The First Rate Cut is the Deepest

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X (formerly Twitter) below.

This past week has been nothing short of eventful, driven largely by the Harris-Trump presidential debate.

To summarize: very little of substance was addressed. Trump was the only candidate to be fact-checked during the debate, while Kamala Harris exceeded some expectations with her composure and responses. However, an excessive amount of time was wasted on an absurd topic—whether Haitian immigrants in Ohio eat pets. Harris also made several promises, including food and rent controls, but these fell flat. As the de facto leader of the country, with many Americans struggling to afford basic necessities, her assurances felt out of touch with the harsh realities most families are facing.

Polls remain tight, with each candidate briefly taking the lead before the other catches up. However, voter registrations saw a notable spike following Taylor Swift’s public endorsement of Kamala Harris on Instagram, where she signed off as the “childless cat lady.” While this endorsement generated excitement among some of Swift’s fans, it also drew criticism, with many arguing that her message was out of touch, portraying her as another billionaire disconnected from the everyday struggles of average Americans. This highlights the ongoing debate about celebrity influence in politics and its real-world impact.

The First Rate Cut is the Deepest

Markets are currently pricing in a 100% probability that the Federal Reserve will begin lowering interest rates during its September 17-18 meeting, with the potential for more aggressive cuts later in the year. While this may create some optimism, leading to a few green days in the market ahead of the decision, it's important to remain cautious. Historically, the first rate cut after a period of higher rates doesn't always signal the bullish momentum investors expect. In fact, markets often taper off following an initial cut, as the move can be seen as a response to underlying economic concerns rather than a boost to growth. Historical data suggests that the first rate cut can often lead to short-term volatility rather than sustained gains.

Although the market is hovering near all-time highs, many Americans are still struggling to afford basic necessities, creating a dissonance between financial markets and everyday realities. Despite this, there is no definitive signal of a strong bearish or bullish trend. The mixed economic indicators—high stock valuations on one side, and inflation-driven hardship on the other—have made it difficult to predict the market’s next move with clarity.

Does all this debt, inflation, and economic tension mean the market is bound to collapse? That’s the million-dollar question. We find ourselves in uncharted waters: despite recessionary indicators flashing across the board, employment remains strong, and market activity hasn’t significantly slowed down. This mix of signals is causing confusion, leaving many wondering what comes next.

One of the key issues at play is that inflation reports don’t tell the whole story—they fail to capture how different sectors of the population are impacted. While the official numbers may seem low, certain groups are disproportionately affected, and the rising costs hit them much harder.

In the midst of this, the national debt continues to surge, surpassing $35.27 trillion as of September 2024. That’s an increase driven by pandemic relief, military spending, and large fiscal policies. The U.S. has borrowed over $1.29 trillion in just the first eight months of 2024 alone. The burden is immense, and interest payments on the debt are now at record levels—expected to reach $1.2 trillion by the end of this fiscal year. To put that into perspective, the government is paying around $3 billion daily just to cover interest. For the first time, these payments are outpacing spending on national defense and Medicare.

Despite these financial pressures, the U.S. economy is showing resilience. The GDP was around $28.65 trillion in the second quarter of 2024, growing by 3.0%, buoyed by consumer spending and business investment. Yet, with debt growing and interest costs climbing, the sustainability of this economic growth is in question.

The crux of the issue lies in the stock market’s influence on future tax receipts. The U.S. has a higher concentration of wealth tied to the stock market than most other developed nations, and much of executive compensation is linked to stock value. If the market stagnates or declines, it could create a ripple effect, leading to lower tax revenues and further fiscal stress.

Political leaders hope that advances in productivity, particularly through AI, will outpace inflation. The idea is that rising productivity will keep prices from spiraling too high, even if the money supply continues to grow to support ongoing deficits. However, this is a gamble. What we really need in government is leadership that applies the unconventional “founder mode.” As Chamath Palihapitiya often advocates, what’s really needed is a "founder mentality" in government—breaking the system down to its core and applying first principles to restructure it.

Kamala Harris's policies, while addressing immediate needs, often feel like temporary fixes, shifting money around rather than tackling the deeper inefficiencies in the system. What’s truly required is a bold restructuring that addresses the root causes of the nation’s economic imbalances. Such is the current joint proposal by Trump and Elon Musk.

In short, the market may not be on the brink of collapse, but without systemic reform, the long-term trajectory remains uncertain.

A related question arises regarding the impact of these trends on the crypto markets. While crypto is traditionally seen as a "risk-on" asset that tends to follow the movements of the stock market, there’s been a noticeable decline in enthusiasm, particularly for new narratives beyond Bitcoin. Travis Kling likened this sentiment to a form of "Quiet Quitting," where many in the crypto space remain present, waiting for a market shift, but without the usual excitement and fervor that typically drives the sector. The energy that once fueled innovation and hype seems to have dwindled, leaving a sense of cautious anticipation rather than exuberant optimism.

Additional Reading

Below are a few sources that have helped me understand the current state of the market

September 2024 Newsletter: Why Nothing Stops This Fiscal Train by Lyn Alden

The Uncomfortable Truth About Crypto in 2024 with Travis Kling

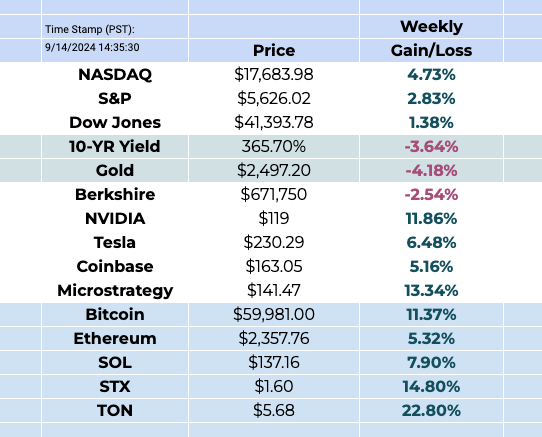

This Week By the Numbers 📈

Markets & Economy 📊

US inflation falls to 2.5%, lower than expectations

US government announces it has spent over $1 trillion this year on interest payments for its $35.3 trillion national debt

Peter Thiel's Palantir $PLTR officially joins the S&P 500 Index

Crypto & Blockchain 🚀

$725 billion asset manager Bernstein says if Donald Trump is re-elected president, Bitcoin may reach $90,000

Japan's largest electricity company, Tokyo Electric Power, to use renewable energy to mine Bitcoin

Coinbase launches wrapped Bitcoin product (cbBTC) Hits, $100M in One Day

India leads in global crypto adoption for the second year in a row

Politics & Regulation ⚖️

England's High Court of Justice rules Tether's stablecoin USDT is a property

Donald Trump says he will charge a 100% tariff on countries shifting away from the US Dollar, if elected President

Global & Geopolitical Events 🌍

US may approve Ukraine use of long range missiles, Putin says approval would be act of war by NATO

Brazil lifts X and Starlink bank account blockage after Elon Musk pays $3.31 million fine

Top Stories 🗞️

Trump safe after new assassination attempt, suspect arrested

Republican presidential candidate Donald Trump was safe on Sunday after what the FBI said appeared to be a second assassination attempt while he was golfing on his course in West Palm Beach, Florida. Law enforcement officials said U.S. Secret Service agents spotted and fired on a gunman in some bushes near the property line who dropped an AK-47-style assault rifle and was arrested after fleeing the scene. The New York Times and Fox News identified the suspect as Ryan Wesley Routh, 58, of Hawaii, citing unnamed law enforcement officials. After spotting the rifle barrel about 400 to 500 yards (365 to 457 meters) away from Trump as they cleared holes of potential threats ahead of his play, the agents engaged the gunman and fired at least four rounds of ammunition around 1:30 p.m. (1730 GMT), Palm Beach County Sheriff Ric Bradshaw told a news conference.

US Dollar Is Taking Over the World Thanks to Stablecoins

Stablecoins are boosting U.S. dollar dominance around the world in countries that otherwise have no access to the currency, according to a new report sponsored by global payment giant Visa. Authored by Castle Island Ventures and Brevan Howard Digital, the report outlined how stablecoins adoption is rising irrespective of crypto’s market cycles, and gaining adoption as a monetary instrument for reasons unrelated to digital asset trading and speculation. For example, data from Visa and Allium Labs shows that stablecoin volumes reached $461 billion in August alone (adjusted to weed out inorganic activity from blockchain bots). That’s the third-highest month on record, surpassing any point from the 2021 bull market, despite crypto’s market slump over the past two quarters.

OpenAI says latest o1 model on ‘new level,’ can ‘think before it answers’

OpenAI has released several new artificial intelligence models under a revised naming scheme — starting with its latest OpenAI o1 model it says can “think before it answers.” “For complex reasoning tasks, this is a significant advancement and represents a new level of AI capability,” OpenAI said in a Sept. 12 blog post. “Given this, we are resetting the counter back to one and naming this series OpenAI o1.” The new models can take their time to think and use “chain-of-thought” reasoning to solve complex tasks — particularly in STEM (science, technology, engineering and math) and coding-related tasks, OpenAI said. The AI firm shared videos of OpenAI o1 coding a video game from a prompt and solving a complex logical puzzle, among other things. The OpenAI o1 “preview” and “mini” models were made available to ChatGPT Plus subscribers with the firm planning to release improved versions in the coming months.

FTX founder Sam Bankman-Fried appeals fraud conviction

Lawyers for Sam Bankman-Fried claim in an appeal filed Friday that the imprisoned FTX founder was the victim of a rush to judgment by a public that wrongly believed he was guilty of stealing billions of dollars from his customers and investors before he was even arrested. The lawyers filed papers with the 2nd U.S. Circuit Court of Appeals asking a three-judge panel to reverse Bankman-Fried's conviction and assign the case to a new judge for a retrial, saying the trial judge "imposed a draconian quarter-century sentence on this first-time, non-violent offender" after they contend he hurried the jury into reaching a one-day verdict to cap off a complex four-week trial. They said the passing of time has cast Bankman-Fried in a better light. "Now, nearly two years later, a very different picture is emerging — one confirming FTX was never insolvent, and in fact had assets worth billions to repay its customers. But the jury at Bankman-Fried's trial never got to see that picture," they added.

“Myth Of Money” Book - Now on Pre-Sale 🤓

As many of you know, making financial education accessible has always been a passion of mine, and I’ve always offered it for free!

After a year of hard work, I'm excited to announce that my new book, published by Wiley Publishing, will be officially available on October 1st!

This book is a thrilling blend of personal stories from the financial world, coupled with clear explanations of how things really work—from investment banking and stocks to venture capital, macroeconomics, and cryptocurrencies.

How can you support?

For individuals the book is available for sale on Amazon!

If you pre-order and leave a review, I will add you to my personal Telegram group, where I share exclusive investment tips and tricks! Just email me a screenshot of both the pre-order and review, along with your Telegram ID.

For bulk orders, we offer discounts if you order 10 or more copies for your business or educational institution. Additionally, we are setting up a donation program for corporates interested in donating books to schools. If this interests you, please reach out to me directly!

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. Currently working as a proud General Partner at Moonwalker Capital.

(More about me 👉 here).