Myth Of Money: We Are Through the Gates

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

Greetings from Dubai :)

Bitcoin resumes an epic bull run this week reaching a new all time high of $67,276.79, before dropping back down its the $61,000-range.

The move was largely catapulted by the long-awaited Bitcoin ETF approval. Applications were in the works for the better part of a decade, apparently.

What is an ETF?

An ETF is a basket of securities, shares of which are sold on an exchange. They combine features and potential benefits similar to those of stocks, mutual funds, or bonds. Like individual stocks, ETF shares are traded throughout the day at prices that change based on supply and demand.

How Does the Bitcoin ETF Work?

The Bitcoin ETF, currently trading on the NASDAQ, reflects the price of ‘futures contracts’ on Bitcoin.

According to CoinDesk and JPMorgan:

This week’s launch of the ProShares Bitcoin Strategy Exchange-Traded Fund (BITO) may have aided the cryptocurrency’s recent price surge to an all-time high, though the perception of bitcoin as an inflation hedge over gold is probably a bigger factor, a JPMorgan strategist wrote Thursday.

In its first two days of trading, BITO amassed assets of over $1 billion, according to ProShares.

Bloomberg ETF analyst Eric Balchunas said the new ProShares futures-focused fund is the fastest in the history of the ETF industry to reach $1 billion in two sessions. Such an ascent eclipsed the SPDR Gold Trust (GLD) ETF’s 18-year record at three days to reach this level.

JPMorgan strategist Nikolaos Panigirtzoglou wrote in a note to clients there has been a shift from gold ETFs into bitcoin funds since September, and there are already existing vehicles for investors to gain bitcoin exposure. The bank sees this shift in flows being bullish for bitcoin into year’s end.

BITO had trading volume of over 29 million shares Wednesday, representing over $1.2 billion, according to a representative from the company.

Separately, billionaire investor Paul Tudor Jones told CNBC earlier this week he currently prefers bitcoin over gold as an inflation hedge.

Many expected this announcement to not be a big deal. “Sell the news” they said. And I was tempted to think they are right.

The truth is, Bitcoin is now through the gates. This was the last hurdle for regulators to fully acknowledge Bitcoin as an institutional asset class. I have no question in my mind that Bitcoin will be worth $1M in the next 5 years. Just think about all of the pension and institutional capital that is yet to flow in.

And then there is inflation. We have 5.4% CPI and 4% core inflation. In reality, the cost of lumber, steel and pretty much everything else has gone up double-digits. Unless something drastically changes, consumer savings will continue to disintegrate. (I keep telling all my friends to buy at least one piece of real estate for this reason).

Those of you who bought Bitcoin 10 years ago, 5 years, even 2 years… Congrats you had the foresight to be early. But frankly, we are still early. This is the sweet spot when you can invest in an asset poised for incredible growth without the speculative risk of a potential ban or over-regulation. We are here.

This Week By the Numbers 📈

This Week in Forbes

Worldcoin Wants To Give Cryptocurrency To Every Human On Earth

Co-founded by Y-Combinator former president Sam Altman and physicist Alex Blania, the new crypto company Worldcoin has a bold ambition - to put its currency into the hands of every human on Earth.

Despite the increasing buzz with Bitcoin hitting all time highs and the NFT-mania populating every corner of the sports and entertainment industry, only 3% of the world’s population hold any cryptocurrency. According to Global Findex, over 31% of the global population is unbanked. This means billions of people who don’t have access to traditional financial services, have also never used a cryptocurrency network for simple transactions such as payment of goods and services.

The lack of adoption can be attributed to high technological barriers to entry for joining the ecosystem. Wallets are confusing to understand and crypto protocols are complex to communicate. New currencies are usually marketed through airdrops, where users with wallets who have participated in related projects are gifted a small amount of the new currency. By their nature, airdrops exclude those that are not part of this privileged group and fail to give access to the freedoms and power that cryptocurrency can provide to the people who need it most.

In an effort to put cryptocurrency in the hands of more users, Worldcoin has launched a plan to distribute their cryptocurrency to all, with an emphasis on new users in developing markets.

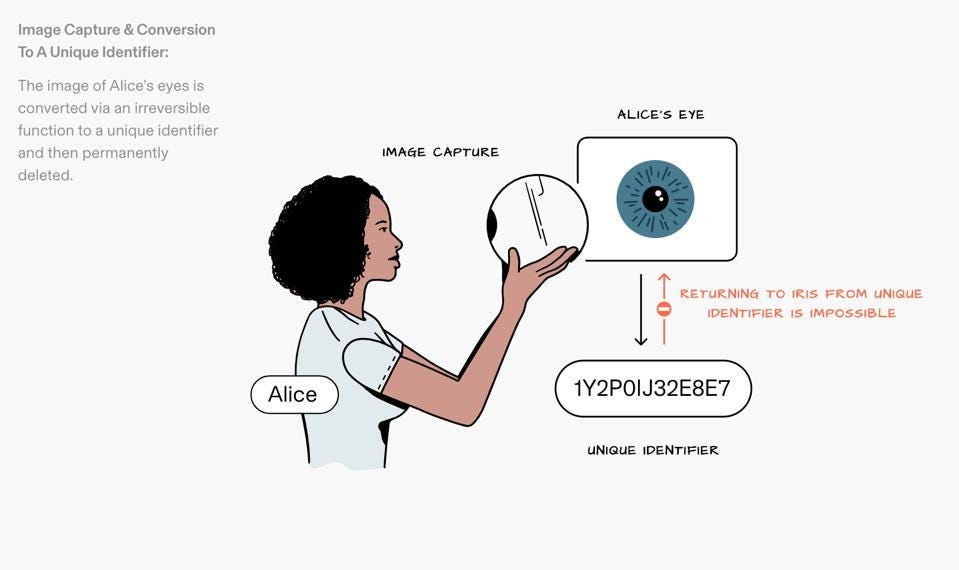

In its tokenomics design, each future user has been pre-allocated their share of the coin’s supply. Employing a unique distribution strategy, the company has built an Orb, a hardware biometric device that uses unique identification techniques to identify users, help people set up their wallets and receive their allocation of the digital currency. The Worldcoin team plans to identify operators around the globe to operate the device and reward successful signups. These operators organize in town squares, transit hubs, and public rights of way to enroll people and deposit the coin into a wallet application on their phone.

Top Stories 🗞

North Vancouver becomes first to heat buildings through Bitcoin mining

North Vancouver announced Thursday it would become the world's first city to be heated almost entirely by bitcoin mining, an innovative way to tackle climate change by creating valuable cryptocurrency coins and usable thermal energy at the same time. The city energy utility company is teaming up with MintGreen, a Canadian cleantech cryptocurrency miner, to create renewable and clean energy for the city by mining for the popular digital coin using their proprietary "Digital Boilers," which recover more than 96% of the electricity used for bitcoin mining in the form of heat energy. Read Full Story.

Walmart Has Quietly Begun Hosting Bitcoin ATMs

Walmart, the world’s largest company by revenue, is letting customers buy bitcoin at dozens of its U.S. stores. Shoppers can purchase the cryptocurrency at Coinstar machines inside the retailer’s cavernous big box stores. Coinstar is best known for allowing consumers to exchange coins for paper bills or gift cards. The ability to buy bitcoin is enabled by Coinme, a crypto wallet and payment firm that specializes in bitcoin ATMs (BTMs). Read Full Story.

Australia Has Third-Highest Rate of Crypto Adoption in the World

Finder’s survey found Australia has the third-highest rate of crypto ownership at 17.8%, topping such countries as Indonesia (16.7%) and the city of Hong Kong, a special administrative region of China (15.8%). The global average is 11.4%, according to Finder’s results. Of the nearly 1 in 5 adults in Australia who own some form of crypto, Finder found bitcoin is the most popular coin as 65.2% of Australians who own crypto own the world’s largest crypto, the fifth-highest percentage of all 22 countries surveyed. Ethereum, meanwhile, is the second-most popular coin in the country with a share of 42.1% among those who own crypto, while cardano’s share comes in third at 26.4%. Two other cryptos Australian crypto owners hold are dogecoin (23%) and binance coin (14.6%).

Galaxy Digital’s Entertainment Arm Raises $325M Fund for NFT, Gaming Bets

Galaxy Digital re-stocked its crypto-culture war chest earlier this year with a $325 million venture fund focused on digital entertainment. The fund, from Galaxy Interactive, which scouts gaming and arts startups for Mike Novogratz’s crypto conglomerate, has been investing in projects such as Art Blocks for months now, General Partner Sam Englebardt told CoinDesk. If non-fungible tokens (NFTs) and other crypto tech are to form the backbone of this coming metaverse, then Galaxy wants its share of the spine. The same goes for gaming. Read Full Story.

Join Our Syndicate 💰

Following the success of our last 3 deals, have spawn off a new venture - a hub for all future SPV’s under the brand of Moonwalker Capital on Angellist. To participate in future deals, SIGN UP HERE (LINK).

We are launching our first deal shortly, so don’t miss out.

If you are a founder looking for additional exposure and funding, please reach out. SPVs are a great way to open your deal to the investment community while keeping you cap-table squeaky clean ;)

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below