The Tariff Trap

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X below.

As I am offline this week on a personal matter, this week’s edition of the Myth of Money is brought to you from one of our associates, writer and researcher Katherine MacLellan.

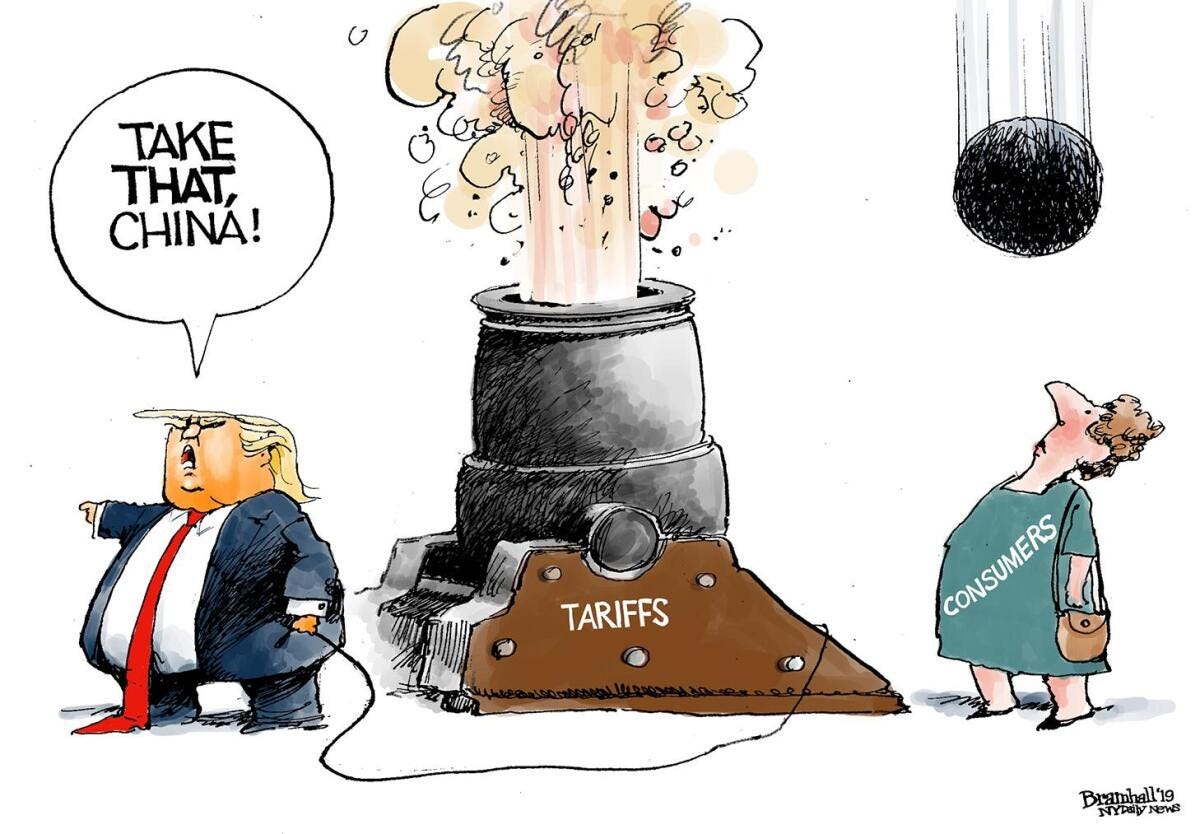

Economic policies, along with the political dynamics that shape them, significantly influence our investment portfolios. The recent proposal to substantially increase tariffs on imported goods has brought this issue to the forefront of economic discussions. These proposed changes, led by former President Trump, could have a widespread impact across various sectors and potentially reshape the U.S. economy.

Understanding Tariffs and Their Strategic Use

Tariffs are taxes applied to imported goods. They’re often used to protect domestic industries by making imports more expensive and encouraging consumers to buy local. In the United States, certain industries have long benefited from tariffs, including sugar producers since 1789, and the auto industry since 1964. Tariffs are also used to counter unfair trading practices, like when foreign governments heavily subsidize their industries.

The Trump Administration's Approach

Trump’s administration took a firm stance on trade, especially with China. A 2018 U.S. Trade Representative report called China's intellectual property practices "unreasonable or discriminatory," accusing the country of forcing American companies to hand over their IP in exchange for market access—a practice known as forced technology transfer.

In response, Trump imposed tariffs on about $360 billion worth of Chinese imports. His goal was to protect American intellectual property rights and level the playing field for U.S. businesses.

Economic Impact on Consumers

The narrative from both sides of the political aisle suggests that tariffs will restore manufacturing jobs and boost domestic production while lowering consumer prices over time as industries adapt and thrive globally. However, this perspective merits scrutiny. Research indicates that consumers ultimately bear these costs. By raising the price of foreign goods, tariffs also inflate production costs for American companies reliant on global supply chains.

Studies indicate that American households could face annual cost increases ranging from $2,600 to $7,600 if these tariffs are enacted. Essential goods—such as groceries, fuel, electronics, and household items—would see price hikes that directly affect all consumers regardless of income level. For instance, Trump's steel and aluminum tariffs resulted in an additional $2.2 billion in costs for U.S. beverage companies between 2018 and 2021, which were ultimately passed on to consumers.

In the automotive industry, rising steel and aluminum prices have raised manufacturing costs for U.S. automakers. General Motors estimated a loss of $1 billion in profits in 2018 due to these increased costs. If new tariffs are implemented, similar or even greater impacts could be expected across the automotive industry.

Protecting Vulnerable Industries: Targeted, Short-Term Tariffs

While we as consumers may care most about our bottom line, politicians have a more complicated hand to play. The tariffs on steel and aluminum did drive up prices, but were aimed to protect American workers from unfair competition due to China’s non-market overcapacity in steel and aluminum production. The U.S. steel industry is experiencing a significant resurgence, with major companies investing billions of dollars in new, state-of-the-art facilities across the country. This wave of expansion includes U.S. Steel's $3 billion investment in a highly sustainable mill in Arkansas, Nucor's new mills in Missouri and Florida, and Steel Dynamics' job-creating facility in Texas. Additionally, Big River Steel is expanding its Arkansas operations, while Commercial Metals is constructing one of the world's cleanest steel mills in Arizona. These investments are creating thousands of high-paying jobs and fostering economic growth in multiple states, demonstrating the renewed strength and competitiveness of American steel production.

The nascent solar panel industry has also benefited from tariffs in its infancy–U.S. producers now account for roughly 30% of market share for solar panels. The tariffs have encouraged some companies to invest in U.S.-based solar manufacturing. For example, Hanwha Q CELLS opened a factory in Georgia, while First Solar expanded its production in Ohio. The tariffs have incentivized domestic companies to invest in research and development to improve efficiency and reduce costs, helping them compete with foreign manufacturers. While there have been costs associated with the protectionist measure, proponents believe that protecting American solar panel manufacturing will be important for a future where the technology is relied on extensively as an element of critical infrastructure.

Inflation and Investment Volatility

On the other hand, as a long-term, wide-reaching policy, tariffs threaten to increase inflation. The U.S. is already battling inflation, and economists predict tariffs could push it up by as much as 1%. With inflation already above the Federal Reserve's target of 2%, this could prompt more aggressive interest rate hikes, which would squeeze consumer spending and hurt investment returns.

For companies that depend on imported components, such as those in tech, production costs would soar. Apple, which relies on China for iPhone production, could see costs increase by as much as $160 per iPhone if tariffs rise—a cost that would likely be passed on to consumers.

The Global Trade Ripple Effect

Tariffs don’t exist in a vacuum. They can spark trade wars, as we saw during Trump’s first term. His tariffs on Chinese goods led to swift retaliation, with China imposing duties on U.S. agricultural products, such as soybeans, corn, and pork. The result? U.S. soybean exports to China plummeted by 74%, leading to a surplus of crops, falling prices, and financial devastation for American farmers. The U.S. government stepped in with a $30 billion bailout to support struggling farmers—a bailout funded by U.S. taxpayers.

The agriculture sector wasn't alone. Other countries responded to U.S. tariffs by slapping duties on American exports like Harley-Davidson motorcycles, bourbon, and even Levi’s jeans. If Trump follows through with his latest proposals, major U.S. trading partners like the European Union, Canada, and China may retaliate, potentially leading to a full-blown global trade war. According to the Peterson Institute for International Economics, retaliatory tariffs from these countries could affect as much as $1 trillion in U.S. exports, sending shockwaves across financial markets and eroding investor confidence.

Impact on U.S. Exports

Higher tariffs make U.S. goods more expensive for foreign buyers, reducing demand and hurting American businesses. Meanwhile, a weakened U.S. dollar—should the economy slow—could further raise the cost of imported goods, worsening inflation. Foreign investors might pull out of U.S. assets, creating a feedback loop of falling exports and rising import prices.

The Political Entrenchment of Tariffs

One of the most troubling aspects of tariffs is how difficult they are to implement short-term. Even though the Biden administration has expressed concerns over Trump’s tariffs, many remain in place, especially in swing states where industries like steel rely on this protectionism. Tariffs are politically popular with those who view them as a way to protect American jobs. But this support obscures the longer-term risks. Tariffs may provide short-term protection to specific industries, but long-term, they stifle innovation and competitiveness, leaving the U.S. economy weaker.

This political reality means that even if Trump’s proposed tariffs are implemented, they could linger for years or even decades, no matter the administration in power. Tariffs can create a drag on consumer spending, squeeze corporate profits, and reduce market liquidity.

As investors, we need to see past the headlines and understand the real, long-term economic risks behind tariffs. While they may appear to protect domestic industries, tariffs may represent significant threats to economic growth, portfolio performance, and market stability. And once they’re in place, removing them is often far more difficult than anticipated—leaving us to navigate the lasting consequences.

This Week By the Numbers 📈

📊 Markets & Trading

💰 Finance & Cryptocurrency

Arkham Intelligence to launch derivatives exchange next month

739,000 merchants now able to accept crypto payments via Stripe

🏛️ Regulation & Policy

US considers capping AI chip exports from Nvidia and AMD to Middle East

FTC finalizes "click to cancel" rule for subscription services

🔒 Security & Legal

FBI arrests suspect in SEC Twitter hack that promoted Bitcoin

Bitcoin miner sues local council to exhume 8,000 BTC buried in landfill

🏢 Corporate News

🚀 Space & Technology

SpaceX catches Super Heavy booster with robotic arms during Starship's fifth test flight

Google invests in nuclear power plants to fuel AI operations

Amazon joins tech giants in exploring nuclear power for data centers

Vitalik Buterin releases Part 2 of Ethereum scaling road map “The Surge”

🌐 Only on the Internet

Data suggests single entity responsible for $26M worth of Polymarket bets

Perplexity AI launches finance platform, and it is beautiful

World’s first Degen AI model raises over $500k on Solana meme coin $GOAT

Musk raises payment offer to $100 for swing state voters who sign 2A petition

Top Stories 🗞️

Israel says it killed the Hamas mastermind behind October 7. Here’s what we know

More than a year after Hamas’ devastating October 7 attacks on Israel, the country’s military said Thursday it had killed the man it considers to have been the chief architect of that cross-border massacre – raising questions about the future of the war and of the militant group itself, which has faced blow after blow in recent months.

The death of Hamas leader Yahya Sinwar could pose a rare opportunity to strike a ceasefire, US officials say – with Israel having killed several other top Hamas commanders including Ismail Haniyeh, the group’s former political leader, as well as leaders of militant group Hezbollah in Lebanon.

In a recorded video message Thursday, Israeli Prime Minister Benjamin Netanyahu said Sinwar’s death marked “the beginning of the day after Hamas,” but “the task before us is not yet complete.”

But much remains unknown – including the fate of Sinwar’s brother. Mohammed Sinwar recently took over as Hamas’ military commander, a senior Israeli official told CNN last month. The brothers were very close, and as recently as late August were often still together, the same official told CNN.

If Mohammed survived this week, he will likely continue his brother’s hardline negotiating tactics as Israel seeks to extract its remaining hostages from the Palestinian enclave. But until a clear picture emerges, it will be hard to know the militant group’s next move.

Kamala Harris Highlights Capital Access, Crypto in Bid to Woo Black Men

Vice President Kamala Harris is ramping up her outreach to Black men, pledging to provide outlets for economic security, as polls show Donald Trump is gaining support among Black voters.

Harris on Monday proposed a new program for Black entrepreneurs, and others who have faced barriers to accessing financing, to provide loans to those starting businesses. The plan would provide 1 million loans that are fully forgivable up to $20,000, according to a campaign outline about Harris’ efforts to reach Black male voters.

The Democratic nominee also pledged to support a regulatory framework for cryptocurrency, to give more investment certainty to the 20% of Black Americans who own — or have owned — digital assets. She vowed to work with Congress to legalize recreational marijuana and make sure Black men are able to create businesses and access jobs in a burgeoning cannabis industry.

Grayscale Files To Convert $520M Multi-Crypto Fund Into Spot ETF

Grayscale, the massive cryptocurrency asset manager overseeing $14.74 billion, is seeking to convert a multi-asset crypto fund into a spot exchange-traded fund (ETF).

On Oct. 15, the New York Stock Exchange (NYSE) Arca, submitted a 19b-4 filing on Grayscale’s behalf petitioning the U.S. Securities and Exchange Commission (SEC) to allow the conversion of Grayscale’s Digital Large Cap Fund into a spot ETF.

The fund currently holds $520 million in assets, 76% of which is invested in Bitcoin while 18% is allocated to Ethereum. The fund also invests 4.16% of its capital in Solana (SOL), 1.76% in Ripple (XRP), and 0.66% in Avalanche (AVAX).

If approved, this conversion would make it Grayscale’s first multi-token ETF, offering investors exposure to a basket of digital assets in a single, tradeable product.

Sui Foundation disputes $400 million insider selling allegation amid token’s price surge

The Sui SUI +1.31% Foundation rebutted social media allegations of $400 million insider selling on the open market throughout its recent price run-up, stating on Monday that no such activity had occurred from someone within the foundation or its core contributor, Mysten Labs.

The claim surfaced as pseudonymous crypto analyst Lightcrypto alleged on X on Monday that "insiders" had sold $400 million worth of Sui during the token's recent price surge. Light identified wallets linked to the Sui initial coin offering as insiders, although specific wallet addresses were not disclosed.

“It does not bring comfort that the people building this ecosystem, the people who arguably know this token's value best, are unloading hundreds of millions of dollars of the token into less informed buyers chasing momentum,” they alleged. In the same tweet, Lightcrypto questioned Sui’s recent surge and whether the blockchain has shown as much potential as the token’s valuation.

Meanwhile, the Sui Foundation speculated that the wallet that sold $400 million worth of Sui tokens was to be owned by an “infrastructure partner” that owns tokens under a lock-up schedule.

“All token lockups are enforced by qualified custodians and continuously monitored by Sui Foundation, and this partner is in compliance,” the foundation noted.

Sam Altman’s Worldcoin becomes World and shows new iris-scanning Orb to prove your humanity

Worldcoin, the Sam Altman co-founded “proof of personhood” crypto project that scans people’s eyeballs, announced on Thursday that it dropped the “coin” from its name and is now just “World.” The startup behind the World project, Tools for Humanity, also unveiled its next generation of iris-scanning “Orbs” and other tools at a live event in San Francisco.

The World project is predicated on the idea that advanced AI systems — like the one Altman’s OpenAI is trying to build — will one day make it impossible to tell whether you are talking to a human online. Its solution is “human verification services” based around blockchain. The startup also promises to make the benefits of AI accessible to everyone, potentially by redistributing the wealth generated by AI to people through its Worldcoins.

If all this sounds a bit dubious, you’re not the only one who thinks so. Governments around the world — including Kenya and countries in the EU — have probed and suspended Worldcoin over the years over privacy, security, and financial concerns. The Kenya investigation concluded, allowing World to continue operating, but some of those EU investigations are ongoing, and World’s fate there remains uncertain.

“Myth Of Money” Book - Shipping this week! 🤓

As many of you know, making financial education accessible has always been a passion of mine. After a year of hard work, I'm excited to announce that my new book, published by Wiley Publishing, is finally out!

This book is a thrilling blend of personal stories from the financial world, coupled with clear explanations of how things really work—from investment banking and stocks to venture capital, macroeconomics, and cryptocurrencies.

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. Currently working as a proud General Partner at Moonwalker Capital.

(More about me 👉 here).

About the Author: Katherine MacLellan

Katherine holds an MA (Hons) in Economics and International Relations from the University of St. Andrews, and a JD from Osgoode Hall. She has been thinking and writing about Bitcoin and blockchain technology since 2013.