Myth Of Money: We Are Launching a Syndicate

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

We Are Launching a Syndicate 💰

Sincere thank you to everyone who participated in our Minicircle SPV. We pooled $400k+ into their seed round, backed by Peter Thiel, Sam Altman and Naval Ravikant. The company is developing longevity gene therapy for the masses.

The success of our last 3 deals, have spawn off a new venture - a hub for all future SPV’s under the brand of Moonwalker Capital on Angellist. To participate in future deals, SIGN UP HERE (LINK).

If you are a founder looking for additional exposure and funding, please reach out. SPVs are a great way to open your deal to the investment community while keeping you cap-table squeaky clean ;)

Dear Investors,

Crypto markets took a beating last week due to China’s second largest property developer Evergrande facing default. The Chinese government stepped in to provide oversight, easing pressure on the markets.

But the bullish sentiment didn’t last for long, as China decided to ban Bitcoin… again. The market flinched, but avoided the big dip we expected. This is because investors are becoming desensitized to China’s scare tactics.

According to CNBC:

Services offering trading, order matching or derivatives for virtual currencies are strictly prohibited, the PBOC said, while overseas exchanges are also illegal.

Beijing has cracked down sharply on crypto this year. The Chinese government moved to stamp out digital currency mining, the energy-intensive operation that validates transactions and produces new coins. That led to sharp slump in bitcoin’s processing power as miners took their equipment offline.

The PBOC banned banks and non-bank payment institutions like Alibaba affiliate Ant Group from providing services related to virtual currency.

Bitcoin dipped 5% and Ethereum 7% after the announcement.

Of course, the more China tries to ban something, the stronger the case for decentralization becomes.

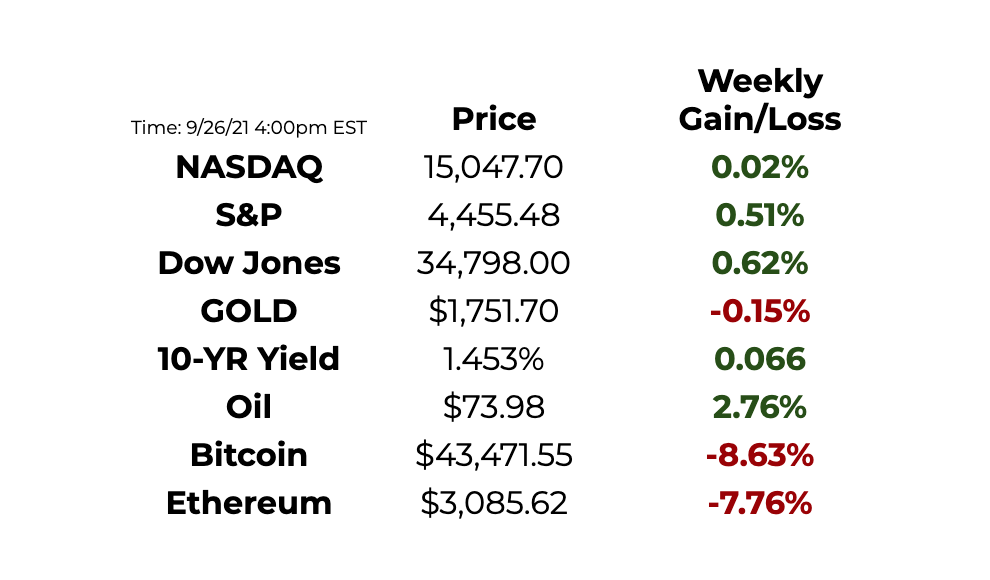

This Week By the Numbers 📈

Top Stories 🗞

Bakkt to Go Public Next Month After SEC OK’s SPAC Plans

Bakkt Holdings and VPC Impact Acquisition Holdings (VIH) have received approval from the U.S. Securities and Exchange Commission to complete their merger and push forward with plans to operate as a single publicly traded entity, the companies said in an announcement Friday. VIH shareholders will meet on Oct. 14 to approve the merger, the companies said. Cryptocurrency exchange Bakkt, which is majority-owned by Intercontinental Exchange (ICE), has been planning to go public via the merger with VIH, a special purpose acquisition company (SPAC). VIH is affiliated with Victory Park Capital. Read Full Story.

Federal Reserve Could Taper ‘Soon’ as Officials See Interest Rate Hike Next Year

The U.S. Federal Reserve said it will keep interest rates near 0% and continue to purchase bonds at the same $120 billion-a-month pace it has been doing, but the market now has clarity on how the central bank will start to unwind, or taper, its stimulus program. The Federal Open Market Committee (FOMC), the central bank’s monetary policy panel, said Wednesday in a statement that tapering the bank’s bond purchases “could be warranted soon,” because the economy has made progress toward its goal of maximum employment. The panel said it will keep the target rate for federal funds in a range of 0% to 0.25%. Read Full Story.

MiamiCoin Going Mainstream ‘Faster Than Bitcoin,’ Mayor Suarez Says

MiamiCoin (MIA), the cryptocurrency created by private actors to benefit the 44th-largest U.S. city, may have a better shot at everyday use than bitcoin, Mayor Francis Suarez said Thursday. In an appearance on CoinDesk TV’s “First Mover,” Suarez, who is working to attract crypto businesses to Miami, claimed MIA has “been mainstreaming significantly faster than bitcoin,” even though you can’t yet buy anything with the token. He noted that the coin is trading for pennies, which Suarez suggested may make holders more willing to spend it than bitcoin. “What’s interesting about bitcoin is that its use case has essentially been a store of value, and the question is, does MiamiCoin remain a store of value ... or does it have a different use case?” Suarez said. “We feel that if MiamiCoin metamorphoses into a currency ... there exists a possibility that it could have wide use and applicability.” Read Full Story.

Dapper Labs Said to Reach $7.6B Valuation in $250M Funding Round

Dapper Labs has closed a $250 million funding round, the company behind NBA Top Shot and the Flow blockchain said Wednesday. Coatue led the raise, which also included Andreessen Horowitz, Google’s GV and Version One Ventures. According to a source familiar with the deal, Dapper Labs received a $7.6 billion valuation. The Dapper mega-round comes just a day after soccer NFT giant Sorare raised $680 million in a raise that valued the Paris-based fantasy sports platform at $4.3 billion. Read Full Story.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.