The Future of Corporate Treasuries

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ subscribers.

Disclaimer: The following is not intended as investment advice. Do your own research.

Square Buys $50 Million of Bitcoin

Payments company Square, led by Jack Dorsey, announced a purchase of 4,709 bitcoins on Thursday, worth approximately $50 million, representing about 1% of Square’s total assets. Square is the second company to make headlines with this new treasury management strategy, after a recent announcement by MicroStrategy, which bought $425 million worth of Bitcoin.

Amid global geopolitical uncertainty, there is a clear trend emerging for companies looking to diversify their cash holdings. There is even a tally of all publicly traded companies who hold Bitcoin at BitcoinTreasuries.Org.

Jack Dorsey was kind enough to provide a blueprint for other companies who wish to follow suit, in this short investment whitepaper.

What is the Future of Treasury Management?

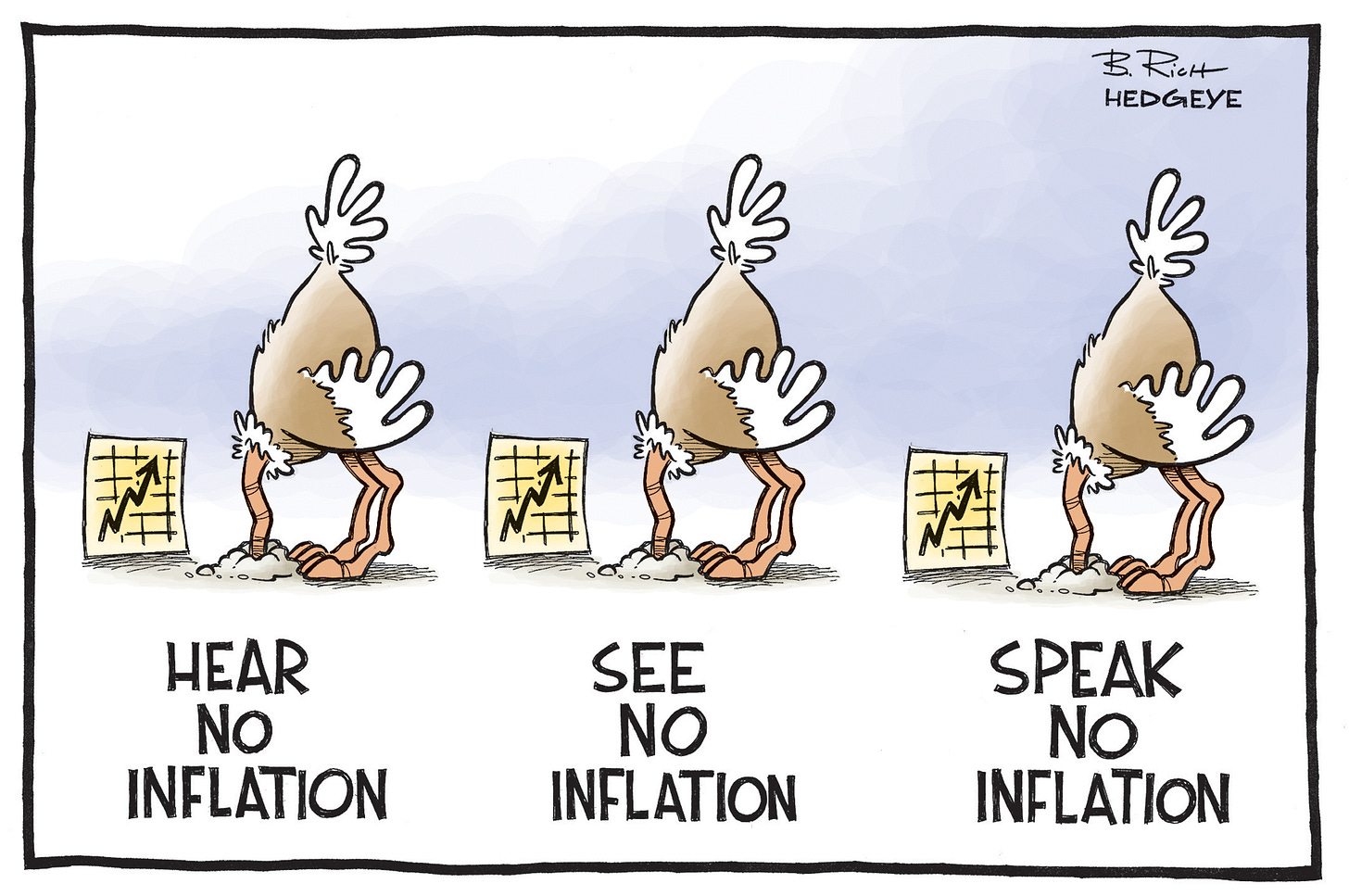

Internal treasury management services were established in the 1970s after Nixon took the dollar off the gold standard. For the first few years, inflation hovered around 10-12%. For large companies, sitting on cash was not an option. So they established internal departments to make safe investments in bonds, treasuries and low-risk equities. [One could argue that the entire investment industry was created to beat inflation].

Today, the Fed made it clear they will use all measures possible to maintain inflation above 2% for a sustained period of time, while interest rates remain at 0%. Treasury departments that invested in interest-rate products, are forced to look elsewhere to maintain cash value, and are increasingly turning to Bitcoin.

Chinese Yuan as the New Reserve Currency?

Another element for treasuries to keep in mind is the strengthening of the Chinese Yuan against the Dollar. This week, the yuan hit a 17-month high against the USD, the strongest one-day rise since it was de-pegged from the dollar in July 2005.

Apparently, this has a lot to do with Biden leading in the polls. Biden would be less likely to use import tariffs in disputes with China. A Biden presidency also means no contested election, a more global-minded trade policy, and a more affordable dollar for foreigners seeking to do business with the U.S. On the flip side, a Biden presidency is likely to further hurt oil producers as more green policies are pursued.

China’s central bank is actively pushing a digital version of their currency. The city of Shenzhen is planning to distribute a total of 10 million digital yuan ($1.5 million) to encourage consumers. The value of the yuan will continue to appreciate as its digital version becomes more popular.

This Week By the Numbers

Markets saw a sharp dip on Monday as Trump said he would halt all stimulus negotiations until after the election. Trump quickly retracted his stand, driving markets into an upward frenzy.

Although stimulus is not yet finalized, the latest offer on the table is $1.8 trillion, which would make the total fiscal stimulus approximately $4 trillion for 2020. This doesn’t take into account the $3 trillion increase in Fed Assets as a result of quantitive easing and other monetary policy measures. If these numbers make little sense, just remember that the 2019 U.S. GDP was only $21.43 Trillion. The government is getting dangerously close to propping up almost 50% of the American economy, begging the question - how much longer can this bull market be sustained?

Top Stories

China Central Bank Official Reveals Results of First Digital Yuan Pilots

An official for China’s central bank has unveiled usage statistics of state-backed digital currency trials conducted in three Chinese cities. The bank opened 113,300 consumer digital wallets and 8,859 corporate digital wallets for residents of Shenzhen, Suzhou and Xiong’an to pilot a digital yuan. The digital wallets processed RMB 1.1 billion ($162 million) across 3.1 million digital yuan transactions between April and August, making it the most widely used central bank digital currency (CBDC) in a commercial setting. Read Full Story.

World Bank: Coronavirus may push 150 million people into extreme poverty

Releasing its flagship biennial report on poverty and shared prosperity, the multilateral development lender said that an additional 88 million to 115 million people will fall into extreme poverty - defined as living on less than $1.90 a day -in 2020. The report said this could grow to 111 million to 150 million by the end of 2021. That would mean that 9.1-9.4% of the world’s population would be living under extreme poverty this year, about the same as 2017’s 9.2% and representing the first rise in the extreme poverty percentage in about 20 years. Read Full Story.

Google Cloud Joins Forces With EOS

Google Cloud has partnered with Block.one and will become a block producer candidate to provide infrastructure in support of the EOS network, which is built on the EOSIO blockchain protocol published by Block.one. Google Cloud's highly provisioned, low-latency global fiber optic network provides stability, reliability, security, and extensive global infrastructure coverage for Block.one’s public blockchain efforts and development. Read Full Story.

Biden Economic Bounce Is Possible, With Hefty Deficit Price Tag

Financial markets are warming to the idea that the U.S. economy could get a Biden bounce -- but it hinges on a new government being able and willing to run big budget deficits. Democratic challenger Joe Biden is promising more than $3 trillion in extra spending over a four-year term if he beats President Donald Trump next month. On top of that, pandemic relief measures worth another couple of trillion -- which got stalled in the current legislature for months -- are likely to get pushed through, especially if Democrats win Congress as well as the White House. Read Full Story.

On YouTube:

In our third episode of the MythOfMoney.com interview series, I sat down with Mike Novogratz and Ben Forman to discuss the Future of #DeFi.

Subscribe to the Myth of Money YouTube here.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.