Myth Of Money: What Does Independence Mean To You?

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

Happy Independence Day for those celebrating this weekend. Stock markets remain closed until tomorrow, while the crypto markets continue to heat back up.

This weekend I got to thinking about monetary sovereignty or independence, and what it might mean for our global economies.

What is Monetary Sovereignty?

Monetary sovereignty is the power of the state to exercise exclusive legal control over its currency, broadly defined, by exercise of the following powers:

Legal tender – the exclusive authority to designate the legal tender forms of payment.

Issuance and retirement – the exclusive authority to control the issuance and retirement of the legal tender.

Which Countries Have Monetary Sovereignty?

Countries such as the U.S., Switzerland, Japan and Canada have monetary sovereignty, while EU countries have ceded their monetary sovereignty to the European Central Bank.

The ability of a government to spend its way out of an economic downturn is paramount. It is what separates America from say… Greece in a financial crisis. The Federal Reserve can print more dollars during a shortage and then raise interest rates to contract the supply when the crisis is over. This monetary sovereignty did not exist previously when the dollar was pegged to gold.

Monetary sovereignty, however, is a continuum rather than a binary classification. India, for example, has monetary sovereignty but must pay a lot of its debt in U.S. dollars. That means that India’s monetary policy is constrained by its balance of payments. It needs foreigners to buy its domestic assets in dollars in order to fund its account deficit, creating a financial constraint on its monetary system.

Where Does Bitcoin Fit In?

Countries such as El Salvador, Lebanon, Nigeria and Zimbabwe technically have monetary sovereignty, but because they borrow and repay debt in U.S. dollars, and their fiat currencies are untethered to any real assets, their fiat is much more susceptible to devaluation and hyperinflation.

In the past, the remedy was simple - adopt the U.S. dollar or peg your currency to it. But at a time of global instability and questionable monetary decisions by the U.S. Federal Reserve, these countries want a fighting chance at independence. And to them, that chance is Bitcoin. We can expect El Salvador to be the be first of a series of countries adopting Bitcoin as legal tender across South America, Africa and even the Middle East.

What Is Happening in Lebanon?

The consequences of doing nothing are staggering. This past week, Lebanon has witnessed riots, fires and bank break-ins as its currency continues to plummet. Thousands are in line for fuel and food as resources grow scarce, and the Lebanese pound has lost 90% of its value this past year.

To learn more about what caused this currency crisis, you can check out profile on Lebanon in Forbes here.

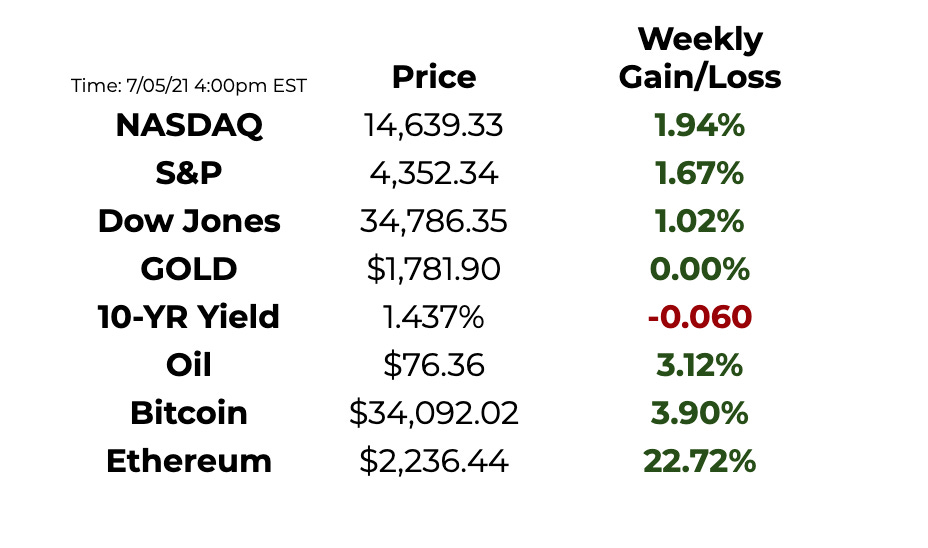

This Week By the Numbers 📈

Top Stories 🗞

Jeff Bezos is stepping down as Amazon CEO

Amazon founder Jeff Bezos on Monday will hand over his chief executive title to Andy Jassy, ending a more than two-decade run leading the company through its evolution from online bookseller to $1.75 trillion global retail, logistics and internet behemoth. The company announced in February that Bezos would transition from CEO to executive chair, saying he wanted to spend more time on his other ventures, including the Washington Post, space company Blue Origin and philanthropy. But even as he stepsback into a less public role at the company, Bezos will still have tremendous influence at Amazon for years to come, by virtue of being its largest individual shareholder, a longtime mentor to the incoming CEO and his role heading the board. Read Full Story.

Tom Brady, Gisele Bundchen take equity stakes in crypto company FTX

NFL star Tom Brady and his wife, supermodel Gisele Bundchen, are taking equity stakes in cryptocurrency-exchange company FTX. In a statement Tuesday, FTX said the couple will enter a long-term partnership as company ambassadors and receive an unspecified amount of crypto assets. The couple will also work on FTX’s charitable efforts. Brady, a seven-time Super Bowl-winning quarterback, said in the statement that he looks forward to “educating people about the power of crypto,” while Bundchen noted “the potential to apply resources to help regenerate the Earth, and enable people to lead better lives, therefore generating real transformation in our society.” FTX is one of the world’s largest crypto exchanges, and is seeking as much as $1 billion in a new funding round that would value the company at around $20 billion. Read Full Story.

Coinbase Debuts Savings Product With 4% APY on USDC Deposits

Coinbase is rolling out a crypto savings account that lets you earn 4% annual percentage yield (APY) by lending out your USDC. The account isn’t FDIC- or SIPC-insured and functions much like other products at crypto lenders and other exchanges that regularly offer yields around 8%. The reason why Coinbase is offering a comparatively lower yield is because it doesn’t lend to “unidentified third parties,” said Thorsten Jaeckel, senior product manager at Coinbase. Coinbase, which administers the USDC stablecoin in partnership with Circle through the CENTRE Consortium, appears to be aiming squarely for banks with its new product, touting rates “more than 50x the national average of a traditional savings account.” Read Full Story.

Product of the Week: GDA Lending

This week I’m giving a shout out to my friends at GDA Lending. Having recently worked on a loan with them, I can say that they offer the best rates for collateralized crypto loans at 4.5%, with the lowest counter-party risk. If you are looking to borrow against your BTC or ETH, ping me for an intro here.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.