Myth Of Money: The "Up Only" Market Update

Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 10,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

Greetings from Dubai 🇦🇪

The last couple of weeks have been a whirlwind of travel from my home in Malibu, California to the Grand Prix in Bahrain to the UAE for Dubai Blockchain Week.

Are We Heading Into Another Bull Run?

Many of you have asked me if we are about to have another bull run in the crypto markets. I have been speaking to some of my favorite crypto traders and investors on this side of the world and wanted to share their thoughts.

The market is in a crucial position. We have hovered around $44k all last week, with resistance at $45k. Most traders were sitting at the edge of their seats last night, waiting for a weekly close above $46k as the crucial level to support the ‘bull run’ theory. We surpassed that, hitting $47k. The question is - can we sustain it until monthly close on Thursday night. If we sustain the $46k level, this will likely mean that we are getting another alt season, particularly if ETH/BTC pair starts to trade at 0.08 or higher.

This would confirm the “supercycle” theory, where we can expect not one local top (or the two we have already seen) but three or four, each reaching new highs but taking longer to get there. This is a reasonable assumption given that this adoption curve in crypto is different than in other cycles, with more retail and institutional participators than before. I have been re-entering the market the last two weeks and so have many of the traders I trust. My spidey senses are telling me we are heading for another run.

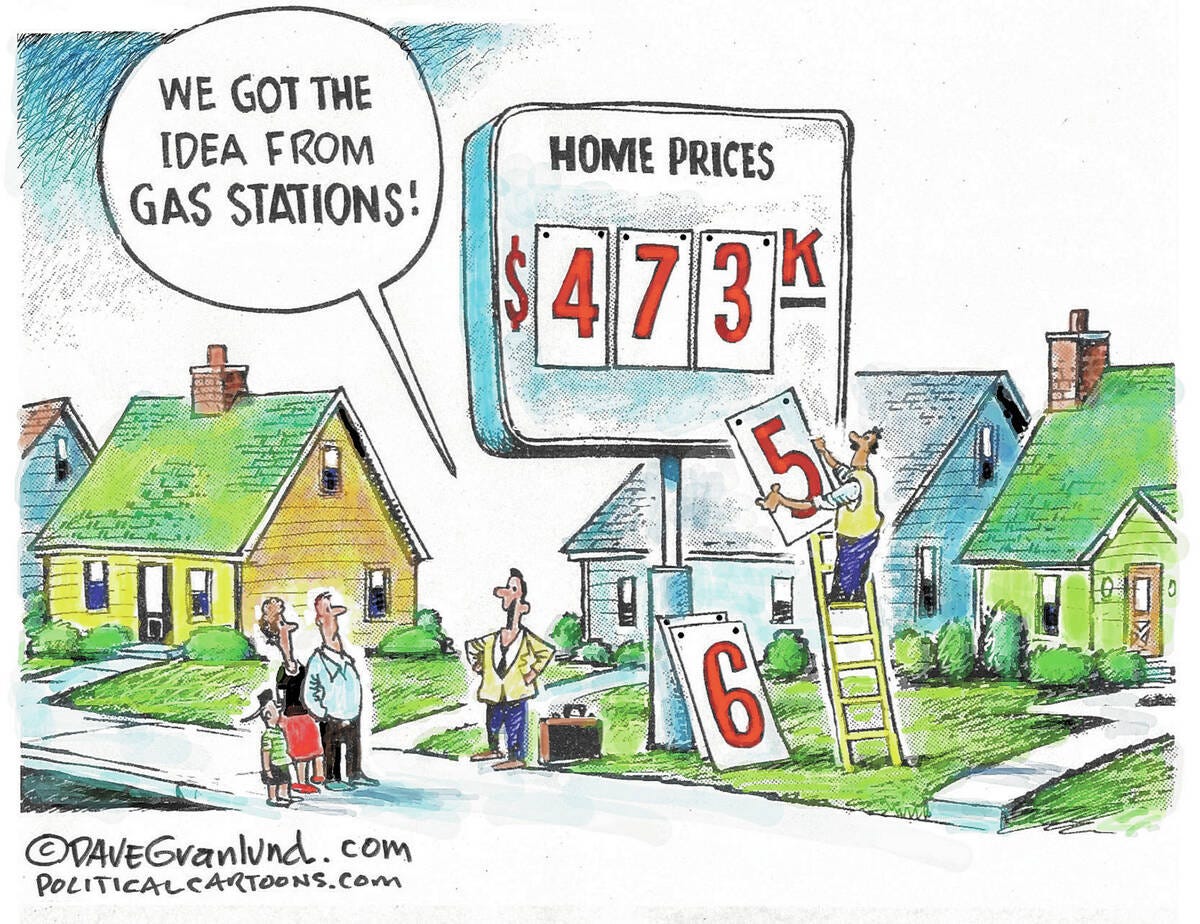

Macro and Inflation

From a macro perspective, we are seeing more global support for Bitcoin. Due to the Russia/Ukraine conflict, Putin has proposed accepting Bitcoin payments for oil and natural gas, instead of the U.S. Dollar. This is not a small move. We know that inflation is happening at an unprecedented rate. In simple terms, inflation occurs when there is more money in the system than goods produced by that system, so the price per unit of good has to go up. Historically, dollar-based inflation is largely absorbed by the global market. American GDP has never had the true pressure of trying to keep up with dollars printed because so much of the global trade and debt created artificial demand for the dollar. If global trade starts to move to the Chinese Yuan or to Bitcoin, we will see inflation accelerate and reach new highs.

What should we do to protect ourselves from inflation?

Hold Bitcoin, Gold, Silver, Real Estate, and Commodities. Price of wheat, oil, and steel are all expected to rise.

This Week By the Numbers 📈

Since we missed the last 2 weeks, the changes on the chart below will seem a bit more drastic. Nonetheless, I think it’s good to see that, despite the war, the last 3 weeks have been positive across the board for traditional and crypto markets.

Top Stories 🗞

India enforces 30% tax on profits from cryptocurrency assets

As revealed in the Union Budget, profits from trading in crypto and other virtual assets such as non-fungible tokens (NFTs) will be taxed at a flat 30% rate beginning in April. This would apply to all virtual digital assets (VDA) and their earnings from Bitcoin to non-fungible tokens (NFTs). Furthermore, for every transaction involving crypto and other virtual assets, 1% of tax will be deducted at source (TDS). Meanwhile, with only a few days till the new tax system for crypto assets takes effect, numerous investors are reportedly booking profits, rejigging their portfolios, or transferring their crypto assets to private wallets outside of India.

Coinbase to reportedly buy the $2.2B Brazilian unicorn behind Mercado Bitcoin

Coinbase is set to continue its global acquisition strategy, reportedly buying the Brazilian company 2TM, the parent company of Mercado Bitcoin. Mercado Bitcoin is Latin America’s largest crypto brokerage, whose parent company, 2TM cemented its unicorn status as a billion-dollar company in 2021. Valued at $2.2 billion, 2TM has also pursued an acquisition strategy, particularly in lusophone countries. 2TM’s Mercado Bitcoin snapped up Portuguese CriptoLoja, a Lisbon-based crypto exchange in January.

Recession Signals Light Up as Section of US 'Yield Curve' Inverts

While bitcoin's bullish breakout has brought cheer to the crypto market, the U.S. bond markets appear to signal an economic recession, a bearish cue for risk assets. Data tracked by charting platform TradingView shows that a section of the Treasury yield curve inverted early on Monday. The spread between yields on the 30- and 5-year government bonds fell under zero for the first time since 2006 – a year before the great financial crisis of 2007-2008. The spread between the 10- and two-year yields, another widely-tracked section of the yield curve, was 12 basis points short of inversion at press time. A yield curve is a graphical representation of expected returns from bonds of different maturities. Yields have an inverse relationship with bond prices – as price increases, yields fall.

NFT Collection Failures Begin to Mount in Flashback to ICO Bust

For every Bored Ape and CryptoPunk there is a Baby Baller, one of the thousands of NFT projects that have faltered not long after celebrated debuts. On average, one in three NFT collections have essentially expired, with little or no trading activity, blockchain analytics firm Nansen found. Another third are trading below the amount it cost issuers to mint the tokens. Nansen analyzed about 8,400 collections comprised of 19.3 million individual NFTs on the Ethereum blockchain. As failed projects pile up, long-time crypto observers are having flashbacks to the Initial Coin Offering bust of 2018, when thousands of digital token quickly become worthless after regulators warned they’re probably unregistered securities. Much like ICOs in their heyday, NFTs have become one of the hottest corners of the cryptocurrency world as speculators seek to take advantage of the surging interest and prices for the digital certificates of authenticity most commonly representing art or collectibles.

Sacha Jafri’s #ARTMAZE

On a more creative note…

Last night I attended the Art Maze, created by amazing artist Sacha Jafri, displaying a collection of UNESCO World Heritage Sites from around the world. The exhibit took place on the Helipad of the iconic Burj Al Arab hotel in Dubai. The first painting was of Mount Kenya 🇰🇪

The exhibition will continue at UNESCO sites around the world.

Details on their » website.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.