$TRUMP Launches Meme Coin to Shake Up the Market

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X below.

$TRUMP: A Presidential Play on Crypto

On January 17, 2025, just days before his inauguration as the 47th President of the United States, Donald Trump unveiled $TRUMP, a memecoin billed as "the only official Trump meme." Launched via his Truth Social platform, the token quickly captured global attention, soaring to a fully diluted market cap of $72 billion within 48 hours.

The announcement coincided with the Inaugural Crypto Ball in Washington, D.C., an event blending crypto star power with political spectacle. Guests included the Winklevoss twins, Coinbase CEO Brian Armstrong, and MicroStrategy’s Michael Saylor. David Sacks, Trump’s newly appointed "Crypto Czar," declared, “The reign of terror against crypto is over. The beginning of innovation in America has just begun.”

Market enthusiasm was immediate. By Saturday morning, $TRUMP surged over 300%, and by Sunday, it was trading at $72, placing it as the 15th largest cryptocurrency globally, at a valuation of $70B+, according to CoinMarketCap.

Tokenomics: Power in Insider Hands

Built on the Solana blockchain, $TRUMP has a capped supply of 1 billion tokens, with 200 million made available to the public on Day One. However, 80% of the supply is held by two Trump Organization-affiliated entities, CIC Digital LLC and Fight Fight Fight LLC. This concentration, subject to a three-year vesting schedule, gives insiders significant control over the token's price dynamics—a structure critics argue undermines the decentralized ethos of blockchain technology.

Ethical, Regulatory, and Foreign Policy Concerns

The timing and structure of $TRUMP’s launch has drawn some ire. With $500 million reportedly earned from liquidity provision on Day One, critics like venture capitalist Nick Tomaino have labeled the project “predatory,” while Anthony Scaramucci warned of its potential to damage the broader crypto ecosystem. Nikita Bier summarized the controversy succinctly:

Strategic Implications for Crypto

Trump’s alignment with Bitcoin further deepens the narrative. As rumors circulate about a potential Ethereum-based follow-up meme coin, analysts suggest $TRUMP’s launch may trigger new capital flows across blockchain ecosystems. Meanwhile, Michael Saylor’s MicroStrategy is reportedly planning to increase its Bitcoin holdings, with the company set to raise $750 million through stock sales to fund additional Bitcoin purchases and other corporate initiatives.

At the time of writing, the $TRUMP coin started to collapse as a new coin, $MELANIA, was announced.

Innovation or Achilles’ Heel?

$TRUMP’s launch may herald a new era for crypto, but it also highlights the ethical and systemic vulnerabilities of an unregulated market. Whether it’s a masterstroke of innovation or a risky gamble remains to be seen.

As the crypto world reacts, the regulatory landscape faces a seismic shift. SEC Chair Gary Gensler’s recent resignation has thrown an additional layer of uncertainty into the mix, raising urgent questions about how—or if—the government will address the challenges $TRUMP has introduced.

The Gensler Era Ends as Trump Ushers in Crypto’s Future

The U.S. cryptocurrency landscape is at a turning point as President-elect Donald Trump prepares to take office tomorrow on Monday, January 20th. His inauguration promises a significant shift from years of regulatory hostility to an era of clarity, fairness, and support for innovation. Markets have already begun to respond, digesting recent macroeconomic data and anticipating pro-growth policies. Inflation reports show the core Consumer Price Index (CPI) rose 2.9% year-over-year, slightly below expectations, but still 50% above the Federal Reserve’s 2% target. This tempered optimism among investors but spurred speculation about potential rate pauses, which helped boost equities, with the S&P 500 and Nasdaq rallying.

Trump’s administration has framed its approach as "America first for crypto," prioritizing U.S.-based digital assets to establish the country as a global blockchain leader. "We will make America the leader in digital assets by prioritizing innovation here at home," said Trump. "By investing in U.S.-based technologies, we will ensure our economic and national security and take control of our financial future." As we stand on the brink of a new administration, it’s time to examine what lies ahead for crypto under Trump’s leadership—and reflect on the challenges and lessons of the era we’re leaving behind.

Reflecting on Gary Gensler’s Polarizing Legacy

Gary Gensler’s resignation as Chair of the U.S. Securities and Exchange Commission (SEC) marks the end of a contentious chapter in crypto regulation. Initially welcomed by the industry due to his blockchain expertise at MIT, Gensler’s tenure quickly shifted to enforcement-heavy tactics. He spearheaded over 100 crypto-related actions against major firms like Coinbase, Binance, Ripple, and Kraken. These efforts, while aimed at consumer protection, earned criticism for lacking clear regulatory guidance.

Key moments of Gensler’s term:

SAB 121 Compliance Rule: Intended to improve transparency in safeguarding customer crypto-assets, it instead imposed costly compliance burdens, drawing industry backlash.

Court Rebukes: The SEC faced sharp criticism for its “arbitrary and capricious” refusals to clarify crypto asset classifications, including a landmark Coinbase case. The court’s intervention highlighted the SEC’s lack of cohesive policy.

In his farewell address, Gensler described Bitcoin as "a highly speculative asset," drawing parallels to gold: “Just like we’ve had gold for 10,000 years, we have Bitcoin. It might be something else in the future as well.” To their credit, the SEC has consistently maintained that Bitcoin, unlike most other cryptocurrencies, is not a security.

Market Optimism Builds Ahead of Policy Shifts

Investor sentiment reflects hope for a more favorable regulatory environment under Trump’s leadership. Bitcoin recently surpassed $102,000, while Solana and XRP surged on speculation about upcoming crypto-friendly policies. Bloomberg Intelligence predicts Litecoin may secure SEC approval for the first spot ETF among altcoins, and analysts from HashKey Capital forecast Bitcoin reaching $300,000 by 2025, driven by ETF adoption and regulatory clarity.

As the U.S. transitions from Gensler’s enforcement-heavy approach to Trump’s vision of clarity and innovation, the crypto industry is optimistic but cautious. The launch of $TRUMP, a memecoin tied directly to the President-elect, embodies the promise and peril of this new era. While it has energized markets and highlighted the potential for American-made blockchain projects, it also underscores the need for safeguards that protect retail investors, promote institutional investment, and prevent fraud and grift.

"The Gensler years were marked by chaos and ambiguity," said Ripple CEO Brad Garlinghouse. "What we need now is structure, not punishment."

The $TRUMP launch shows the potential for U.S. leadership in crypto, but without a framework that ensures transparency and accountability, we risk repeating past mistakes.

With the Trump administration’s focus on collaboration and leadership, 2025 could usher in a transformative era for the U.S. crypto economy—one where innovation thrives within a foundation of trust and integrity.

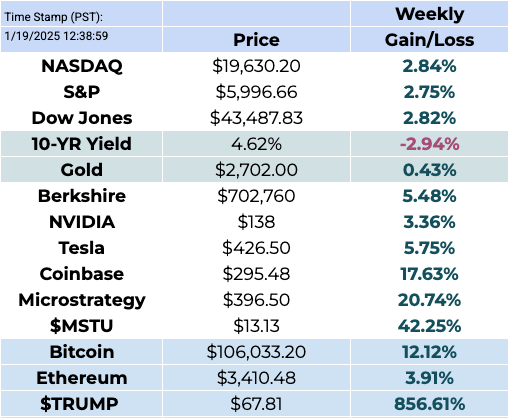

This Week By the Numbers 📈

Cryptocurrency & Blockchain 💰

Trump plans to prioritize Bitcoin and regulatory clarity with new executive order

MicroStrategy seeks approval to expand common stock issuance limit to 10.33 billion shares

Coinbase relaunches Bitcoin-backed loans via Morpho protocol with cbBTC collateral

2025 is the year to definitely report your crypto transactions to the IRS

DeFi platforms expected to benefit from stricter crypto tax laws

Trump-controlled World Liberty Financial sells $10M Bitcoin for Ethereum

Litecoin price surges amid growing speculation of imminent ETF approval

FDIC whistleblower alleges agency destroyed documents related to crypto

Macroeconomics & Global Markets 🌍

December CPI softens to 3.2% YoY, signaling slower inflation growth

BoJ rate hike could unwind yen carry trade, pressuring global markets

Russia and Iran deepen economic ties with a 20-year partnership agreement

Oil giant BP announces 4,700 layoffs, about 5% of its workforce

Politics & Regulation 🏛️

Treasury nominee Scott Bessent opposes US central bank digital currency plans

Robinhood settles SEC charges for $45M over data breaches and record-keeping violations

EU implements new DORA rules, reshaping financial services cybersecurity

Pro-Bitcoin UK minister Tulip Siddiq resigns amid corruption allegations, raising uncertainty

Technology & Corporate News 💡

Google won’t add fact-checks to search or YouTube despite new EU law

Hindenburg Research shuts down amid volatile market conditions

Top Stories 🗞️

Gaza ceasefire to begin Sunday after Israel approves deal in marathon cabinet meeting

The long-awaited ceasefire and hostage release deal between the Israeli government and Hamas will take effect on Sunday, potentially signaling a new chapter in a bloody 15-month conflict that has enflamed the Middle East.

The first phase, expected to last six weeks, will see a pause to the fighting in Gaza and the release of 33 Israeli hostages and nearly 2,000 Palestinian prisoners.

Humanitarian aid into the Gaza Strip will also be ramped up; 600 trucks will now be sent into the enclave per day, a significant increase from the 614 truckloads of aid that entered Gaza in the first two weeks of January, according to data from the United Nations Office for the Coordination of Humanitarian Affairs (OCHA).

A joint operations room will be established in Cairo to monitor the implementation of the deal and will include representatives from Egypt, Qatar, the United States, Israel, and Palestinian officials, according to Egypt’s state-affiliated Al Qahera News, citing a senior Egyptian official.

Trump’s second term marks new cryptocurrency era

Advocates and holders of crypto will soon influence U.S. policy on the emerging technology after a slew of nominations and advisory appointments by President-elect Donald Trump, who takes office on Monday. The crypto industry has spent years fighting lawsuits and enforcement actions by the U.S. government. It hopes the incoming Trump administration will mark a shift in policy.

Political appointees will be vetted for potential conflicts. Some have committed to selling their interests. The industry is hosting a sold-out black tie ball in Washington on Friday, with tickets ranging from $2,500 to $10,000. David Sacks, Trump's artificial intelligence and crypto czar, is scheduled to attend. Below are some facts on the crypto positions of key members of the incoming administration and Trump's inner circle.

Supreme Court upholds TikTok ban, but Trump might offer lifeline

The Supreme Court on Friday upheld the law requiring China-based ByteDance to divest its ownership of TikTok by Sunday or face an effective ban of the popular social video app in the U.S.

ByteDance has so far refused to sell TikTok, meaning many U.S. users could lose access to the app this weekend. The app may still work for those who already have TikTok on their phones, although ByteDance has also threatened to shut the app down.

In a unanimous decision, the Supreme Court sided with the Biden administration, upholding the Protecting Americans from Foreign Adversary Controlled Applications Act, which President Joe Biden signed in April.

TikTok’s fate in the U.S. now lies in the hands of President-elect Donald Trump, who originally favored a TikTok ban during his first administration, but has since flip-flopped on the matter. In December, Trump asked the Supreme Court to pause the law’s implementation and allow his administration “the opportunity to pursue a political resolution of the questions at issue in the case.”

Canada preparing retaliatory tariffs to unveil as soon as Trump's inauguration day

The Trudeau government is planning a first round of counter-tariffs that could be unveiled as soon as incoming U.S. president Donald Trump is sworn in on Monday, Radio-Canada has confirmed. The counter-tariffs would apply to $37 billion in goods that would be less harmful to the Canadian economy.

Trump has threatened to levy a 25 per cent across-the-board tariff on Canadian goods. Experts and lawmakers have warned such a move would be devastating for the Canadian economy. The Canadian government is also preparing additional retaliatory tariffs that would cover up to $110 billion, depending on the Trump administration's actions. Those could potentially be more damaging to the Canadian economy.

The initial retaliation could come as soon as Monday if Trump enacts them after he's sworn in. A period of consultation between 15 and 30 days would be required before the tariffs take effect.

Biden signs order allowing federal land leases for AI data centers

President Joe Biden signed an executive order on Tuesday to provide federal support to address massive energy needs for fast-growing advanced artificial intelligence data centers, the White House said.

The order calls for leasing federal sites owned by Defense and Energy departments to host gigawatt-scale AI data centers and new clean power facilities - to address enormous power needs on a short time frame.

Biden said the order will "accelerate the speed at which we build the next generation of AI infrastructure here in America, in a way that enhances economic competitiveness, national security, AI safety, and clean energy."

The order also requires companies tapping federal land for AI data centers to purchase an "appropriate share" of American-made semiconductors. The number of purchases required would be worked out on a case-by-case basis for each project and comes as the Biden administration is spending more than $30 billion to subsidize U.S. chip production.

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman & Katherine MacLellan

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. Currently working as a proud General Partner at Moonwalker Capital.

(More about me 👉 here).

About the Author: Katherine MacLellan

Katherine holds an MA (Hons) in Economics and International Relations from the University of St. Andrews, and a JD from Osgoode Hall. She has been thinking and writing about Bitcoin and blockchain technology since 2012.