Threads vs. Twitter - Which Should You Use?

Dear Investors,

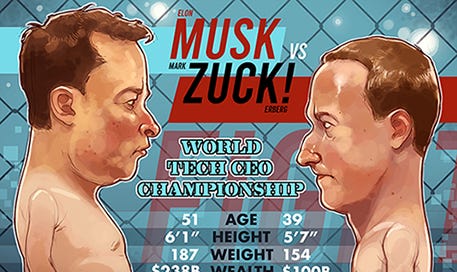

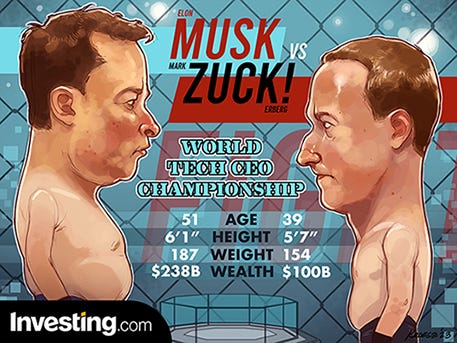

META launched a new text-based product this week, called Threads, which piggy-backs off of Instagram’s social graph and oddly looks walks and quacks a lot like Twitter.

Rumored to have only been built over the last 6-9 months with about 20 engineers inside META, Threads is quickly approaching 100M users, with experts pontificating that this could mean as much as $20B in additional valuation to the company.

In a recent development, Alex Spiro, a legal representative from Twitter, took action by sending a letter to Mark Zuckerberg, the CEO of Meta, on Wednesday. The letter accuses Meta of engaging in "systematic, willful, and unlawful misappropriation of Twitter's trade secrets and other intellectual property" in the creation of the Threads app.

According to Mr. Spiro, Meta allegedly hired numerous former Twitter employees who had access to Twitter's trade secrets and highly confidential information. It is claimed that this insider knowledge played a significant role in the development of what Mr. Spiro refers to as a "copycat" Threads app.

The letter from Twitter's legal team makes it clear that Twitter is fully committed to protecting its intellectual property rights and insists that Meta immediately cease the use of any Twitter trade secrets or highly confidential information. The letter also states that Twitter reserves all rights, including but not limited to seeking civil remedies and injunctive relief, without any further notice.

This legal move by Twitter highlights its determination to address the alleged infringement of its intellectual property and seek appropriate recourse in response to the situation.

But the real question is - Will Threads be a flash in the pan or a lasting platform? Should you be rushing to build you following there?

Here are some main differentiators:

Threads is absolutely free to download and use, without any sneaky features hidden behind a paywall. As of now, Threads doesn't bombard you with advertisements, but it's possible that could change in the future. We all know how Instagram has become quite heavy on ads and shopping, right?

While browsing through your Threads feed, you might come across some account handles adorned with blue checkmarks. These checkmarks signify that the user is verified, and this verification carries over from Instagram. So, if you're lucky enough to be verified on Instagram, that status will automatically extend to your presence on Threads as well.

The primary purpose of both Twitter and Threads is essentially the same: sharing short messages that other users can view and engage with. Whether it's witty jokes, personal updates, gripes, or even song lyrics, you have the freedom to express whatever is on your mind and connect with those who follow you. The key distinction lies in the character limits: Threads allows up to 500 characters per message, while Twitter restricts you to a concise 280 characters.

In terms of content, both platforms enable you to share website links, videos, and images. GIFs can be posted on both services, although on Threads, you'll need to save the GIF to your camera roll before sharing it. Notably, Threads grants you more flexibility when it comes to multimedia, as you can share up to 10 items in a single post. This stands in contrast to Twitter's limit of four items per tweet, which aligns with the limit for carousel posts in the Instagram apps.

Engagement options on Twitter and Threads are quite similar, encompassing features such as liking, commenting, reposting, quoting, and sharing. These functionalities empower you to interact and connect with others on both platforms seamlessly.

However, the approach to content discovery diverges between Threads and Twitter. On Twitter, you have the ability to finely curate your post feed, tailoring it to your preferences. You can opt for a "For you" feed that blends suggested posts with content from accounts you follow or stick to a "Following" feed that exclusively showcases posts from accounts you've chosen to follow.

In terms of search capabilities, Twitter allows you to explore recent and relevant publicly-available posts by searching for specific words or phrases. On the other hand, Threads limits its search functionality to finding accounts. Consequently, Threads may not be the go-to platform for seeking out news or trending topics, at least for the time being.

One noticeable distinction in messaging features between Threads and Twitter is that Twitter incorporates an in-app messaging function, whereas Threads does not offer such functionality at this time.

If I had to guess, Threads will not be able to create a lasting and engaging community. Habits are tough to break and social media platforms need to offer something materially different to create new engagement, similar to how TikTok created a new and innovative video platform. The benefit of jumping to a new platform remains the first mover advantage, which is why creators are moving their content - for fear of missing out. You can still find me on Twitter, as I remain a loyalists to what has worked for years.

What I’m Reading This Week 📚

The rich are different: Unravelling the perceived and self-reported personality profiles of high-net-worth individuals

Abstract - Beyond money and possessions, how are the rich different from the general population? Drawing on a unique sample of high-net-worth individuals from Germany (≥1 million Euro in financial assets; N = 130), nationally representative data (N = 22,981), and an additional online panel (N = 690), we provide the first direct investigation of the stereotypically perceived and self-reported personality profiles of high-net-worth individuals. Investigating the broad personality traits of the Big Five and the more specific traits of narcissism and locus of control, we find that stereotypes about wealthy people's personality are accurate albeit somewhat exaggerated and that wealthy people can be characterized as stable, flexible, and agentic individuals who are focused more on themselves than on others.

This Week By the Numbers 📈

The Fed continues its fight against inflation, and while the economy remains strong, many contend that the Fed might be nailing the “soft landing” we have all been hoping for. While rates are currently at 5-5.25%, the Fed has indicated a pause in rates for now, while further rates may be coming. Inflation has softened, but as many Americans will tell you, the real inflation of food, shelter, and fuel, is still significantly higher than tolerable for most. As always, everything is relative. China’s economy is going strong, while Europe continues to struggle more than the U.S.

Top Stories 🗞️

SEC Approval of Spot Bitcoin ETF Is Unlikely to Be a Game Changer for Crypto Markets: JPMorgan

Any U.S. Securities and Exchange Commission (SEC) approval of a spot bitcoin exchange-traded fund (ETF) will not be a game changer for crypto markets for a number of reasons, JPMorgan (JPM) said in a research report Thursday. While the SEC has yet to approve such an ETF – despite receiving numerous applications – there is now more optimism the regulator will approve one because some of the previous concerns are assumed to have been addressed in recent filings, JPMorgan said. “Spot bitcoin ETFs [have] existed for some time outside the U.S., in Canada and Europe, but have failed to attract large investor interest,” analysts led by Nikolaos Panigirtzoglou wrote. A unit of BlackRock filed paperwork last month for the formation of a spot bitcoin ETF, prompting other asset managers such as Invesco and Wisdom Tree to apply or reapply as well.

Goldman Sachs predicts India will overtake US to become world's second-biggest economy by 2075

Banking giant Goldman Sachs on Monday said that India could become the world’s second-largest economy by 2075, leapfrogging US, Japan and Germany. India's population of 1.4 billion people is expected to drive significant economic growth, with Goldman Sachs Research projecting that India will possess the second-largest economy globally by 2075, said a report by Goldman Sachs. Santanu Sengupta, Goldman Sachs Research's India economist, highlighted the importance of enhancing labour force participation and providing training and skills to harness India's vast talent pool. He emphasised the favourable demographics of India, with a robust working-age population in relation to children and the elderly, presenting an opportune window for India to optimise its manufacturing capacity, expand services, and foster infrastructure growth.

Former SEC Chair Says Bitcoin ETF Could Be Approved—If These Conditions Are Met

Former SEC Chairman Jay Clayton today said that regulators would find it “hard to resist” approving a spot Bitcoin exchange-traded fund (ETF) if such a product performs the same functions as a futures one. Speaking in a CNBC interview Monday, Clayton said that the SEC would have to see that a spot product application would provide “similar efficacy to the futures market” in order to approve it. He argued that although he was very skeptical of Bitcoin trading when he was the SEC boss, he now finds it “pretty remarkable” that major players in traditional finance want to put their name on spot ETF applications. BlackRock, the world’s largest asset manager, last month applied to the SEC for a spot Bitcoin ETF, leading institutional investors to pour money into the space. “If they’re [applicants] right—that the spot market has similar efficacy to the futures market—it would be hard to resist approving a Bitcoin ETF,” Clayton said.

Supreme Court strikes down college affirmative action programs

The Supreme Court on Thursday struck down affirmative action programs at the University of North Carolina and Harvard in a major victory for conservative activists, ending the systematic consideration of race in the admissions process. The court ruled that both programs violate the Equal Protection Clause of the Constitution and are therefore unlawful. The vote was 6-3 in the UNC case and 6-2 in the Harvard case, in which liberal Justice Ketanji Brown Jackson was recused. The decision was hailed by prominent conservatives, who say the Constitution should be "colorblind," with former President Donald Trump calling it "a great day for America." Liberals, however, condemned the ruling, saying affirmative action is a key tool for remedying historic race discrimination. President Joe Biden called the decision a "severe disappointment," adding that his administration would provide guidance about how colleges could maintain diversity without violating the ruling.

Court Orders Kraken to Turn Over History Transaction and Account Information to IRS

A federal court ordered crypto exchange Kraken to turn over account and transaction information to the IRS, which said it needed that information to see if any of the exchange's users had underreported their taxes. The IRS filed a court petition in the Northern District of California in February, moments after the crypto exchange settled charges with the U.S. Securities and Exchange Commission alleging that its staking service violated securities law. The tax enforcer alleged that it had issued a summons to Kraken in 2021 that the exchange failed to comply with, and was trying to check for tax liabilities for users who transacted in crypto between 2016 and 2020. According to Friday's order, Kraken must turn over information for users who transacted with more than $20,000 over the course of a calendar year for that year, including the user's name (and any pseudonyms), birthdate, taxpayer identification number, address, phone number, email address and a host of other documents.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).