The Ordinals Protocol and the Rise of Bitcoin NFTs 🚀

Welcome to this week’s edition of Myth of Money, a weekly newsletter on all things crypto, macro, and tech, read by 13,000+ investors. If you enjoy this newsletter, follow us for a daily dose of market news on Twitter 👇

Dear Investors,

Last month’s launch of the Ordinals protocol has sparked an avid debate within the Bitcoin community.

What is the Ordinals Protocol?

The Ordinals protocol was launched on the Bitcoin mainnet by software engineer Casey Rodarmor on January 21, 2023. It enables digital artifacts like images, text, programs, and video games to be inscribed directly on the Bitcoin blockchain, effectively adding NFTs to the Bitcoin mainnet.

A Divided Response…

The introduction of the Ordinals protocol has sparked a division in the Bitcoin community, with some perceiving it as a threat to Bitcoin and others utilizing it to add unnecessary information to each block in a way to annoy the Bitcoin Maxis. This has reignited an old argument in the cryptocurrency world: should Bitcoin be utilized for purposes beyond finance? For the libertarian-oriented "maxis", Bitcoin serves as a tool to secure savings and battle inflation, as well as a political stance against the federal reserve, government, and traditional banks.

For the average NFT enthusiast, however, Bitcoin is just another cryptocurrency. Adding NFTs to Bitcoin challenges the identity of the average Bitcoin’er.

What Are the Potential Benefits?

A widely debated topic within the cryptocurrency community is "Why do NFTs need to be on Bitcoin?" The simple answer is that it expands the utilization of Bitcoin, but that answer does not delve into the deeper cultural significance of Ordinals, Bitcoin, and cryptocurrency.

Perhaps Bitcoin is not intended to have an increased number of use cases, and the notion of creating use cases just for the sake of having them is one of the major criticisms faced by the cryptocurrency industry.

As more companies strive to bring the next billion people onto Web3, a larger number of individuals will use blockchain technology without even realizing it. Meanwhile, some of us will observe the progress being made around us, in quiet online forums, and question why certain items (both digital and physical) are being recorded on the blockchain.

It seems that the Ordinals argument may be a preliminary instance of a trend that we will continue to experience in the near future. The reason behind the need for NFTs to be on the Bitcoin network is often answered with "Because they can be!" which aligns with the essence of Bitcoin being about freedom and lack of restrictions. However, if regulations are imposed on what can and cannot be minted on the chain, the question of who gets to make those decisions arises. The Ordinals discussion could be a preview of a future where the idea of being on the chain is taken for granted, and instead of questioning why an item is on the chain, we will ask why it is on a specific chain.

The transaction fees for Bitcoin went up dramatically after the introduction of Ordinals due to the increased amount of data in each transaction. This was largely due to the actions of groups like Taproot Wizards who chose to disrupt the network by sending larger blocks, including the largest block ever recorded in Bitcoin's history which contained 4MB of data.

Why All the Tension Around Bitcoin NFTs?

The debate surrounding the Ordinals brings attention to the cultural significance of cryptocurrency and how it is perceived by different individuals.

In 2008, Satoshi Nakamoto introduced Bitcoin to the world with the intention of resolving the trust issues associated with electronic payments through third-party financial institutions. However, as we near 2023, some of the original goals of Bitcoin, such as enabling micro-transactions globally without relying on third-party trust, are becoming a pipe dream due to factors like increased transaction fees, larger block sizes, and the need for moderation.

Thus, the question arises whether NFTs on the Bitcoin network align with Satoshi's original mission. It is crucial to remember that Satoshi's objective was to eliminate the need for trust in intermediaries. NFTs on Bitcoin could potentially lead to wider adoption of the cryptocurrency and more opportunities for people to exchange small amounts of currency without relying on a third party, as Satoshi intended.

While some may argue that NFTs should not be created on Bitcoin just because it is possible, it is important to acknowledge that the use cases for cryptocurrencies like Bitcoin are bound to evolve over time. Sometimes, straying from the original vision may be necessary to ultimately achieve it.

As the use of blockchain technology becomes more widespread, the need for regulation and standardization will become increasingly obvious, leading to similar debates about the role and purpose of cryptocurrencies in society.

Top Bitcoin NFTs

Here are some of the Bitcoin NFT projects making noise in the space today:

The Taproot Wizards

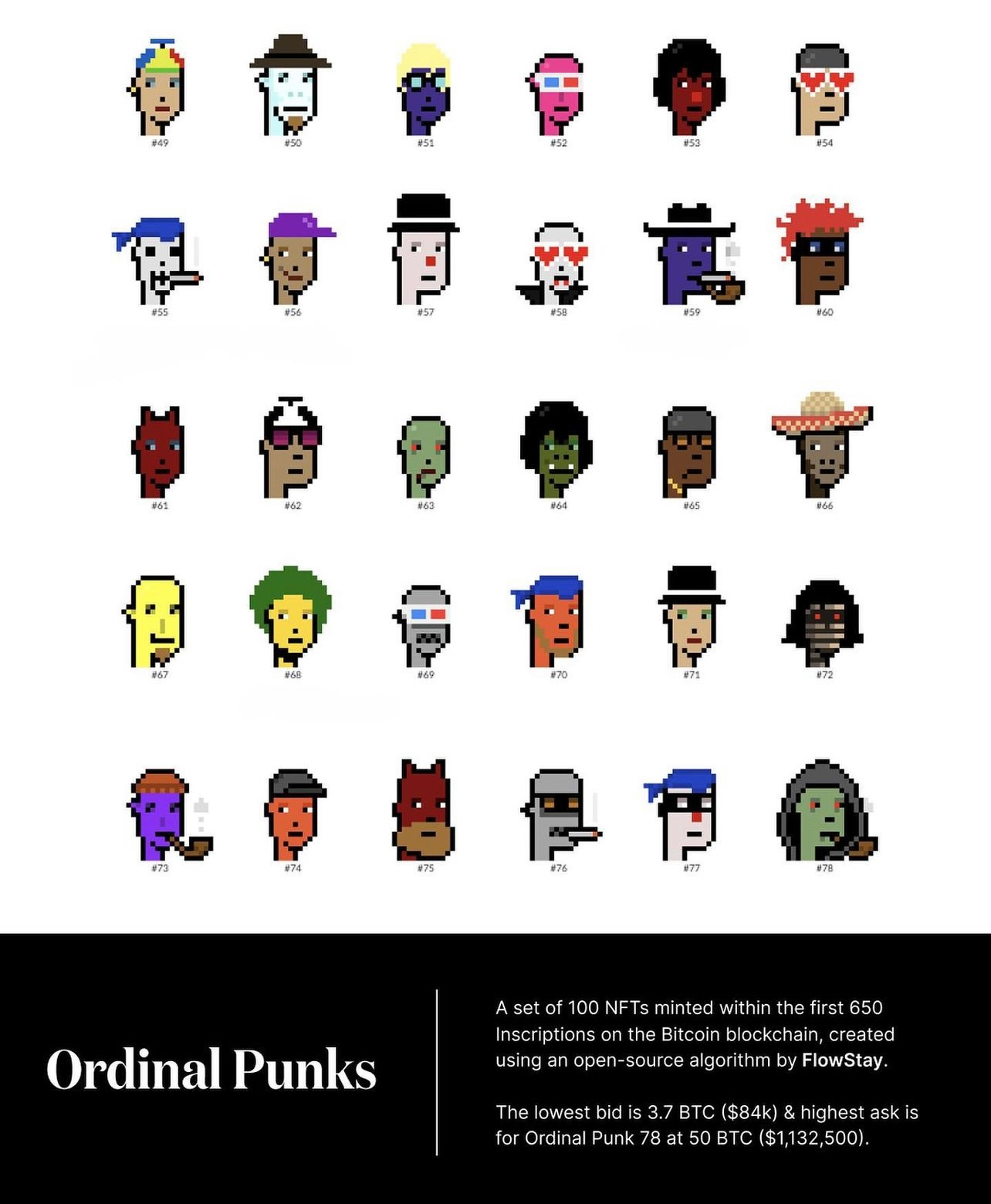

Ordinal Punks

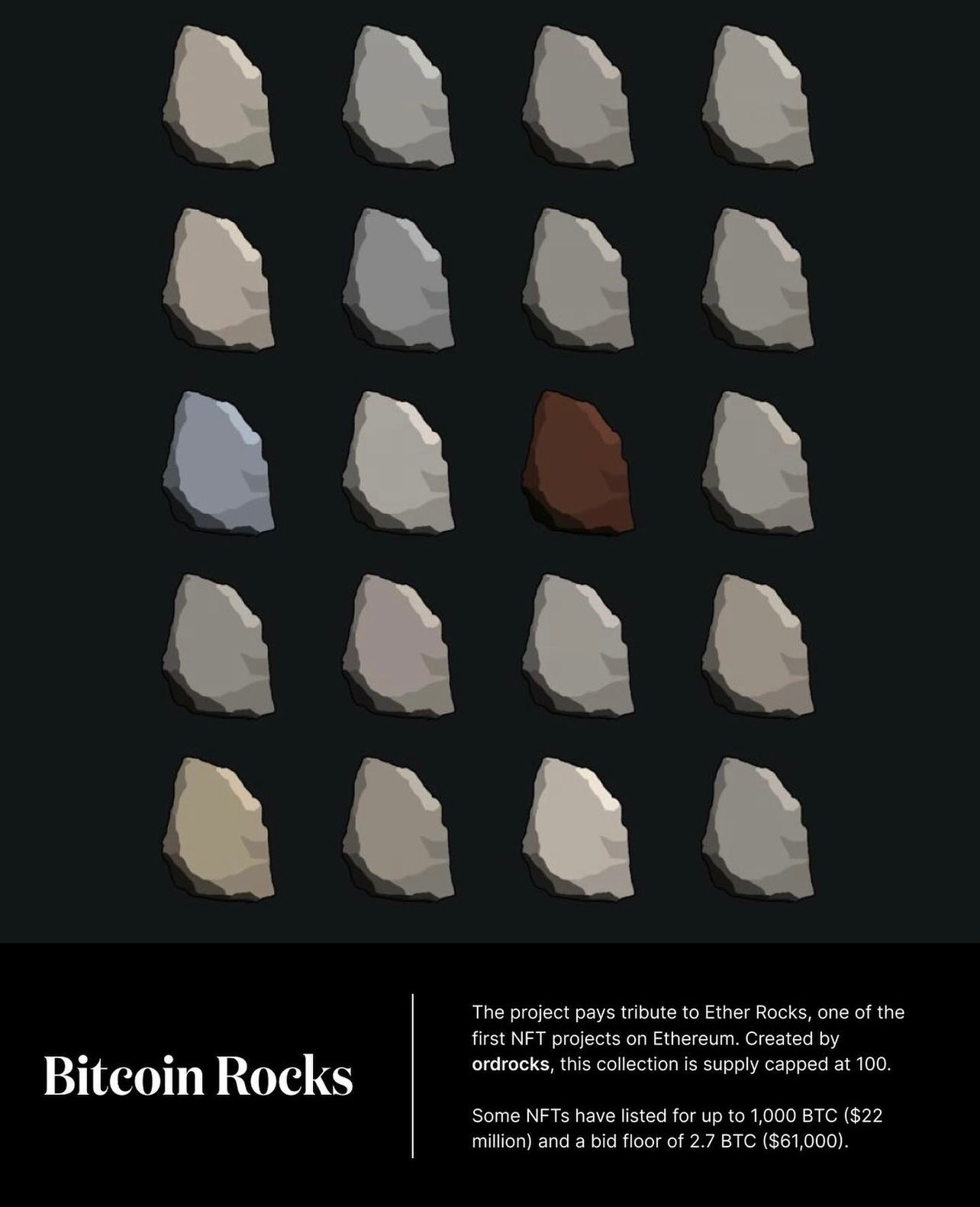

Bitcoin Rocks

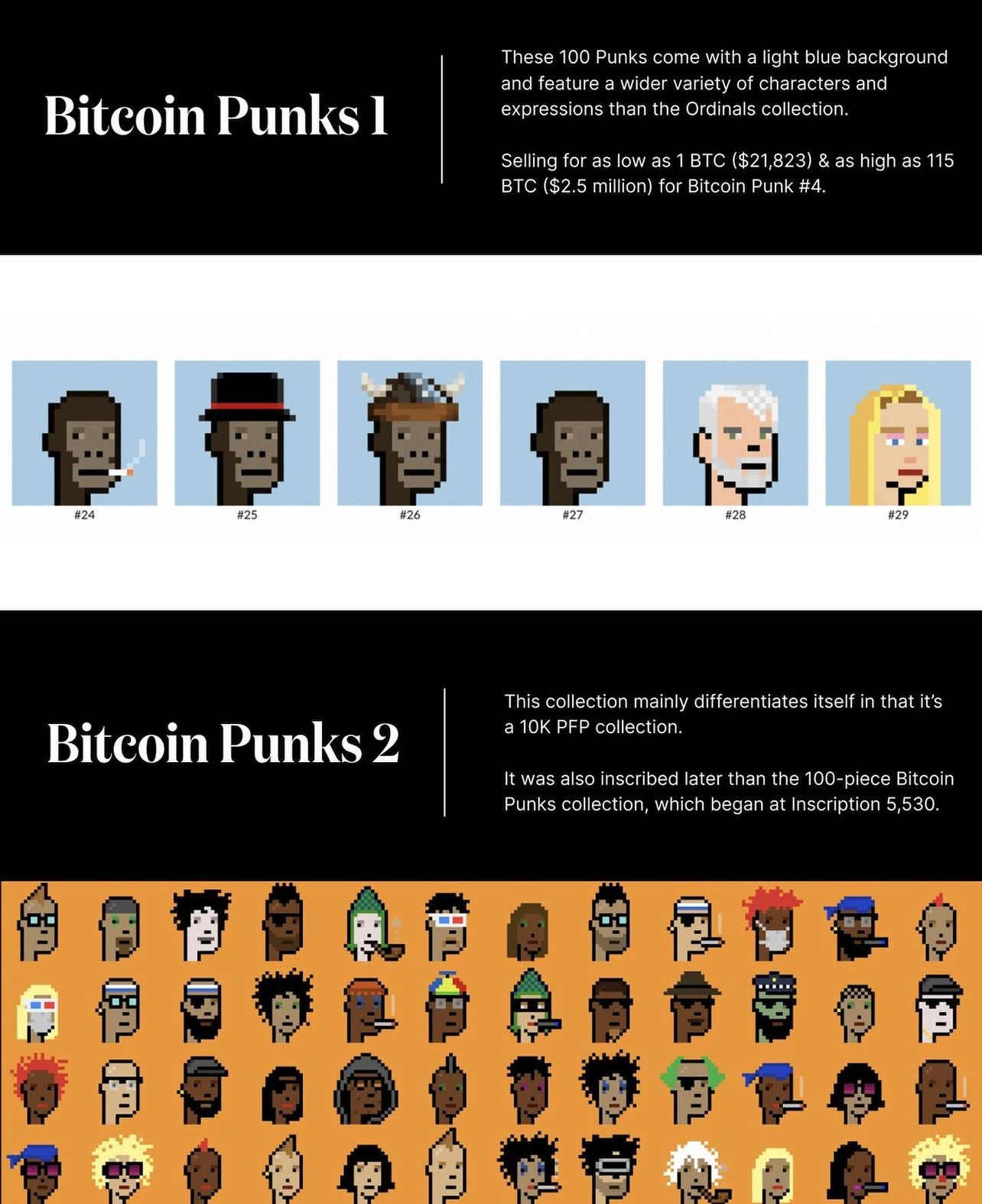

Bitcoin Punks

On-Chain Monkey

Ordinal Loops

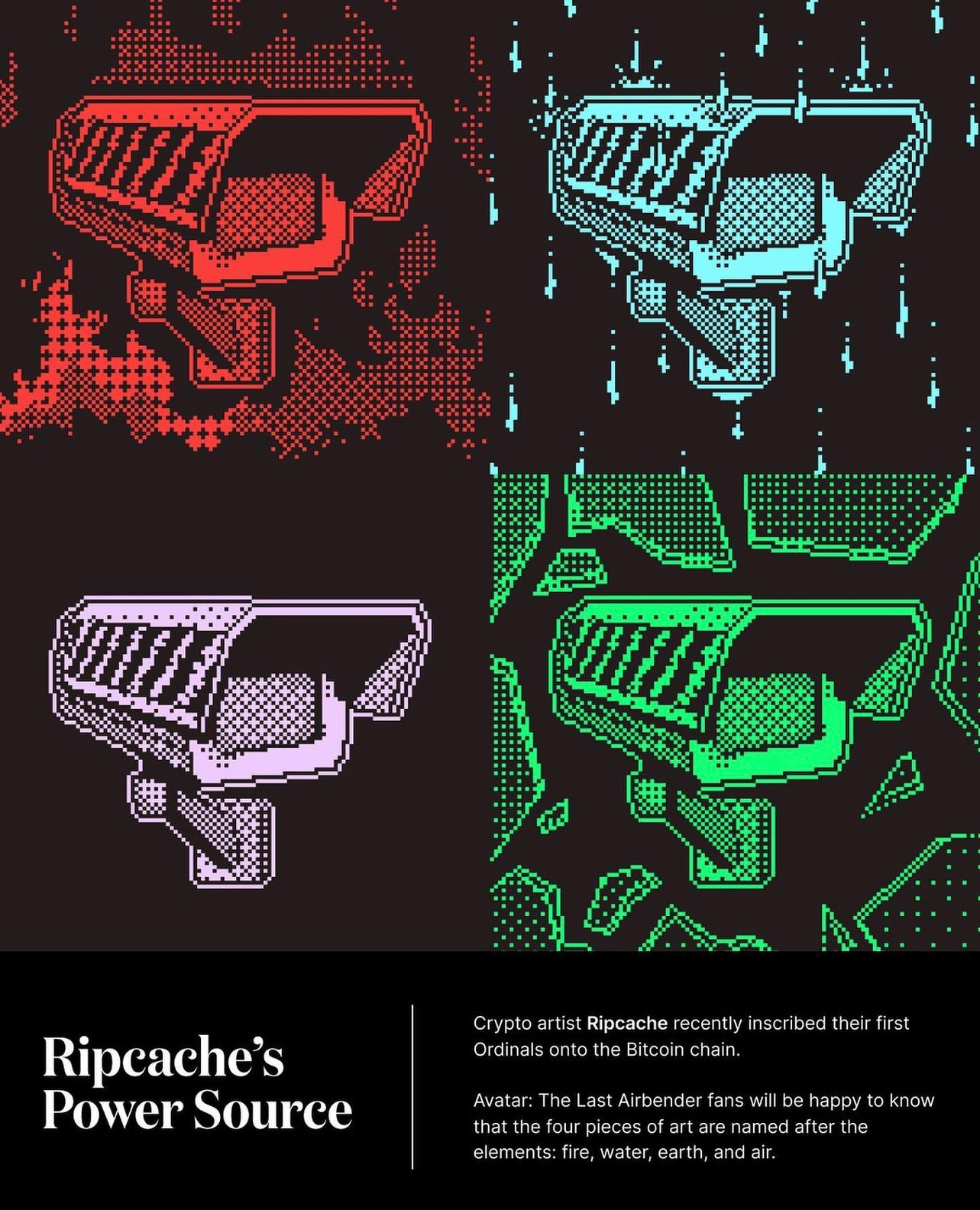

Ripcache’s Power Source

On the Edge of Oblivion

This Week By the Numbers 📈

Deal of the Week 💰

This week I angel-invested in a new start-up based in Kenya:

AMINI is fixing Africa’s data gap through deep tech infrastructure (AI, IoT, and Satellites,) and enabling economic transparency for a continent of 1 billion people by 2030. They use nanosatellites to fetch data, host it on-chain, and use machine learning to generate predictions and return near-real-time data and insights to businesses.

Current raise: $3M Seed.

Founder: Ex-NVIDIA, Intel, Arm, founding member of the tinyML movement, VentureBeat Women in AI Top 100

If this sounds interesting, DM me for an intro!

Top Stories 🗞️

Banks under pressure from U.S. authorities to cut ties with crypto firms

According to sources, US authorities are reviving old tactics to crack down on crypto firms and banks offering services to the industry. The strategy is to isolate the traditional financial system from the crypto market by using multiple agencies to discourage banks from dealing with crypto firms, leading crypto businesses to become unbanked. This claim is based on conversations between Nic Carter, co-founder of Castle Island and Coin Metrics, and bank executives, including both crypto-native and traditional banks. They reported facing pressure from the Federal Reserve and Federal Deposit Insurance Corporation. A recent joint statement from the Fed, FDIC, and the Office of the Comptroller of the Currency also warned about the risks of banks engaging in crypto and encouraged them to refrain from doing so due to safety and soundness concerns. Binance also announced last month that it would only process US dollar transactions over $100,000 due to a new policy by Signature Bank.

3AC and CoinFLEX launch website, waitlist for crypto claims exchange

The Open Exchange (OPNX) project, initially proposed by 3AC and Coinflex, has launched its official website and waitlist as of February 9th. The project aims to become "the world's first public marketplace for crypto claims trading and derivatives," according to its official Twitter account. 3AC founder Zhu Su stated in a Twitter thread that the project was created to recover from past mistakes and will provide real-time public cryptographic audits to ensure all user funds are untouched. The exchange will start as a claims trading service but will later expand to include FX, stocks, and innovative products, providing the best of both centralized finance (CEFI) and decentralized finance (DEFI), according to Zhu Su.

Stablecoin Issuer Paxos Is Being Investigated by New York Regulator

The New York Department of Financial Services (NYDFS) is investigating the stablecoin issuer Paxos, according to CoinDesk. The extent of the investigation is unknown. Paxos offers stablecoins such as the Pax dollar (USDP) and Binance USD (BUSD), which is a Binance-branded stablecoin provided through a white-label service. The NYDFS spokesperson stated that the agency cannot comment on ongoing investigations. Paxos has recently been in the news over rumors that the U.S. Office of the Comptroller of the Currency may ask it to withdraw its application for a full banking charter, which Paxos has denied. However, the ongoing investigation by a state regulator suggests that the company, which received a provisional bank charter from the OCC in 2021, is under closer scrutiny than its peers. Paxos also holds a virtual currency license, also known as a BitLicense, from the NYDFS.

Montana Passes Bill to Exempt Utility Tokens From Securities Laws

The U.S. state of Montana has become friendly towards cryptocurrency with the passage of new legislation regarding the use of utility tokens. Governor Steve Bullock signed House Bill 584 into law, recognizing utility tokens and exempting them from being considered securities under local regulations with certain restrictions. The bill, titled "Generally revise laws relating to cryptocurrency," was sponsored by State Representative Shane Morigeau and outlines that utility token transactions are allowed as long as the token's primary purpose is for consumption and not marketed as an investment or for speculation. The issuer must file a notice of intent to sell the tokens with the state's securities commissioner and the "consumptive purpose" of the utility token must be available within 180 days of its sale or transfer. The initial buyer is also prohibited from reselling or transferring the token until its consumptive purpose becomes available, which is defined as providing or receiving goods, services, or content, including access to goods, services, or content.

Microsoft launches the new Bing, with ChatGPT built in

Microsoft has integrated OpenAI's GPT-4 model into Bing, its search engine, in an effort to better compete with Google. The integration provides a conversational experience similar to OpenAI's ChatGPT. The new Bing also features a chat option in its toolbar. The version of the search engine is more up-to-date and can handle recent events, while OpenAI's ChatGPT was trained on data only up to 2021. Microsoft is also launching a new version of its Edge browser with the AI features built into the sidebar.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.