Myth of Money: UAE Awards License to Kraken Exchange

Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 12,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your own research.

***Correction*** - the previous post had a typo in the heading. Travel days can be quite tiring and mistakes happen 🥱

Dear Investors,

Today I am heading back to Dubai after a fruitful trip across Nigeria and Kenya. Seeing a new generation of crypto investors and traders around the world, only further solidifies my faith in our budding industry, despite current market conditions. Innovation is here, and it is here to stay.

I have frequently shared my thesis on investing in infrastructure, as these investments tend to better withstand economic cycles. I look at exchanges, wallets, L1s, payment rails, etc.

Exchanges continue to be the focus of discussion globally, as American crypto exchange Kraken becomes the second virtual asset platform after Binance to receive regulatory approval to operate in Abu Dhabi’s free zone, Abu Dhabi Global Market (ADGM).

What does this mean for Kraken and UAE?

With the new operational license in Abu Dhabi, Kraken aims to better integrate with local banks and payment service providers. This will help the crypto exchange bring global-level liquidity to the United Arab Emirates region, which sees trading volumes upwards of $25 billion worth of cryptocurrency annually. While operating as a fully licensed crypto exchange, Kraken will offer United Arab Emirates dirham (AED) pairs for local investors.

Kraken will become the first cryptocurrency exchange to offer direct funding and trading in UAE dirhams against BTC, ETH and a range of other virtual assets.

Kraken, which launched in 2011 and operates in over 60 countries, said the UAE launch marks a wider play into an increasingly lucrative region.

Why is the UAE crypto market significant?

The Middle East is one of the fastest-growing cryptocurrency markets in the world, making up 7% of global trading volumes. The UAE transacts approximately $25 billion worth of cryptocurrency each year. It ranks third by volume in the region, behind Lebanon (about $26 billion) and Turkey ($132.4 billion).

Many Web3 entrepreneurs have moved to Dubai and Abu Dhabi in the last 12-24 months due to friendly COVID conditions and 0% tax regime, attracting new talent and capital to the region. Greater regulatory clarity further encourages this migration, establishing the UAE as the “new Singapore.”

Binance has also been given regulatory approval to operate in Abu Dhabi in recent weeks and will recruit for over 100 positions in the country. Fellow exchange Bybit was also given approval to open a headquarters in Dubai last month, while FTX received a virtual-asset license in Dubai and will set up a regional headquarters soon.

In addition to the influx of regulated businesses in the Middle East, both local businesses, real estate brokerages, and even schools have started to accept cryptocurrencies.

What about money laundering?

While the Emirates might be winning over some of the world's largest crypto companies, the country is also coming under increasing international scrutiny for not doing enough to crack down on so-called ‘dirty money’ flows. Recent reports claim that crypto firms in the UAE have been inundated with requests to liquidate billions of dollars of virtual currency, as Russians seek a safe haven for their fortunes within Dubai's property market and UAE banks, amid the war in Ukraine.

Last month, the world's main anti-money laundering watchdog, the Financial Action Task Force, also placed the UAE on its "gray list" of countries that need extra monitoring. The UAE joins Syria, Turkey and Panama in a list of countries which, according to the FATF, need to address money-laundering threats.

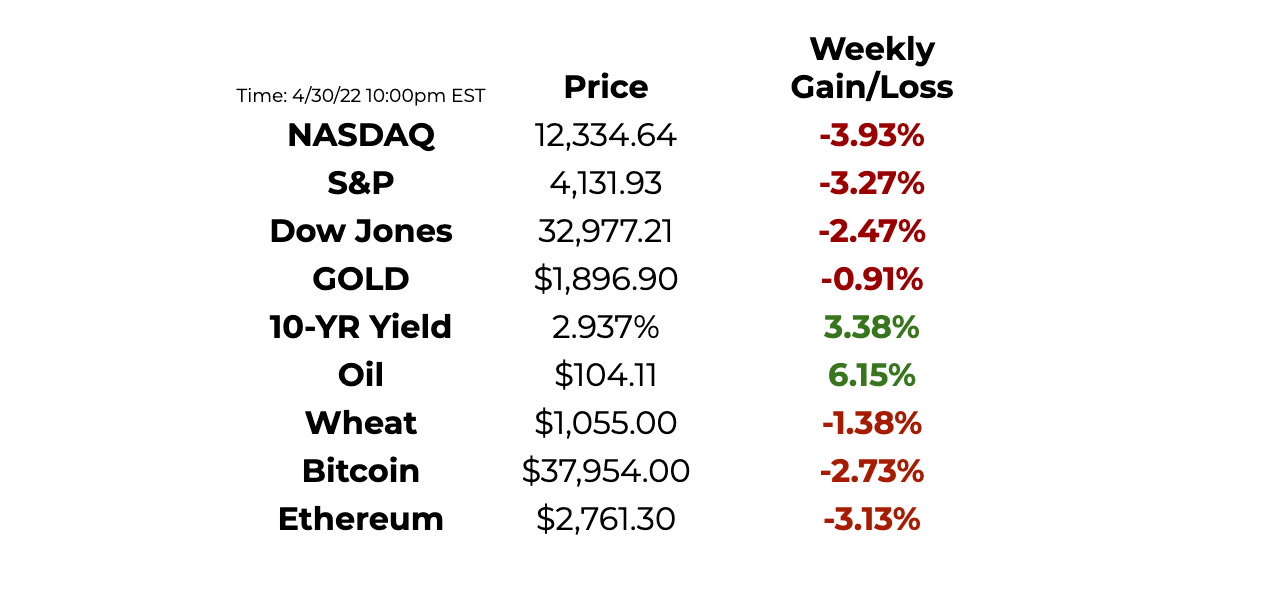

This Week By the Numbers 📈

Markets dipped further this week as the Fed continues “Quantitative Tightening”. By the looks of things, price action will get worse before it gets better.

Top Stories 🗞️

Failure to launch: Australia’s first 3 crypto ETFs all miss launch day

Three cryptocurrency exchange-traded funds scheduled to launch on the Cboe Australia exchange were delayed due to “checks” still being undertaken. The launch of Australia’s first three Bitcoin (BTC) and Ether (ETH) exchange-traded funds (ETF) scheduled for Wednesday has been delayed as a result of further “checks” needing to be completed. The exchange listing the Bitcoin Spot ETF from Cosmos Asset Management, Cboe Australia, released a statement late Tuesday stating that “standard checks prior to the commencement of trading are still being completed” and a “further update will be provided in the coming days.”

New York State Assembly Passes Bill Blocking New Crypto Mines That Use Non-Renewable Power

The New York state Assembly passed a bill to block new crypto mining facilities using non-renewable energy sources from setting up shop in the Empire state. Assembly bill A7389C, sponsored by Democrat Anna Kelles, will impose a two-year moratorium on new crypto mining firms that use a carbon-based energy source. A corresponding bill is working its way through the state Senate. The crypto industry mounted fierce opposition to the bill, warning it might lead to miners relocating, impacting jobs or the U.S.'s "geopolitical interests.”

Tesla Share Price Tanks — $126 BILLION Wiped as Elon Musk's Twitter Deal Causes Alarm

Tesla's share price plunged by 12% on Tuesday as traders reacted with alarm to Elon Musk's $44 billion purchase of Twitter. Tuesday's bloodbath on Wall Street wiped $126 billion off the company's valuation and also caused Musk's net worth to fall heavily. It's a sign that Tesla investors are unhappy about his plan for two reasons. There are fears that Musk would need to sell his shares in order to finance the deal to buy the social network. And amid uncertainty over whether the world's richest man would also become Twitter's CEO, investors worry he could be spread too thin. Ed Moya, a senior market analyst at OANDA, has warned that Musk might not have the financing to complete the Twitter acquisition if Tesla's share price continues to fall.

Bipartisan bill to give CFTC authority over exchanges and stablecoins

A bipartisan group of lawmakers in Washington, D.C., introduced an updated bill on Thursday to regulate cryptocurrency developers, dealers, exchanges and stablecoin providers, bringing them under the regulatory control of the United States Commodity Futures Trading Commission (CFTC). The Digital Commodity Exchange Act of 2022 (DCEA) was re-introduced to Congress by Republican Representatives Glenn Thompson and Tom Emmer with support from Democrat co-sponsors Darren Soto and Ro Khanna. The updated version includes a section covering stablecoin providers, who can register as a “fixed-value digital commodity operator.” These operators would be obligated to share how the stablecoin operates, retaining records for the regulator along with providing information on the assets backing the “fixed-value digital commodity” and how they’re secured.

Binance blocks crypto accounts of relatives tied to the Russian government

The Binance cryptocurrency exchange is adopting more measures to prevent the Russian government from mitigating the impact of sanctions through the use of crypto. Binance has shut down several accounts tied to relatives of senior Kremlin officials over the past two months since Russia began military action in Ukraine, Bloomberg reported on Thursday. According to the report, the affected persons included Elizaveta Peskova, the daughter of Russian President Vladimir Putin’s spokesman, Dmitry Peskov, and Polina Kovaleva, the stepdaughter of foreign minister Sergei Lavrov. Binance said it had also blocked Kirill Malofeyev, the son of Konstantin Malofeyev, a Russian oligarch who was previously charged with violating sanctions from the United States.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.