Myth Of Money: Time to Un-Tether?

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

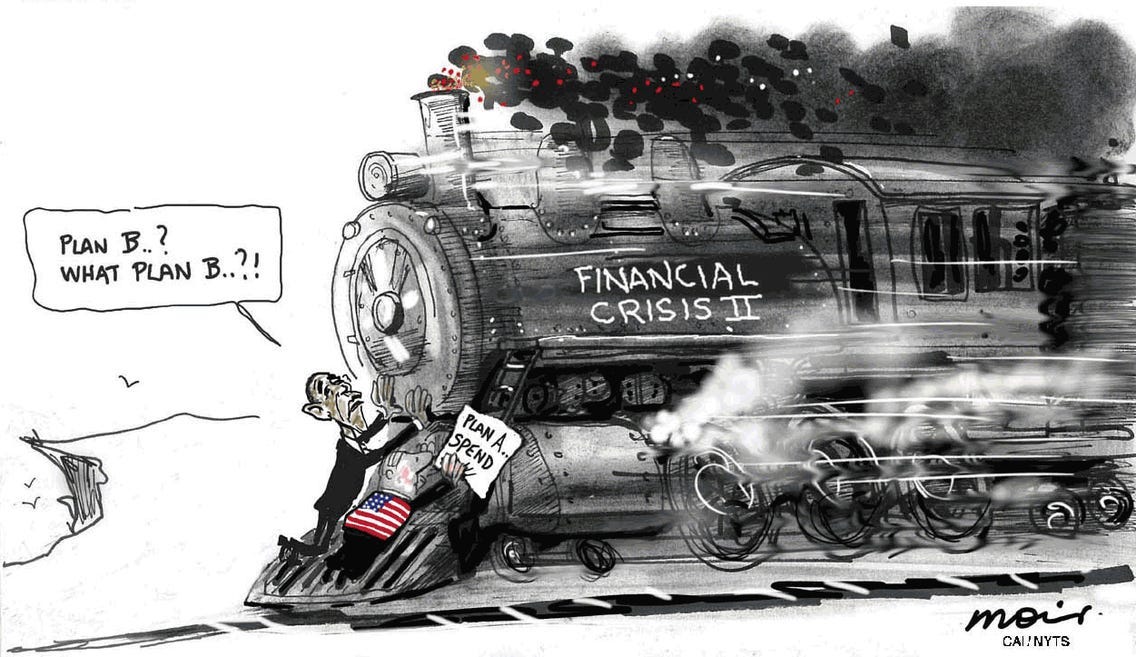

Boston Federal Reserve Bank President Eric Rosengren delivered delivered a speech on Friday citing several financial systemic risks to the financial system.

Rosengren covered three specific areas:

Periodic disruptions to short-term credit markets

Role of Money Market Mutual Funds (MMMFs)

Other potential cash management alternatives

New disruptors – for example Tether

Need for emergency lending facilities and regulatory changes in crises

Extraordinary actions were required

Despite efforts, many programs seem better suited to larger institutions and firms

Need a less ad hoc approach

Possible risks in housing

Residential housing prices showing some exuberance

Real estate has played a role in financial stability problems in the past

What was most impactful about this speech is that a senior U.S. Federal Reserve official called Tether’s USDT stablecoin a risk to the stability of the financial system. Rosengren included the stablecoin among what he termed “new disruptors” to short-term credit markets.

“The reason I talked about Tether and stablecoins is if you look at their portfolio, it basically looks like a portfolio of a prime money market fund but maybe riskier…Tether has a number of assets that, during the pandemic, the spread got quite wide on those assets.”

“I do think we need to think more broadly about what could disrupt short term credit markets over time, and certainly stablecoins are one element,” Rosengren said. “I do worry that the stablecoin market that is currently, pretty much unregulated as it grows and becomes a more important sector of our economy, that we need to take seriously what happens when people run from these type of instruments very quickly.”

This statement is particularly interesting as it calls out Tether by name, among a sea of stablecoins. Tether has long been criticized as posing a risk to the crypto markets as a whole, and in particular Bitcoin.

A recent report showed that Tether is 49% backed by unspecified commercial paper.

According to the breakdown, Tether’s reserves as of March 31, 2021 were composed of 75.85% cash and equivalents, 12.55% secured loans, 9.96% in corporate bonds and precious metals and 1.64% in other investments, including digital currencies. This is consistent with the company’s past statements but more precise. The cash section was further broken out into different components: 65.39% commercial paper, 24.2% fiduciary deposits, 3.87% cash, 3.6% reverse repo notes and 2.94% Treasury bills.

It is unclear what the ratings are on the commercial paper or the corporate bonds, which agencies rated them or which companies issued them. Tether declined to identify the borrowers of the loans or the collateral backing them.

This is not meant to be an alarmist post to urge your to sell your Tether. I will say that the vast majority of traders and those wishing to hold ‘digital’ cash do so in Tether. If something where to happen to call Tether’s value into question, it would cause a domino effect on the entire crypto markets. Proceed at your own risk and diversify accordingly.

—

On a more personal note, I am back in Los Angeles for the summer and look forward to catching up with colleagues and friends :)

This Week By the Numbers 📈

While traditional markets recovered this week, the crypto markets continue to move sideways. Pending positive news, we are unlikely to see any significant recovery until at least September.

Top Stories 🗞

Peter Thiel-Backed Exchange Bullish Is in Talks to Go Public in SPAC Merger

The crypto exchange Bullish is in talks to go public via a SPAC merger with fintech-focused acquisition company Far Peak Acquisition Corp. Bullish is backed by billionaire investor Peter Thiel, as well as Galaxy Digital and Tokyo-based Nomura Holdings. Bloomberg reports the deal could value Bullish at up to $12 billion, though the final valuation will largely depend on the price of bitcoin at the time of the deal. The exchange has close ties to Block One, the parent company behind EOS. Read Full Story.

McAfee Found Dead in Spanish Prison as Extradition Loomed

John McAfee, the controversial software magnate and crypto booster, has died in what’s preliminarily being called a suicide in a prison in Barcelona. McAfee was awaiting extradition to the U.S. to stand trial on charges of tax fraud. “Everything indicates that it could be a death by suicide,” the Catalan Department of Justice said in a statement. According to an October 2020 indictment by the U.S. Department of Justice (DOJ), “McAfee earned millions in income from promoting cryptocurrencies, consulting work, speaking engagements, and selling the rights to his life story for a documentary.” He faced a total of 10 years in prison for allegedly cheating his way out of $4 million. Read Full Story.

Bipartisan Crypto Bills Pass US House of Representatives

The U.S. House of Representatives passed two crypto bills on Tuesday evening. The Consumer Safety Technology Act, sponsored by Rep. Jerry McNerny (D-Calif.), directs the Consumer Product Safety Commission to establish a pilot program to explore use cases for artificial intelligence in commerce. The two blockchain bills – the Blockchain Innovation Act and parts of the Digital Taxonomy Act – direct the Secretary of Commerce and the Federal Trade Commission (FTC) to study and report on the use of blockchain technology and digital tokens. The Consumer Safety Technology Act was approved in a previous session of Congress, passing the House in September 2020, but was never approved by the Senate and died at the close of the session. Read Full Story.

Product of the Week: GDA Lending

This week I’m giving a shout out to my friends at GDA Lending. Having recently worked on a loan with them, I can say that they offer the best rates for collateralized crypto loans at 4.5%, with the lowest counter-party risk. If you are looking to borrow against your BTC or ETH, ping me for an intro here.

💰 VIP Investor Opportunities

FullCycle Climate Partners is a $250M fund built to deliver climate impact and financial returns at scale. The fund invests in technology companies and their associated pipeline of real-assets, accelerating the deployment of climate-critical projects. Current investments include waste-to-energy, sustainable agriculture, and hydro power.

Who is this opportunity for?

Institutional investors with a long-term time horizon and an interest in the climate sector.

[Respond to this email to learn more and for an introduction to the team.]

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.