Reddit Plans to IPO Next Month

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X below.

Following the successful launch of our firm, Moonwalker Capital, we are preparing for our first close on March 1. We are excited to be joined by industry leaders and founders of amazing companies joining our investor community.

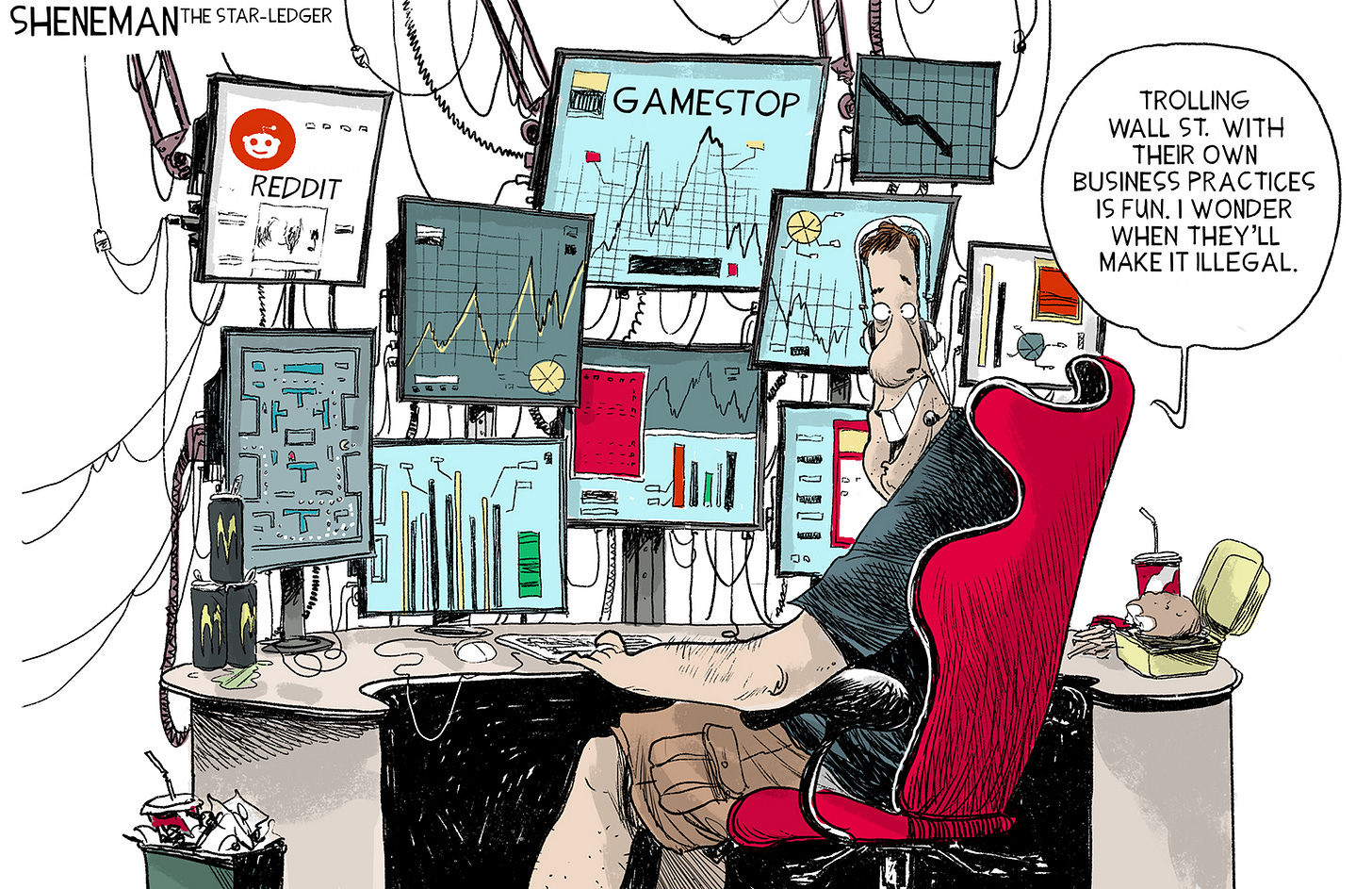

While taking a break this weekend, I finally watched the film “Dumb Money” on Netflix, which dives into the GameStop stock trading frenzy of 2021. This cinematic portrayal brings to life the David vs. Goliath story of amateur investors versus Wall Street giants, focusing on how a group of retail traders on the Reddit forum r/WallStreetBets challenged the status quo of the stock market. Using humor, drama, and a keen insight into the complexities of the financial world, "Dumb Money" explores the collective power of social media-driven investors who decided to bet on GameStop's stock, leading to a massive short squeeze that shook the foundations of Wall Street.

I too participated in the r/WallStreetBets forum in 2021, finding a home with the rest of the “smooth-brained autists” gambling on GME, AMC, and silver.

And now, the platform that has given us a home to move markets, is planning its own entry into the public markets next month.

All About Reddit

Reddit is a vast network of communities based on people's interests where users can find forums (known as "subreddits") on almost any subject imaginable. Founded in 2005 by Steve Huffman and Alexis Ohanian, Reddit has grown to become one of the most popular websites globally, offering a platform for users to share news, content, and opinions. Each subreddit is dedicated to a specific topic, ranging from serious discussions on science and politics to more lighthearted content like memes and personal stories.

Reddit plays a significant role in internet culture, often being at the forefront of memes, viral trends, and even social movements.

Reddit’s Upcoming IPO

On Thursday, the company officially filed its IPO prospectus with the Securities and Exchange Commission, setting the stage for a highly anticipated market debut on the New York Stock Exchange under the ticker symbol “RDDT.” This event, expected to occur in March, marks the first major tech IPO of the year and the first social media platform to go public since Pinterest in 2019.

Reddit reported a notable increase in its revenue, reaching $804 million in annual sales for 2023, a 20% jump from $666.7 million the previous year. This growth underscores the company's expanding influence in the realm of online advertising, which forms the core of its business operations. Despite this upward trajectory, Reddit has faced challenges, including net losses since its inception, with a reported loss of $90.8 million for the year ending December 31, 2023.

The platform boasts impressive engagement metrics, with more than 100,000 communities, 73 million average daily active users, and 267 million average weekly active users. However, it has encountered difficulties in scaling its online advertising business to the heights achieved by tech giants like Meta and Alphabet.

Looking forward, the company has ambitious plans to tap into the global advertising market, excluding China and Russia, which it estimates to be $1.4 trillion by 2027. It aims to enhance its search capabilities and leverage artificial intelligence to bolster its ad business, along with exploring new revenue streams through tools and incentives that encourage content creation and commerce.

A particularly intriguing aspect of Reddit's strategy involves developing a data-licensing business, allowing third parties to access and search its platform data. This move was highlighted by an expanded partnership with Google, aimed at training AI models, showcasing Reddit's intent to innovate and diversify its revenue sources.

Reddit's approach to its IPO is unique, offering three classes of stock with varying voting rights and allowing its community moderators to participate in the IPO through a directed share program. This inclusive strategy underscores the company's community-centric ethos but also introduces potential volatility in its stock price due to the unconventional mix of investors.

As Reddit prepares for this next chapter, it reflects on its journey from a startup founded in 2005 to a major player on the digital stage, navigating the challenges and opportunities of the evolving social media landscape. With a blend of technology, community, and innovation at its core, Reddit's IPO represents not just a financial milestone but a testament to the enduring power of online communities in shaping the digital world.

This Week By the Numbers 📈

Quick Facts:

Bitcoin holdings by investment funds reach unprecedented levels

MicroStrategy acquires an additional 3,000 Bitcoin, valuing at $155 million

Former President Donald Trump acknowledges the growing acceptance of Bitcoin and its use for payments

VanEck's Bitcoin ETF sees a 14-fold increase in trading volume over the past week

NodeMonkes, a leading Ordinal, now valued at $20,000

Ethereum's price breaks the $3,000 mark

Justin Sun invests an additional $41 million in Ethereum.

Grayscale's CEO anticipates the launch of a spot Ethereum ETF as inevitable

Uniswap's UNI token surges 75% following a proposal for revenue sharing

FTX obtains approval to divest its stake in Anthropic

Ryan Salame, an FTX executive, scheduled for sentencing in May

Nvidia momentarily achieves a $2 trillion valuation, with projections suggesting a potential $10 trillion, surpassing the entire crypto market's value

The DePin sector emerges as a leader in the crypto market post-Nvidia's earnings announcement

Terra's founder, Do Kwon, faces extradition to the United States

Notable billionaires and foundations liquidate stocks, including sales by the Bill and Melinda Gates Foundation ($MSFT), Jamie Dimon ($JPM), Mark Zuckerberg ($META), Jeff Bezos ($AMZN), Lilly Endowment ($LLY), Alex Karp ($PLTR), and McDermott ($26mn).

Top Stories 🗞️

Odysseus Marks the First US Moon Landing in More Than 50 Years

For the first time in more than half a century, a US-built spacecraft has made a soft landing on the moon. There was high drama and plenty of intrigue on Thursday evening as Intuitive Machines attempted to land its Odysseus spacecraft in a small crater not all that far from the south pole of the moon. About 20 minutes after touchdown, NASA declared success, but some questions remained about the health of the lander and its orientation. Why? Because while Odysseus was phoning home, its signal was weak. But after what the spacecraft and its developer, Houston-based Intuitive Machines, went through earlier on Thursday, it was a miracle that Odysseus made it at all. This mission was part of a NASA initiative called the Commercial Lunar Payload Services Program, in which the space agency is paying private companies to deliver science experiments and other cargo to the lunar surface.

Reddit converts excess cash into Bitcoin and Ethereum

Social media giant Reddit has been using its excess cash to add small amounts of Bitcoin and Ether to its treasury since 2022 and believes crypto and blockchain have “significant potential,” new filings reveal. “We invested some of our excess cash reserves in Bitcoin and Ether,” Reddit stated in a Feb. 22 initial public offering filing with the United States Securities and Exchange Commission. Reddit said Bitcoin and Ether were the only cryptocurrencies held in the firm’s treasury as of Dec. 31, 2023, but also said the amounts are “immaterial.” Reddit added that it has been “experiment[ing] with blockchain technology” by buying Ether and Polygon’s MATIC as a form of payment for the sales of certain virtual goods.

Nigeria Blocks Access to Prominent Crypto Exchanges

In what is certainly a notable move for the country, Nigeria has blocked access to crypto exchanges Binance, Kraken, and Coinbase. Indeed, the country has taken the step to curb the slide of its local currency, according to a report from the Financial Times. The report notes that the Nigerian Communications Commission (NC) has ordered telecom companies to limit access to the three cryptocurrency exchanges. The decision was made as the government has attempted to limit currency speculation. Meanwhile, Nigeria’s Naira has fallen to record lows. The overall prevalence of the digital asset market in 2024 has been a massive development for the industry. However, many countries across the globe are still learning to navigate the new asset class. Specifically, the ongoing development of regulatory standings has been an ongoing process for a plethora of regions.

Capital One to buy Discover Financial in $35.3 billion all-stock deal

Warren Buffett-backed U.S. consumer bank Capital One plans to acquire U.S. credit card issuer Discover Financial Services in an all-stock transaction valued at $35.3 billion to create a global payments giant, the companies said on Monday. The deal, which is expected to receive intense antitrust scrutiny, would form the sixth-largest U.S. bank by assets and a U.S. credit card behemoth that would compete with rivals JPMorgan Chase and Citigroup. While Discover has a network that spans 200 countries and territories, it is still much smaller than rivals Visa, Mastercard and American Express. "This acquisition adds scale and investment, enabling the Discover network to be more competitive with the largest payments networks," the companies said in a statement. Discover shareholders will receive 1.0192 Capital One share for each Discover share, representing a 26.6% premium over Discover's closing price. If concluded, Capital One shareholders will own 60% of the combined company, while Discover shareholders will own the rest.

Warren Buffett mourns Charlie Munger, says Berkshire's 'eye-popping' performance is over

Warren Buffett on Saturday moved to reassure investors that his conglomerate Berkshire Hathaway would serve them well over the long term, even as he mourned the recent passing of his longtime second-in-command Charlie Munger. In his widely-read annual letter to Berkshire shareholders, Buffett said his more than $900 billion conglomerate has become a fortress that could withstand even an unprecedented financial disaster. "Berkshire is built to last," Buffett wrote. Still, Buffett tempered expectations for Berkshire's stock price, saying his Omaha, Nebraska-based company "should do a bit better" than the average American corporation, but that its huge size left "no possibility of eye-popping performance." "There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others," Buffett wrote.

My Top 10 Investment Ideas for 2024 🐸

This week, we are offering an additional free knowledge source - My Top 10 Investment Ideas for 2024, including picks across stocks and crypto, and my reasoning behind making those investments personally.

To receive this product, simply refer 3 friends using your unique shareable link 👇

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).