In cryptocurrencies circles, the art of creating a token that has both a practical use and a consequential appreciation in price is called ‘tokenomics.’

A common example of a real world token is arcade tickets. The tickets are first ‘printed’ and either given or sold to the player. The player then uses the tokens to play games, during which the arcade recuperates its tickets for providing the games. On occasion the players can also purchase toys with their tickets. The arcade then either reuses the tokens or issues new ones to keep the cycle moving. Ultimately, the arcade has full control of the supply of arcade tickets outstanding and can choose to increase or decrease the supply at any time from the arcade ‘treasury’. The tickets have value so long as players continue to participate in the arcade economy.

This is the basic model that is applied to most cryptocurrencies today, with the main exception of Bitcoin, which behaves more akin to a commodity such as gold.

The same proponents of cryptocurrencies, which are born out of ‘thin air’ and are supported by the hypothetical ‘utility’ of the tokens within that particular economy, consistently criticize the U.S. Dollar for also being backed by ‘thin air.’ We often hear the argument for ‘hard money’, or money that is backed by real world assets, such as gold.

Now, before I go further, I will state on the record that I am a proponent of Bitcoin (as evidenced by my other writings.)

This week I decided to take a peak at Stephanie Kelton’s new book - the Deficit Myth. As the former economic advisor to the Bernie Sanders campaign, Kelton is a proponent of Modern Monetary Theory, a polarizing idea that most of our social problems such as education, healthcare and climate initiatives can be funded by printing more dollars. Once a crazy leftist idea, it appears the current Republican government has decided to do just that to solve for the current pandemic.

Kelton argues that there is no real limit on how much money we can print, and that the only limit is inflation. Sounds reasonable. So how do we avoid a high rate of inflation when printing $3 trillion+ U.S. dollars (and counting) during a pandemic?

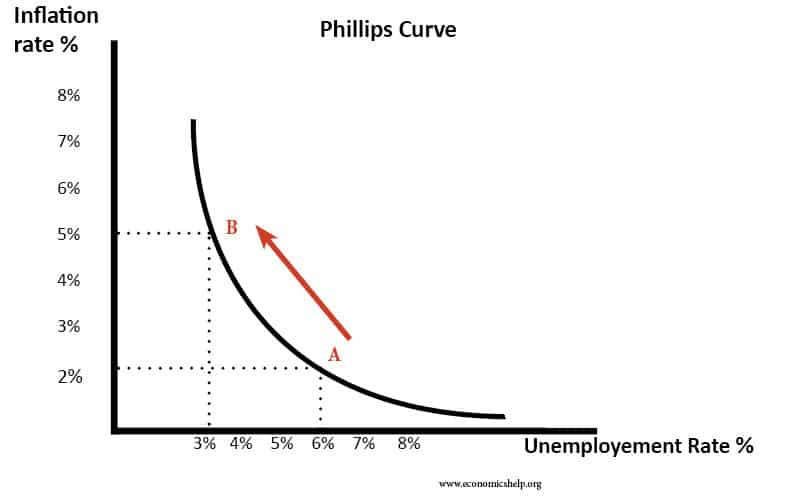

Kelton uses the tried and true economic argument of the Phillips Curve, which states that the higher the level of unemployment, the lower the level of inflation, and vice versa. This is because in a recession, much of the production capacity sits idle. Just think of the restaurant kitchens or car manufacturers that had to decrease production during the pandemic. There is not enough income in the system and therefore monetary stimulus is appropriate to increase production. As the stimulus gets distributed and more people become employed, competition for workers increases, salaries rise, and consequently so do price levels, leading to inflation.

Since the U.S. employment hit a record high of 14.7% in April, the government had room to print more dollars without approaching inflation.

The July unemployment rate was recorded at 10.2%, meaning the Federal Reserve can continue to further stimulate the economy, until we reach a ‘natural rate of unemployment’ of 3.5-4.5%, at which point the Federal Reserve can slow down the stimulus and even begin to decrease the amount of dollars in circulation.

A common question is - “if the government can print as much as money as it wants, what makes that money valuable?” We are apprehensive watching other countries such as Lebanon, Venezuela and Zimbabwe print too much, and hit hyperinflation or the rapid devaluation of their currencies. The reality is, the value of the dollar does not depend on the amount that is being printed but rather the utility that dollar has within the economy. So long as people believe the dollar to be valuable, and the dollar continues to be accepted as the primary method of payment both in the American economy and the global economy, the utility and therefore the value of the dollar continues to be supported.

Similar to a token which is created before it has any utility or inherent value, the dollar can be printed first and assigned a value once in circulation. There is no theoretical need for the dollar to be backed by a hard asset, so long as the Federal Reserve continues to cautiously balance stimulus with unemployment.

So then, what are the real threats to the U.S. Dollar today?

The imminent threat is surprisingly not posed by the money printer. Like in any business, the real threat is competition - someone creating a better alternative to your product.

Today, the U.S. Dollar has several competitors:

Euro - although a real competitor, the Euro is an unlikely threat to the dollar given current economic issues in Europe.

Digital Yuan - once a far fetched idea, the Chinese Digital Yuan poses a real threat as a more efficient and easily accessible currency across emerging markets. An easy to use and stable digital currency can solve for the problem of remittances and provide a secure solution to the unbanked in Africa, East Asia and South America.

Bitcoin - Bitcoin’s real competitive advantage is sovereignty. With growing geopolitical uncertainty, there is an increasing demand to hold money or wealth outside political systems. Bitcoin provides just that.

This Week By the Numbers

Markets had mixed results this week amid confusion of America’s future. Technology stocks continue to rally driving the NASDAQ further, while S&P closed at a new record high. Gold remains strong amid global uncertainty, while Bitcoin dips after rallying to a new 2020 high of $12,486.

Top Stories

New US jobless claims rise back above 1M

New claims for US unemployment aid rose back above 1M last week, as the pace of lay-offs picked up again in a worrying sign for the recovery of the labour market in the world’s largest economy. There were 1.1m initial jobless claims on a seasonally adjusted basis for the week ending August 15, the US Department of Labor said on Thursday. That was higher than economists’ forecast for 925,000 claims. A week earlier, claims totaled 971,000, having slipped below 1m for the first time since the pandemic initially struck the labour market in March. Read Full Story.

At least 5 dead, nearly 700,000 acres burned as massive fires threaten Northern and Central California

Wildfires ringing the Bay Area and other parts of the state killed at least five people, destroyed more than 500 structures and scorched hundreds of square miles as evacuations expanded Thursday. In all, more than 694,000 acres have burned in Northern and Central California — the equivalent of 1,085 square miles, more than twice the size of the city of Los Angeles. The fires, fanned by strong winds, heat and low humidity, have forced more than 60,000 people to evacuate. At least 539 structures have been destroyed, and the fire-fanning weather conditions that have brought record temperatures and thousands of lightning strikes in the past few days are not expected to abate soon. Read Full Story.

Airbnb files confidential IPO paperwork

Airbnb on Wednesday announced that it has submitted a draft registration to the Securities and Exchange Commission for an initial public offering. The company did not disclose its financial information nor did it specify how many shares would be offered. The filing comes after a rough year for Airbnb and the U.S. travel industry. Airbnb in May laid off nearly 1,900 employees, or about 25% of the company. The coronavirus pandemic brought the travel industry to a halt. Airbnb rebounded, however, after a surge of rentals in rural areas as residents with means fled pandemic-stricken cities. Read Full Story.

Key Factors Driving Bitcoin’s 73% YTD Return

Bitcoin surged to a new 2020 high of $12,486, posting a 73% year-to-date return on investment. As both crypto investors and traditional investors pay increasing attention to this alternative asset, a common question arises - what is driving bitcoin’s price? Bitcoin has often been compared to a digital version of gold, as gold is an asset outside of the control of any government, regulated as a commodity and is used as a hedge and a store of value during times of geopolitical uncertainty. The following are some of the factors driving Bitcoin’s price appreciation today. Read Full Story.

Product of the Week:

One of my favorite banking alternatives is Aspiration Bank. Focused on fossil-free investments, Aspiration gives you $50 to get your account started and plants 25 trees on your behalf. Use this link to get your $50 today :)

Enjoyed your reading experience?

Thank you for reading this week’s edition of the Myth of Money.🚀As always, reach out with feedback and ideas.

Best,

If you enjoyed your reading experience, say thanks here:

BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.

The function of money has always only been that of unit of account, and the vast majority has at anytime just existed as ledger entries. What these ledger entries represents is the sole thing that matters, and also simply an expression of the record owners value/time preferences. The confusion here is the indoctrination into the pseudo-science of economics in general, and Jevon's 1875 definition of 'money' in particular. The latter only refers to commodity money, which was at no time relevant for economic activity at scale. -- https://hackernoon.com/the-fallacy-that-is-cryptocurrency-ya3u36q3