Dear Investors,

This was so far the most eventful week in the markets of 2023. So let’s dive in.

Powell testifies to Congress. Markets take a nose dive.

On Wednesday, Federal Reserve Chairman Jerome Powell testified on Capitol Hill regarding the state of the economy and the role that monetary policy will play in establishing equilibrium with regards to inflation.

The head of the central bank has outlined a new approach to the Fed's policy path, indicating that interest rates may remain high for a longer period of time than previously expected. This has caused the market to adjust its own expectations and align more with policymakers who have been warning about a higher-for-longer approach to interest rates.

Prior to this announcement, the market was anticipating a gradual increase in interest rates, but Powell's caution about the possibility of rates rising at a faster pace than previously anticipated has led to a shift in expectations. There are now strong expectations of a half-point increase in interest rates in March, with the terminal rate expected to reach close to 5.75%. Powell's change in tone was prompted by strong January inflation data and a robust labor market.

The market's response to Powell's remarks has been significant, with stocks falling as investors grow more nervous about the Fed's future path. Despite Powell's clarification that no decision has been made yet on the March rate move, traders are already pricing in a terminal rate of 5.625% later this year.

Silicon Valley Bank gets seized by regulators.

Later on Wednesday, VC’s and start-up founders in Silicon Valley started to hear rumors that Silicon Valley Bank… may be insolvent.

Silicon Valley Bank, which has historically provided financing for nearly half of all US venture-backed tech and healthcare companies since its founding in 1983, announced plans to raise over $2 billion from investors to fill a hole in its finances caused by the sale of a portion of its bond portfolio. This sale was necessitated by the fastest increase in borrowing costs in decades, driven by central banks raising interest rates to combat high inflation. However, the pace of these increases created unexpected problems and worries persist about further unintended consequences.

Silicon Valley Bank's sale of its $21 billion bond portfolio, consisting mainly of US Treasuries, forced the bank to recognize a $1.8 billion loss, which it sought to fill through a capital raise. However, some of the bank's clients withdrew their funds on the advice of venture capital firms, causing investors to pull out of the stock sale and leading to the collapse of the capital raising effort on Thursday.

As a result, financial regulators have closed Silicon Valley Bank and taken control of its deposits, marking the largest US bank failure since the global financial crisis over a decade ago. As of December 31, 2022, Silicon Valley Bank held about $209.0 billion in total assets and $175.4 billion in total deposits.

Meanwhile, Bank of London officially submitted a bid for Silicon Valley Bank UK, which as also in trouble.

A panic ensued that many companies and venture capital firms may have difficulty making payroll.

Why did Silicon Valley Bank collapse?

Here’s where things get very interesting.

According to the ‘fractional banking’ rules, the banks are only required to hold 5-10% of the deposits on hand and are allowed to lend out the rest to make money for the bank. Most people forget that the banks aren’t actually there to serve you. They are businesses, just like any other. (In 2020, the reserve requirement was essentially reduced to 0% for certain institutions to create further capital flow in the economy).

SVB was highly encouraged by the government in 2020 and 2021 to purchase 10-year federally-backed mortgage securities, yielding 1.5-1.8%. Theoretically, these securities carry very little risk.

SVB made an error by investing in mortgage securities with a maturity period of 10 years instead of opting for shorter-maturity treasuries or mortgage bonds with a maturity period of less than 5 years. This resulted in a mismatch between their assets and liabilities. The risk could have been hedged, but basically wasn’t.

In 2022, when interest rates surged and the bond market plummeted (as bond prices move opposite to yields), SVB's bond portfolio suffered significant losses. SVB had $211 billion in assets at the end of 2022, with $117 billion of that amount invested in securities. Unfortunately, these bonds incurred substantial losses at the end of 2022, with $91 billion of the bond portfolio classified as "held-to-maturity" securities for accounting purposes, now worth just $76 billion.

Even though these securities were facing 20-30% paper losses, the accounting rules allowed the bank to report them at the value at maturity and not mark them down. Some analysts were starting to catch on, however.

Here’s a tweet from January 18th:

As investment dollars slowed down this year, the tech industry faced a higher demand for capital and was looking to take more from their accounts. This caused SVB to prematurely sell some of the securities. As the hole in the balance sheet continued to grow with now ‘realized’ losses, whispers about bank failure caused a full bank run and eventual collapse.

USDC De-pegging

Many were worried that crypto failures would spread to tradfi. But the opposite happened as SVB affected USDC.

USDC, the second-largest US dollar-pegged stablecoin, lost its peg and dropped below 87 cents on Saturday. Its issuer, Circle, announced that it had $3.3 billion banked with SVB, creating a hole of over 5% in its balance sheet. Traders quickly switched to Tether, the largest stablecoin in the world, although questions have been raised about its business practices and reserves.

The de-pegging of USDC is significant as Circle, initially founded by Coinbase and considered a highly regulated and secure business, was poised to go public as a separate entity. The incident provided a wake-up call to investors, demonstrating that "not your keys, not your coins" applies not only to banks but also to centralized entities.

Circle announced that it would use its corporate resources to cover any shortfall, causing the stablecoin market to rebound by Sunday evening. USDC and DAI (which has large USDC reserves) have since returned to their dollar peg, and it is expected that USDC will now trade at par following compensation for SVB depositors.

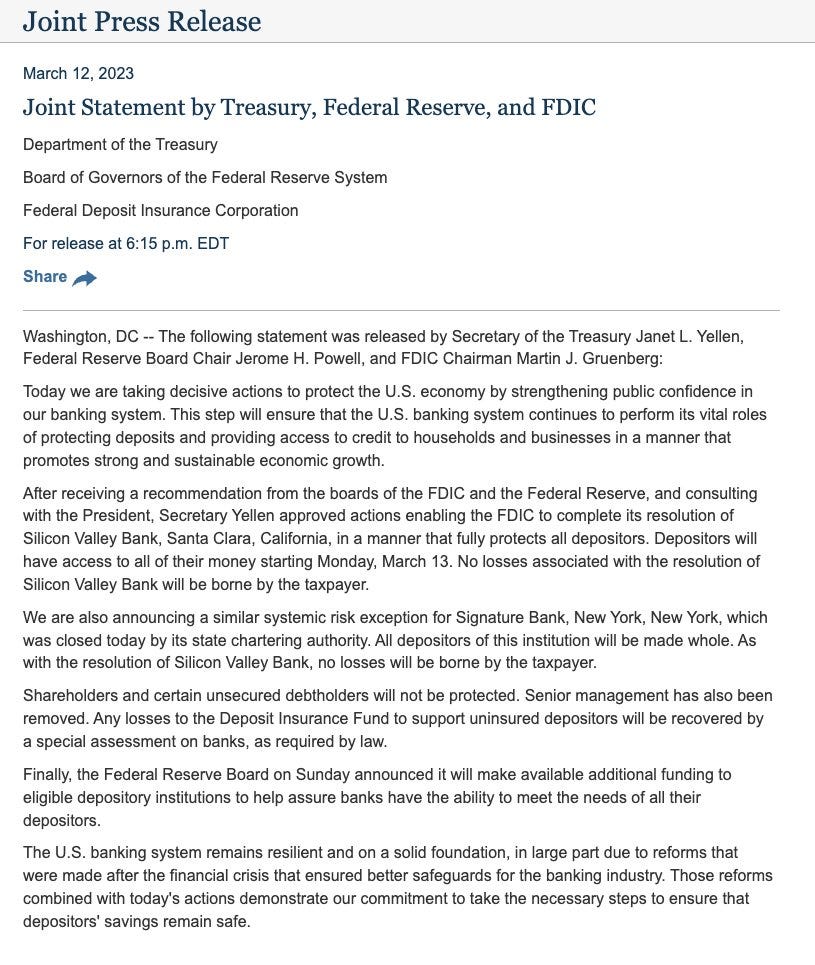

Regulators step in to guarantee depositors’ funds.

The real topic of conversation here is - should we trust centralized institutions?

As the panic continued over the weekend across the venture capital, start-up, and crypto communities, other depositors also began to realize that the FDIC only protects the first $250,000 of their money in a bank. Many lined up at branches to initiate withdrawals and transfer their funds to one of the “Big 4” U.S. banks, such as JP Morgan Chase, Bank of America, Wells Fargo, and Citibank.

And then depositors started to ask the obvious question - why is only $250,000 of my bank deposit guaranteed?

Sure, that seems plenty for the average American family. But for even a medium-sized business, that means that capital has to be split across multiple accounts.

And why is our banking system set up in such a way where bank deposits aren’t 100% guaranteed? Opening up a checking account at a bank in the U.S., should not be considered a high-risk activity.

As public pressure mounted over the weekend, the Fed issued a joint press release with the U.S. Treasury and the FDIC, announcing that it will essentially backstop any shortfalls on deposits, BUT will not bail out the banks. The action was applauded by many until we all collectively realized what this actually means - the money printer is being turned back on, and inflation is not going anywhere.

What does this mean for the crypto sector?

On Sunday, before I finished drafting this newsletter, it was announced that Signature Bank would also be taken over by regulators, making it the third bank to collapse within a week after Silvergate and Silicon Valley Bank. It is widely rumored that First Republic Bank will be taken over next.

The recent shutdown of two key cryptocurrency banking platforms, the Silvergate Exchange Network (SEN) and Signature's Signet, could pose a problem for the wider cryptocurrency market. Both platforms were real-time payment platforms that enabled commercial clients to make payments 24/7 through their respective instant settlement services.

The loss of these two key platforms could impair overall crypto liquidity as they were essential for firms to get fiat in on weekends, leading to a liquidity shortage until new banks step in. The closure of the three largest crypto-friendly banks in the U.S. in a matter of days has left the industry with few options, and investors are now pivoting to other challenger banks that may take up the slack.

Some have speculated that this is a somewhat co-ordinated attack by the regulators on the cryptocurrency sector.

The Great Reset

As the weekend unfolded, Bitcoin maxis everywhere rose up and chanted, "This is what Bitcoin was made for!" As one of those people, I personally concur.

The Great Reset is a concept that advocates for us to stop trusting centralized institutions with things that matter to us. After all, these institutions are run by people who are not necessarily better or smarter than us, but they make all the decisions AND the mistakes for us.

What makes Bitcoin beautiful is the ability to store value in a decentralized way backed by math. No one is lending out 90% of it, there is no run on the bank, and no one is gambling with your hard-earned money on bonds.

However, the concept of decentralization applies to other areas as well, such as how we run our communities, allocate resources, and decide what our government should or should not control.

A major shift is underway, and more and more people are choosing to opt out of the traditional system. We don't know how long it will take, but the Great Reset is coming, and Bitcoin will be its chosen currency.

This Week By the Numbers 📈

Bitcoin and Ethereum began to rally after the Fed announced that it will backstop depositors.

What I’m Reading This Week 📚

The Create from Jekyll Island - by G. Edward Griffin

A somewhat controversial read, the book describes the creation of the Federal Reserve System in the United States and explores the history and events that led to the formation of the Federal Reserve, which is often referred to as the "creature" in the book.

The author argues that the Federal Reserve is a private organization controlled by a small group of bankers and is not accountable to the American people or the government. Griffin also claims that the Federal Reserve has been responsible for many of the economic crises that have occurred in the United States.

The book goes into detail about the meetings and discussions that took place on Jekyll Island in 1910, where a small group of powerful men, including bankers and politicians, met in secret to draft the plans for the Federal Reserve. Griffin argues that this meeting was crucial in shaping the Federal Reserve into what it is today.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).