Project Izanagi: SoftBank's $100 Billion Leap into AI Chips

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X below.

Thank you to everyone inquiring about Moonwalker Capital. Our firm had an exceptional first week trading the L2 Bitcoin narrative with a 30-50% rise across $STX, $ALEX, $DIKO, and other related plays.

Over in traditional markets, in a move that underscores its relentless pursuit of innovation and dominance in the tech industry, SoftBank Group, under the visionary leadership of CEO Masayoshi Son, is reportedly setting its sights on a groundbreaking venture that could reshape the landscape of the semiconductor market. Son is spearheading an ambitious plan to raise up to $100 billion for a chip venture, dubbed Project Izanagi, aimed at rivaling industry giants like Nvidia Corp. This venture is not just another investment; it represents SoftBank's strategic foray into the burgeoning field of artificial intelligence, promising to deliver semiconductors that are crucial for AI advancements.

Project Izanagi, named after the Japanese deity of creation and life, symbolizes SoftBank's commitment to fostering the emergence of artificial general intelligence (AGI). With an initial investment of $30 billion from SoftBank and an additional $70 billion potentially sourced from Middle Eastern institutions, Izanagi's aspirations are not merely financial but are a testament to Son's belief in a future dominated by machines smarter than humans—a future he envisions as happier and more prosperous.

SoftBank's investment strategy has been characterized by its high-conviction bets on startups and its agility in navigating the volatile tech market landscape. Despite the challenges posed by the pandemic and the subsequent economic downturn, which saw a strategic shift towards a more defensive stance, SoftBank has rebounded with remarkable resilience. The company recently returned to profit, buoyed by an upturn in its portfolio companies and a significant surge in the shares of Arm Holdings Plc, a British chip designer in which SoftBank holds a majority stake.

Arm's role in SoftBank's ecosystem cannot be overstated. As a pivotal player in the chip design industry, Arm has been identified as "the core of the core" of SoftBank's conglomerate. The demand for Arm's central processors, particularly for AI work in data centers, has seen a strong uptick, complementing Nvidia's offerings and solidifying SoftBank's position in the tech investment sphere.

The potential success of Project Izanagi could not only cement SoftBank's role as a key player in the AI chip market but also significantly influence the global semiconductor industry. With a valuation that might dwarf Microsoft Corp.'s investment in OpenAI, Izanagi stands as a beacon of SoftBank's unfettered enthusiasm for AGI and its strategic pivot back to "offense" mode, focusing on AI investments.

This venture comes at a time when SoftBank's financial health shows signs of robustness, with significant cash reserves bolstered by gains in global equity markets and strategic investments, including a lucrative stake in Arm. The recent public offering of Arm, which saw a dramatic increase in share value, has further fortified SoftBank's financial standing, offering a glimpse into the potential windfalls from its strategic investments.

Masayoshi Son and SoftBank first hit the headlines during their big bet on Adam Neumann’s WeWork.

Just last year, SoftBank's intervention to aid WeWork with a $3 billion debt-for-equity swap showcases its resolve to salvage the office-space provider and mitigate its investment losses. This critical maneuver comes as WeWork grapples with the fallout from overly ambitious expansions, marking a departure from SoftBank's Masayoshi Son's initial optimistic forecasts. Son's investment in WeWork, which resulted in a significant misjudgment, reflects the high-risk nature of tech investments.

SoftBank has strategically managed its exposure to WeWork, significantly writing down its investment and maintaining a $1.1 billion credit support deal. Despite these efforts, the valuation plummeting from a once towering $47 billion to a mere $10 million starkly illustrates the investment's volatility. Notably, SoftBank owns approximately 71% of WeWork, a figure that highlights the depth of its commitment and the potential scale of its challenge. WeWork is currently facing bankruptcy proceedings in court with Neumann apparently in talks to buy the company back.

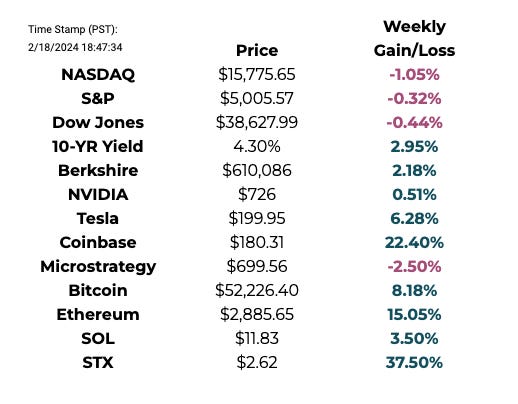

This Week By the Numbers 📈

Quick Facts:

BTC ETFs experience $324m in inflows

BTC ETFs purchase 8x the BTC supplied last week

BTC whales make largest acquisitions in 2 years

Short-term holders liquidate the most in 3 years

Potential $1.6bn GBTC sale anticipated next week

Surge in Coinbase app downloads to recent high

Indicators of 'peak euphoria' emerge in macro trends

Nvidia's valuation surpasses entire S&P sectors

Pudgy Penguins overtake BAYC amidst Yuga Labs criticism

AI narrative remains dominant in crypto discourse

SOL co-founder hints at SOL transfers in X

L2 BTC narratives, including STX, drive crypto market trends

Top Stories 🗞️

Celsius distributes $2B of crypto to 172K creditors

Bankrupt cryptocurrency lender Celsius has announced that most eligible creditors have now collected their liquid crypto distributions from its two distribution agents: payments giant PayPal and crypto exchange Coinbase. According to Kirkland & Ellis, crypto distributions to holders in the United States are facilitated through PayPal, while overseas holders are managed by Coinbase as the distribution agent. The lawyers declared that $2 billion worth of crypto had been transferred to creditors, including 20,255.66 Bitcoin and 301,338.77 Ether. However, the filing explained that account holders who did not agree to the restructuring plan will not receive any distribution until their individual claims are resolved. Additionally, it mentioned that certain account holders might face challenges in receiving their distribution if Coinbase or PayPal flags any Anti-Money Laundering (AML) or compliance issues.

Revolut to Introduce Crypto Exchange Targeting 'Advanced Traders'

Digital bank Revolut is set to introduce a cryptocurrency exchange targeting "advanced traders," according to a customer email seen by CoinDesk. Revolut currently offers basic crypto services to many of its 30 million customers. The exchange will offer lower fees and enhanced market analytics. Fees have been set between 0% and 0.09%, and functionality has been added to allow users to trade using limit and market orders. Limit orders are typically used when a trader wants to purchase or sell an asset at a specific price. Limit orders will incur no fees. Revolut suspended crypto services for business customers in the U.K. in December, citing the Financial Conduct Authority's (FCA) new regulations covering crypto promotions. The email seen by CoinDesk was received by a U.K.-based customer. Earlier this week, it emerged that Revolut plans to list Solana's biggest meme coin, BONK, in a "learn and earn" campaign that will see the distribution of BONK to some of its customers.

Changpeng Zhao Faces 18 Months in Jail

US prosecutors have emphasized the gravity of Binance’s infractions. Indeed, they highlighted the company’s deliberate breach of the nation’s economic sanctions laws. This violation has attracted one of the largest criminal penalties in US history, amounting to $4.3 billion. It also exposed the financial system to exploitation by malicious entities. The plea deal awaits approval by a federal judge in Seattle and reflects the serious nature of Binance’s misconduct. The company’s intentional disregard for regulatory compliance led by Zhao has had far-reaching consequences. It essentially jeopardizes the integrity of the US financial system. Indeed, Binance’s failure to register as a money services business and its inadequate anti-money laundering program made it susceptible to exploitation by groups seeking to undermine US financial security. The admission was that transactions with designated terrorist organizations, including Hamas, were allowed on the platform.

Reddit signs content licensing deal with AI company ahead of IPO

Reddit has signed a contract allowing an Artificial Intelligence (AI) company to train its models on the social media platform's content. Reddit, which is eyeing an initial public offering (IPO) launch, has told prospective investors that it signed the deal, worth $60 million on an annualized basis, earlier this year. The details of the AI deal could change as talks over the Reddit IPO launch, which could come in March, continue. The content licensing deal comes at a time when interest in AI is at an all-time high. The agreement, signed with an "unnamed large AI company", could be a model for future contracts of a similar nature, Bloomberg reported. Reddit's IPO, which has been in the works for over three years now, would be the first IPO of a major social media company since Pinterest's (PINS.N) debut in 2019.

Argentina Sees First Monthly Budget Surplus In 12 Years

The Argentine government in January saw its first monthly budget surplus in nearly 12 years, as new President Javier Milei continues to push for strong spending cuts, the Economy Ministry announced. January was the first full month in office for Milei, a far-right libertarian who took office in December, and it ended with a positive balance for public-sector finances of $589 million at the official exchange rate, the government said late Friday. The figure includes payment of interest on the public debt. It is "the first (monthly) financial surplus since August 2012, and the first surplus for a January since 2011," the Economy Ministry said, according to the official Telam news agency. Milei has been negotiating with the International Monetary Fund over its $44 billion loan and has vowed to achieve balance in public finances this year. "The zero deficit is not negotiable," Economy Minister Luis Caputo said Friday on X, the former Twitter. Milei, an economist, has advocated sharp cuts in spending and a reduction of public debt on the way to a dollarization of the economy.

My Top 10 Investment Ideas for 2024 🐸

This week, we are offering an additional free knowledge source - My Top 10 Investment Ideas for 2024, including picks across stocks and crypto, and my reasoning behind making those investments personally.

To receive this product, simply refer 3 friends using your unique shareable link 👇

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).