The American War on Privacy

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X (formerly Twitter) below.

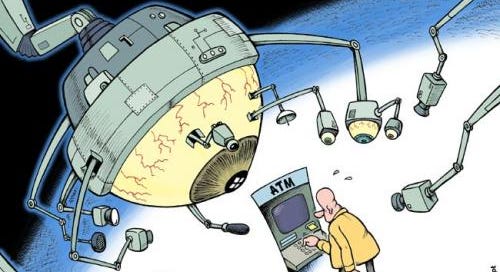

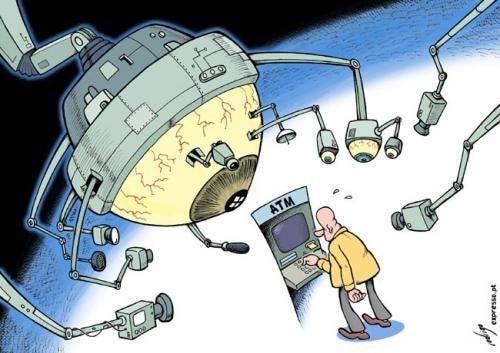

This week, the American government wants you to know that they are no longer messing around and will take action against the privacy you’ve enjoyed trading and storing assets in cryptocurrencies.

Founders of Samourai Wallet Arrested

Keonne Rodriguez and William Lonergan Hill, founders of Samourai Wallet, a tool marketed as enhancing privacy for Bitcoin users, were arrested under charges of money laundering and operating without a proper license. Their service, which included features like "remote self-destruct" and an ability to hide the application on mobile devices, is accused of laundering over $2 billion, with a significant portion linked to dark web transactions on platforms such as Silk Road and Hydra Market. These developments raise critical questions about the balance between privacy and legality in digital financial activities.

The Tornado Cash Case

In a similar vein, the cryptocurrency developer community faces its challenges, as demonstrated by the case against Tornado Cash developer Alexey Pertsev. Dutch prosecutors are seeking a 64-month prison sentence for Pertsev, accusing him of laundering $1.2 billion through his crypto mixing service. This case could set a significant precedent for how developers of open-source projects are treated under the law, especially those whose tools can be used for anonymous financial transactions.

Mango Markets: The Case of Avi Eisenberg

The legal woes in the crypto space extend beyond privacy and mixing services. Avi Eisenberg, a trader, was found guilty of fraud and market manipulation after he exploited vulnerabilities in the Mango Markets decentralized finance protocol to steal $110 million. His actions, which he defended as legal under the "code is law" principle, were deemed fraudulent by a Manhattan jury, reflecting the growing scrutiny and evolving legal standards around market behaviors in decentralized finance platforms.

DoJ Issues Warning Against Decentralized Exchanges and Wallets

Meanwhile, the DoJ has issued a public warning against Americans using platforms that don’t require KYC identification and are not registered as Money Services Businesses. It seems that the U.S. government is angling to have oversight over all of crypto transactions through platforms such as Coinbase, the way it currently does over the banking system, with the ability to track and seize assets as needed.

It remains to be seen if these efforts will stick, but if they do, expect a significant shift in our industry and a flood of talent and innovation in our industry out of the U.S.

This Week By the Numbers 📈

Quick Facts:

President Biden proposes a 44.6% capital gains tax, the highest in history

The proposal also includes a 25% tax on unrealized gains for high-net-worth individuals

FTC bans all non-compete agreements

Tesla expects to spend over $10 billion on next-gen vehicles, AI products, and other projects this year

Elon Musk says Tesla should be valued as an AI robotics company, not a car company

Tesla shares jump 13% after Musk announces the company aims to start production of an affordable new EV by early 2025

X to launch TV app

PCE inflation hits 2.7%, slightly above estimates

China has dumped $74 billion in US treasuries since 2023

Morgan Stanley prepares 15,000 brokers to sell BTC ETF

The DTCC says starting next Tuesday, ETFs that have Bitcoin or any other cryptos will have ZERO collateral value for loans

Franklin ETH ETF listed on DTCC

World's largest custodian bank, BNY Mellon, reports exposure to Bitcoin ETFs

Michael Saylor's MicroStrategy currently has a $6.2 billion unrealized profit on its Bitcoin investment

Pantera buys FTX’s locked SOL, aims to raise $1bn for new fund

BRICS exploring the creation of a crypto stablecoin for international trade settlements

A bill to protect 'fundamental #Bitcoin rights' has PASSED the Senate and House in the state of Oklahoma!

Crypto Punk 635 has been sold for 4,000 $ETH ($12,405,000)

Crypto Punks now individually inscribed onto Bitcoin

Top Stories 🗞️

Senate passes $95 billion package sending aid to Ukraine, Israel and Taiwan

The Senate on Tuesday passed a long-delayed $95 billion package with wide bipartisan support after both sides of Capitol Hill have struggled for months to send aid to Ukraine, Israel and Taiwan. The final vote was 79-18. Fifteen Republicans voted with three Democrats against the bill. Forty-eight Democrats and 31 Republicans voted for the bill. The legislation next goes to President Joe Biden to sign it into law, who said he would sign the package Wednesday. Its passage is a significant victory for the US president, congressional Democrats and Senate GOP leader Mitch McConnell, who long pushed to send aid to Ukraine even as the right wing of his party increasingly soured on support for Kyiv. The package ties together four bills that the House voted on separately in a rare Saturday session, providing nearly $61 billion in aid for Ukraine, over $26 billion for Israel and more than $8 billion for the Indo-Pacific. The first three bills are very similar to the package that the Senate passed earlier this year, which House Speaker Mike Johnson had originally refused to bring to the House floor.

Russia To Seize $440 Million From JPMorgan

Just days after Washington voted to authorize the REPO Act - paving the way for the Biden administration confiscate billions in Russian sovereign assets which sit in US banks - it appears Moscow has a plan of its own (let's call it the REVERSE REPO Act) as a Russian court has ordered the seizure of $440 million from JPMorgan. The seizure order follows from Kremlin-run lender VTB launching legal action against the largest US bank to recoup money stuck under Washington’s sanctions regime. The order, published in the Russian court register on Wednesday, targets funds in JPMorgan’s accounts and shares in its Russian subsidiaries, according to the ruling issued by the arbitration court in St Petersburg. When Washington imposed sanctions on the Kremlin-run bank, JPMorgan had to move the funds to a separate escrow account. Under the US sanctions regime, neither VTB nor JPMorgan can access the funds.

Elon Musk's xAI Close to Raising $6B, Potential $20B Valuation, Led by Sequoia

Elon Musk's artificial intelligence startup, xAI, is reportedly nearing a significant funding milestone, aiming to raise $6 billion at an $18 billion valuation, with a potential to reach $20 billion. The funding round is led by Sequoia Capital and includes other investors. This financial move is aimed at enhancing xAI's chatbot, Grok, positioning it as a competitor to OpenAI's ChatGPT. The company, which is less than a year old, has seen employees joining from Tesla, and the round is expected to close within two weeks. Previously, xAI raised $1 billion primarily from Musk himself. Notably, X, Musk's social network, is already one of its shareholders.

Consensys Sues SEC Over ‘Unlawful Seizure Of Authority’ Over Ethereum

Ethereum developer Consensys has filed a lawsuit against the U.S. Securities and Exchange Commission, striking back against what the company calls an “unlawful seizure of authority” over Ethereum by the federal regulator. The company wants a federal court to declare that ETH (ETH) is not a security, any investigation of ConsenSys based on the idea that ETH is a security "would violate" the company's fifth amendment rights and the Administrative Procedures Act, that MetaMask is not a broker under federal law, that MetaMask's staking service does not violate securities law and an injunction against the SEC investigating or bringing an enforcement action tied to MetaMask's Swaps or Staking functions.

US regulators seize troubled lender Republic First, sell it to Fulton Bank

U.S. regulators have seized Republic First Bancorp and agreed to sell it to Fulton Bank, underscoring the challenges facing regional banks a year after the collapse of three peers. Philadelphia-based Republic First, which had abandoned funding talks with a group of investors, was seized by the Pennsylvania Department of Banking and Securities. The Federal Deposit Insurance Corp (FDIC), appointed as a receiver, said on Friday Fulton Bank, a unit of Fulton Financial Corp will assume substantially all deposits and purchase all the assets of Republic Bank, which is the operating name for Republic First, to "protect depositors". Republic Bank had about $6 billion in total assets and $4 billion in total deposits, as of Jan. 31, 2024. The FDIC estimated the cost of the failure to its fund will be $667 million. Apart from deposits, Republic also had borrowings and other liabilities of approximately $1.3 billion, Fulton said in a statement. Fulton said the deal almost doubles its presence in the Philadelphia market with combined company deposits of approximately $8.6 billion.

My Top 10 Investment Ideas for 2024 🐸

This week, we are offering an additional free knowledge source - My Top 10 Investment Ideas for 2024, including picks across stocks and crypto, and my reasoning behind making those investments personally.

To receive this product, simply refer 3 friends using your unique shareable link 👇

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).