ rapid appreciation this year. Through Monday’s close, the electric car maker has gained nearly 500% in 2020. In the last year, shares have gained 1,004% compared with the S&P 500′s 20% rise. Read Full Story.

Book of the Week

This week I finished reading Stephanie Kelton’s The Deficit Myth. As a die-hard Bitcoiner, it was difficult to read a book by a left-leaning economist advocating for increased printing of money as a solution to all of our problems. After working my way through the book, however, I believe it holds valuable lessons and a balanced perspective on how the American monetary system actually works. One lesson stood out in particular - we may have thought about debts and deficits all wrong, and perhaps they are not a cause of panic after all. Available on Amazon here.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.