Trump Pledges Allegiance to Bitcoin'ers

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X (formerly Twitter) below.

On Saturday, former President Donald Trump delivered a keynote address at the Bitcoin Conference held at the Music City Center in Nashville. Following his speech, Trump attended a campaign fundraiser with ticket prices reaching up to $844,600 per person.

Being in the audience felt like a moment in history, with many of us feeling chills, thinking “our industry has finally arrived.”

Trump's speech marked a significant shift in his stance on cryptocurrency. While he previously expressed concerns about Bitcoin and other digital currencies during his presidency, Trump has now positioned himself as a pro-crypto candidate for the 2024 presidential election.

Key Highlights from Trump's Speech

During his speech, Trump outlined several promises and positions that signal strong support for the crypto community:

Favorable Regulation for Bitcoin: Trump promised to introduce regulations that would be beneficial for Bitcoin and other cryptocurrencies.

No Central Bank Digital Currency (CBDC): He vowed to oppose the implementation of a CBDC.

Support for Self-Custody: Emphasizing the importance of individuals holding their own crypto assets.

Firing SEC Chair Gary Gensler: A commitment to removing the current SEC chair, who has been criticized for his stance on crypto regulations.

Safe and Responsible Expansion of Stablecoins: Advocating for the growth of stablecoins in a secure manner.

Ending the Inflation Nightmare: Trump linked inflation to government policies, describing it as a stealth tax on the middle class, referencing post-war Germany and how inflation can destroy a country.

Energy Independence: Promising to harness American energy resources, including becoming the top country in Bitcoin mining.

National Bitcoin Reserve: Committing to maintain a strategic national reserve of Bitcoin and never sell seized Bitcoin.

Shutting Down Operation Choke Point 2.0: Vowing to end what the crypto industry perceives as anti-crypto regulatory policies.

Trump has successfully raised over $4 million in cryptocurrencies, with contributions coming in the form of Bitcoin, Ether, Ripple’s XRP, and the USDC stablecoin. Notable supporters include the Winklevoss twins, Tyler and Cameron, who each donated over $1 million in Bitcoin. Other significant contributors include Mike Belshe, CEO of BitGo, who donated $50,000 in Bitcoin.

This strong financial backing from the crypto sector reflects the growing support for Trump's candidacy among influential tech and crypto investors. Prominent figures like venture capitalists Marc Andreessen and Ben Horowitz have also thrown their support behind Trump.

Trump's current pro-crypto stance is a dramatic reversal from his earlier views. In 2019, Trump openly criticized Bitcoin, expressing concerns about its valuation and potential for enabling illegal activities. His administration even implemented stricter regulations on cryptocurrencies. However, by actively seeking and receiving support from the crypto sector, Trump has demonstrated a significant shift in his perspective as he campaigns for the 2024 election.

As Trump continues to build his campaign, his pro-crypto promises and strong support from the cryptocurrency community position him as a unique candidate in the upcoming election. If elected, Trump has pledged to end what he calls the "war on crypto" and make the U.S. the "crypto capital of the world."

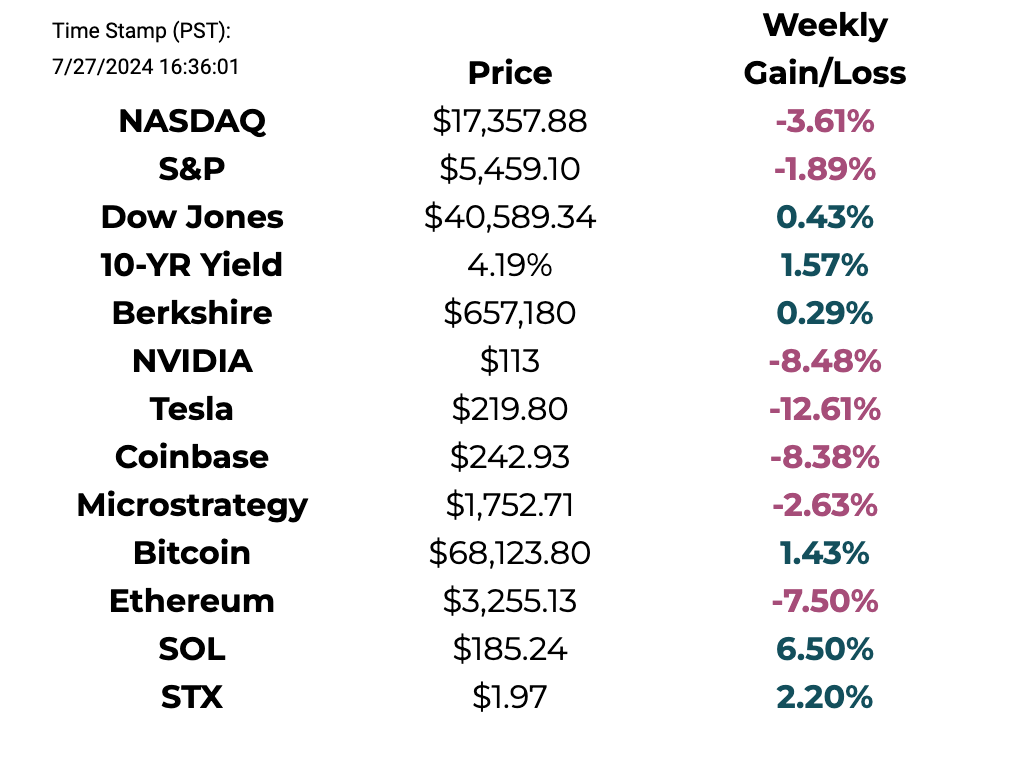

This Week By the Numbers 📈

Bank of Canada cuts interest rate by 25 basis points for the second time in a row to 4.5%, and signals more to come

Early Thursday, the People's Bank of China (PBoC) announced a surprise, off-schedule cut in its one-year medium-term lending facility rate to 2.3% from 2.5%, injecting 200 billion yuan ($27.5 billion) of liquidity into the market, the biggest reduction since 2020

On Wednesday, the Big Tech sector slammed the Nasdaq with worst day since 2022, losing the most market value in a single day on record

Bitcoin experienced a sharp decline of over 3% at the start of Asian trading hours amid a broader stock market downturn, as U.S. technology stocks took a hit on Wednesday causing the tech-heavy Nasdaq 100 index to lose 660 points

BlackRock Leads Bitcoin ETF Inflows As BTC Price Rebounds

Ethereum ETFs inflows at $107 million on day 1 on Tuesday, with trading volume hitting $1 billion

Stablecoin market cap has reached ~$265 billion, the highest since May 2022

Mt. Gox, the defunct exchange which holds $6.08B in BTC, transferred over $2.85 billion in Bitcoin from its cold wallets as part of a $9B repayment plan to compensate creditors

Crowdstrike, the cybersecurity firm that crashed millions of computers offered its partners a $10 apology gift card

Tesla’s 2Q profit falls 45% to $1.48 billion as sales drop despite price cuts and low-interest loans

Meta unveils Llama 3.1, a powerful new AI that can instantly synthesize an entire book and use photos of people to create images from prompts

Top Stories 🗞️

U.S. Dollar ‘Destruction’—Tesla Billionaire Elon Musk Issues $35 Trillion ‘Bankrupt’ Warning

Now, after Treasury secretary Janet Yellen admitted her fears over the future of the U.S. dollar, Tesla billionaire Elon Musk has warned the U.S. dollar is heading for "destruction" and the spiraling $35 trillion debt pile could "bankrupt" the U.S.—something some analysts think could push the bitcoin price higher. U.S. debt interest payments are forecast to hit $870 billion this year, according to a recent analysis by the Congressional Budget Office, after soaring inflation pushed the Federal Reserve to hike interest rates at a never-before-seen clip in the aftermath of huge Covid-era spending and money-printing. Earlier this year, Bank of America analysts warned the U.S. debt load is about to ramp up to add $1 trillion every 100 days—fueling a bitcoin price surge.

Coinbase Asset Management Plans Tokenized Money-Market Fund, a Hot Area After BlackRock's BUIDL Success

The asset management arm of U.S.-listed cryptocurrency exchange Coinbase (COIN) is creating a tokenized money-market fund, jumping into one of the hottest crypto-powered corners of finance, according to four people familiar with the plan. Tokenization, or representing ownership of real-world assets (RWAs) through blockchain-based products, has become one of the big trends in crypto of late. BlackRock, the world's biggest asset manager, introduced a fund called BUIDL that holds U.S. Treasuries. That fund quickly hit $500 million of assets following its introduction in March. For Coinbase Asset Management specifically, this would represent an expansion of the company's already publicly known attempt to break into the tokenization space. In December, the company received in-principle approval from an Abu Dhabi regulator to start tokenizing traditional assets on Base, the exchange's Ethereum scaling network.

OpenAI announces a search engine called SearchGPT; Alphabet shares dip

OpenAI on Thursday announced a prototype of its search engine, called SearchGPT, which aims to give users “fast and timely answers with clear and relevant sources.” The company said it eventually plans to integrate the tool, which is currently being tested with a small group of users, into its ChatGPT chatbot. The rollout could have implications for Google and its dominant search engine. Since the launch of ChatGPT in November 2022, Alphabet investors have been concerned that OpenAI could take market share from Google in search by giving consumers new ways to seek information online. The Federal Trade Commission issued subpoenas to eight companies in financial services and consulting including Mastercard, JPMorgan, and McKinsey that advertise targeted pricing products to clients like Starbucks and McDonalds, investigating how companies use AI to target consumers with individualized pricing based on their personal data, a tactic known as surveillance pricing. FTC Chair Lina Khan said, “the FTC’s inquiry will shed light on this shadowy ecosystem of pricing middlemen.”

HUR Hackers Shut Down Russian Banks and Internet Providers

Cyber specialists from Ukraine’s Main Intelligence Directorate (HUR) have successfully hacked into Russia's banking and other payment systems, sources from the agency told Kyiv Post on Wednesday, July 24. As a result of the cyberattack, which began on the morning of July 23, payment systems, mobile applications of banks, personal accounts, public transport payment systems, etc. have ceased working or been significantly impeded. The hack has also caused interruptions to Russian major mobile operators and Internet providers across the country. Users are reporting that they are unable to access digital services from several major banking institutions in the country. Online services are either not functioning or have been significantly degraded at Alfa-Bank, Sberbank, Raiffeisen Bank, VTB Bank, RSHB Bank, Gazprombank, Tinkoff Bank, and the online banking service iBank. In addition to banks and other payment systems, residents have been unable to use mobile communication or mobile internet services providers Beeline, MegaFon, Tele2, and Rostelecom.

Who Holds Bitcoin? New Report Unmasks US Owners

A new study conducted by the Nakamoto Institute has unveiled surprising insights into the demographics of Bitcoin ownership in the United States, challenging several popular assumptions about the typical cryptocurrency investor. The research, spearheaded by Troy Cross and Andrew Perkins, analyzed responses from a survey of 3,538 American adults, aiming to penetrate deeper into the socio-political and moral fabric underlying financial decisions related to BTC. Contrary to the common stereotype that BTC enthusiasts predominantly align with libertarian or right-leaning political views, the findings from this study reveal a much broader spectrum of political identities among owners. “We found no strong correlations across many dimensions—race, ethnicity, religion, relationship status, income, education, or financial literacy—with owning Bitcoin. Age and gender were the exception,” Cross noted on X. In terms of moral foundations, the study sought to determine whether certain ethical values correlated with BTC ownership. Both liberal and conservative moral values are represented among owners, showing no significant skew towards one or the other.

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).