Myth Of Money: TIME Magazine Names Vitalik in It’s Top 100

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

This week, non-other than the Economist came out with a cover story cautioning readers about DeFi.

A few highlights:

The crooks, fools and proselytisers are off-putting. Nevertheless, the rise of an ecosystem of financial services, known as decentralised finance, or “DeFi”, deserves sober consideration. It has the potential to rewire how the financial system works, with all the promise and perils that entails. The proliferation of innovation in DeFi is akin to the frenzy of invention in the early phase of the web. At a time when people live ever more of their lives online, the crypto-revolution could even remake the architecture of the digital economy.

DeFi is one of three tech trends disrupting finance. Tech “platform” firms are muscling in on payments and banks. Governments are launching digital currencies, or govcoins. DeFi offers an alternative path which aims to spread power, not concentrate it. To understand how, start with blockchains, vast networks of computers that keep an open, incorruptible common record and update it without the need for a central authority.

…

Crypto-enthusiasts see a Utopia. But there is a long way to go before DeFi is as reliable as, say, JPMorgan Chase or PayPal. Some problems are prosaic. A common criticism is that blockchain platforms do not scale easily and that the computers they harness consume wasteful amounts of electricity. But Ethereum is a self-improvement machine. When it is in high demand the fees it charges for verification can climb, encouraging developers to work on minimising the intensity with which they use it. There will be new versions of Ethereum; other, better blockchains could one day replace it.

Despite cautious skepticism expressed by the media, SALT Conference, which is traditionally an event full of Wall-Street suits, was more a crypto conference this year with Galazy’s Mike Novogratz, FTX’s Sam Bankman-Fried, Pantera’s Dan Morehead and a series of “NFT-experts” all shilling crypto to a new set of institutional followers. Even Bridgewater’s Ray Dalio and Point 72’s Steve Cohen appeared to be bullish.

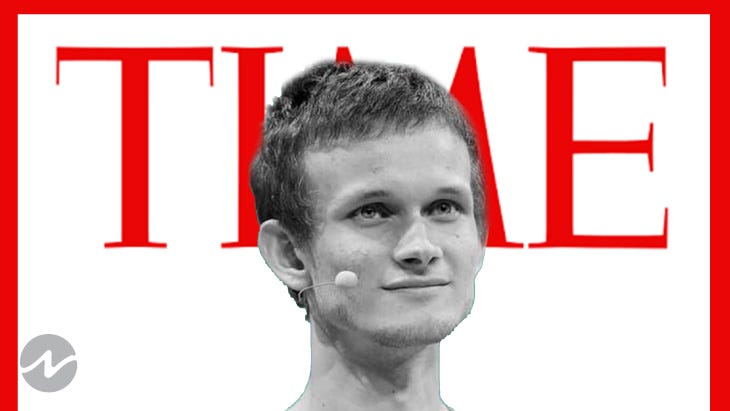

TIME Magazine Names Vitalik in It’s Top 100 Influential People

The second big media event this week was Time’s Magazine Top 100, naming Vitalik Buterin, Ethereum founder, among the list.

Reddit’s Alex Ohanian wrote:

Thanks to Reddit’s r/Ethereum community, I’ve had the privilege of following Vitalik Buterin’s career from early on, which is why I’ve taken a certain pride in watching his legacy grow. Sure, we can talk about the value he’s created as the platform’s co-founder, including Ethereum’s impressive market cap of around $400 billion, the dazzling world of decentralized apps and this year’s boom in the trading of NFTs. What makes Vitalik so special, though, is that he is a builder’s builder. No one person could’ve possibly come up with all of the uses for Ethereum, but it did take one person’s idea to get it started. From there, a new world has opened up, and given rise to new ways of leveraging blockchain technology—some of which I’ve invested in. Whether it’s startups like Sorare reinventing fantasy sports or Rainbow users showing off their NFT collections, none of this would’ve existed without Vitalik’s creation. I’ve never been more excited about the potential of the Internet, and that’s largely thanks to Vitalik Buterin.

This Week By the Numbers 📈

Top Stories 🗞

Degenerate Ape NFT Sells for More Than $1M on Solana

A Degenerate Ape Academy non-fungible token (NFT) on the Solana blockchain was sold Saturday for 5980 SOL, or $1.1 million, in the largest-ever NFT sale on the rival to the Ethereum blockchain. Apparently not content with having shelled out more than $1 million for an NFT of a scarred zombie ape with a halo eating a brain, Moonrock Capital, a Europe-based blockchain advisory and investment firm, announced a few hours later it had purchased a CryptoPunks knock-off NFT also on the Solana blockchain for 1388 SOL, or $257,446.24. Read Full Story.

Gensler Says Most Crypto Trading Platforms Need to Register With SEC

U.S. Securities and Exchange Commission Chairman Gary Gensler will emphasize that almost all crypto trading platforms need to register with the SEC in testimony he plans to give before the Senate Committee on Banking, Housing and Urban Affairs on Tuesday. A copy of his prepared remarks was released on Monday. Gensler wrote that while not every crypto token qualified as a security, the fact that platforms have allowed the trading of so many tokens means it is highly likely that at least some securities are being offered on the platforms. “Make no mistake: To the extent that there are securities on these trading platforms, under our laws they have to register with the commission unless they qualify for an exemption,” Gensler wrote. Read Full Story.

Consulting Firm EY to Work With Polygon on Ethereum Scaling

Big Four consulting firm Ernst & Young (EY) will use Polygon’s protocol and framework to deploy its own EY blockchain products on the Ethereum blockchain. EY will adopt Polygon’s scaling products to allow it to boost transaction volumes and to provide “predictable costs” and settlement for business customers, according to a press release on Monday. EY will also have an option to move transactions onto the public Ethereum network, the company said. Polygon’s “commit chain” – another term for a blockchain scaling product – has been retrofitted by EY to create permissioned, private industry chains that take advantage of new models used to verify transactions. Read Full Story.

Cathie Wood predicts bitcoin will surge to $500,000 in 5 years - and says Ark Invest's confidence in ether has shot up dramatically

Ark Invest CEO Cathie Wood expects bitcoin to soar to $500,000 in five years, and her firm's conviction in ether has strengthened tremendously, the star stock picker said in an interview with the CNBC anchor Andrew Ross Sorkin at the SALT Conference. Her price prediction depends on whether companies continue to diversify their balance sheets into bitcoin, the biggest cryptocurrency by market value, and whether institutional investors begin to allocate 5% of their funds to it. She said that if she could own just one cryptocurrency, she would default to bitcoin, "because countries are now deeming it legal tender." Read Full Story.

VIP Investment Opportunity 💰

Sincere thank you to everyone who participated in our Minicircle SPV last week. We pooled $400k+ into their seed round, backed by Peter Thiel, Sam Altman and Naval Ravikant. The company is developing longevity gene therapy for the masses.

The success of our last 3 deals, have spawn off a new venture - we will be rolling a series of Myth of Money SPVs through Angellist. The sigh-up link will be shared next week.

In the meantime, if you are a founder looking for additional exposure and funding, please reach out. SPVs are a great way to open your deal to the investment community while keeping you cap-table squeaky clean ;)

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.