Unpacking MicroStrategy's Audacious $42B Bitcoin Plan

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X below.

As the week draws to a close and election noise reaches a fever pitch, a strategic transformation is unfolding in corporate finance and cryptocurrency. MicroStrategy, once known primarily as a business intelligence firm, has emerged as a leader in corporate Bitcoin investment, with its Q3 earnings call sending ripples through the investment world.

Under Michael Saylor's leadership, MicroStrategy has taken a decisive lead in the crypto space, capturing attention from Wall Street to Silicon Valley. As of October 31, 2024, the company holds 252,220 bitcoins—valued around $15 billion based on recent prices, equivalent to approximately 1.2% of all Bitcoin in circulation—and it plans to buy a lot more. This scale reflects a deep commitment to digital assets and a bold departure from typical corporate treasury strategies.

Despite the company's innovative approach, MicroStrategy's stock experienced a 10% dip last week, likely due to short-term market reactions and profit-taking following the earnings announcement. This volatility is not uncommon for companies with significant cryptocurrency exposure. However, many analysts remain bullish on MicroStrategy's long-term prospects, citing the company's unique position as a Bitcoin proxy and its potential to benefit from future cryptocurrency adoption.

Saylor’s ambitions could redefine corporate engagement with digital assets. For seasoned crypto investors and those intrigued by evolving financial strategies, MicroStrategy’s latest move provides a compelling glimpse into a corporate strategy with the potential to reshape finance.

The 21/21 Plan: A Groundbreaking Strategy

Central to MicroStrategy’s new strategy is the “21/21 plan,” an audacious initiative to raise $42 billion over three years for additional Bitcoin acquisitions. This effort will split evenly between $21 billion in equity issuance and $21 billion in fixed income securities, making it one of the largest capital raises of its kind in U.S. history. The company plans to raise $10 billion in 2025, $14 billion in 2026, and $18 billion in 2027—significantly surpassing its previous Bitcoin acquisition efforts. Since August 2020, MicroStrategy has invested $9.9 billion in Bitcoin, making this new endeavor over four times as substantial.

Bitcoin Holdings and Performance

As of Q3 2024, MicroStrategy holds 252,220 Bitcoins, valued at approximately $18 billion. This aggressive acquisition strategy has driven impressive returns, with MicroStrategy’s stock consistently outperforming Bitcoin itself:

Year-to-Date Return: MSTR 206.23% vs. BTC-USD 59.47%

1-Year Return: MSTR 487.65% vs. BTC-USD 137.92%

3-Year Annualized Return: MSTR 37.89% vs. BTC-USD 2.81%

These figures highlight the leverage effect MicroStrategy offers to investors seeking Bitcoin exposure through traditional equity markets.

Is MicroStrategy Just a Leveraged Bitcoin Play?

Despite its close association with Bitcoin, viewing MicroStrategy purely as a leveraged Bitcoin ETF may be an oversimplification. Unlike ETFs, which track asset prices and rebalance daily (often resulting in value decay during downturns), MicroStrategy operates as a technology company that leverages its balance sheet to hold Bitcoin strategically rather than mirror price movements.

MicroStrategy’s long-term approach includes exploring potential revenue sources through innovative financial products, such as Bitcoin yield generation, which goes beyond the ETF model. By leveraging its position, MicroStrategy has capitalized on market sentiment, often outperforming Bitcoin itself. Some analysts argue that this dual structure as a tech company with substantial Bitcoin holdings offers investors a diversified exposure to Bitcoin, with more stability than leveraged ETFs in bearish markets due to its financing options and ability to generate revenue outside of mere asset appreciation.

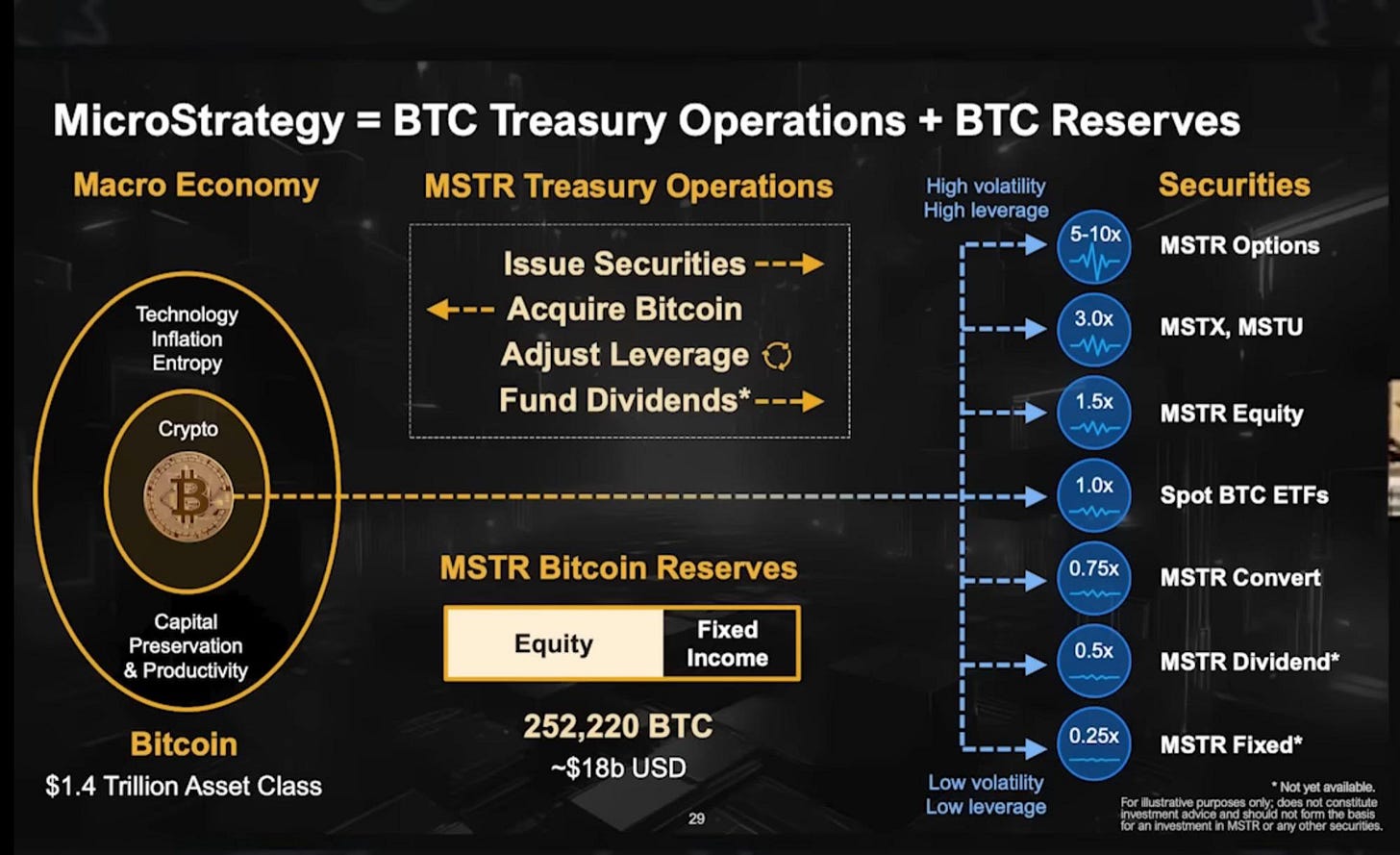

Source: MSRT Q3 2024 Earnings Call

As highlighted in a slide from the earnings call, various strategies are in place to enhance liquidity, including plans to issue dividend and fixed income instruments. These initiatives not only create additional liquidity but also pave the way for further bond and at-the-market convertible offerings under the ambitious 21/21 plan.

Notably, many financial entities and hedge funds are restricted to purchasing dividend-paying stocks listed in indices like the S&P 500 or QQQ, which positions MSTR to attract a broader investor base. Ultimately, all forms of liquidity—long, short, leveraged, and fixed income—contribute positively to MicroStrategy’s financial ecosystem.

The Dilution Paradox

A fascinating aspect of MicroStrategy’s approach is its handling of dilution. Typically, issuing $21 billion in new equity for a company with a $50 billion market cap would be expected to depress the share price. However, MicroStrategy’s stock has defied expectations, rising about 1% post-announcement.

This seemingly paradoxical outcome stems from what some analysts call “accretive dilution.” By issuing shares at a premium to its net asset value (NAV)—primarily Bitcoin holdings—MicroStrategy can purchase more Bitcoin per share than the dilution would normally imply, effectively increasing Bitcoin ownership per share for current shareholders.

One analyst summed it up: “MicroStrategy isn’t just stacking more Bitcoin; it’s increasing Bitcoin per share of diluted stock by selling shares at a premium, which funds additional Bitcoin acquisitions.”

Shifts in the Software Business

While Bitcoin headlines dominate, MicroStrategy is also transitioning its software business from on-premise to cloud-based solutions. This shift has introduced short-term revenue challenges but positions the company for future growth.

Key takeaways from the earnings call include:

A 10% year-over-year decline in total software revenues, driven by the cloud transition.

A 93% year-over-year growth in non-GAAP subscription billings, reaching $32.4 million.

Subscription services revenue now surpasses product license revenue.

Introduction of AI-powered functionality using Azure OpenAI LLM.

Risks and Considerations

Despite MicroStrategy’s performance, investors should be mindful of several risks:

Bitcoin Dependency: MSTR’s performance is closely tied to Bitcoin’s price, amplifying both potential gains and losses.

Debt and Leverage: The company’s debt-funded Bitcoin purchases could create issues in a prolonged bear market.

Regulatory Risks: As a public company heavily invested in cryptocurrency, MicroStrategy may face increasing regulatory scrutiny.

Execution Risk: Success depends on long-term Bitcoin appreciation and effective management of debt and operational costs.

Market Implications

MicroStrategy’s aggressive acquisition plan could significantly impact the broader crypto market. The company intends to purchase an average of $38 million in Bitcoin daily for three years, which slightly exceeds the current daily Bitcoin mining output. This ongoing buying pressure could influence Bitcoin’s price dynamics and market structure.

In Short

MicroStrategy’s strategy is a bold experiment at the intersection of corporate finance and cryptocurrency. By leveraging its NAV premium and anticipated future Bitcoin value, the company has created a unique mechanism for Bitcoin accumulation, which has rewarded shareholders so far.

For investors, MicroStrategy offers a leveraged approach to Bitcoin, combined with the intricacies of corporate strategy and financial engineering. While the returns have been compelling, the risks are equally notable. As the cryptocurrency market evolves, MicroStrategy’s journey will undoubtedly be closely monitored by investors, regulators, and corporate treasurers.

As with any investment in the volatile crypto sector, thorough research and a clear understanding of financial goals and risk tolerance are essential. MicroStrategy’s story is far from over, and the coming years will determine if this bold strategy will establish the company as a financial pioneer or serve as a cautionary tale.

This Week By the Numbers 📈

🔥 Market Movers & Big Tech

📈 Economic Indicators & Inflation

⚖️ Regulatory Updates & Corporate Finance

🏛️ Legal Developments & Crypto Policy

🌎 Global Impact & Events

Russia fines Google $2.5D, more than the world’s GDP

Top Stories 🗞️

U.S. Job Growth Stalls in Days Before Vote

Job creation stalled in October, with employers adding only 12,000 positions in a month that included a major strike and two destructive hurricanes. Unemployment remained steady at 4.1 percent.

The number was significantly lower than economists had expected, suggesting either that disruptions took a larger toll than they had forecast, or that the underlying pace of job growth might be slowing.

The report is the last before a contentious election in which the economy has consistently polled as a top issue for voters, as well as a Federal Reserve meeting at which officials will decide whether to drop interest rates further.

Election Results Will Take Time. How Markets Will Respond if It Takes Days to Declare Trump or Harris the Winner.

The end of the 2024 election is near, but perhaps not as near as many would hope.

A winner is unlikely to be declared after the polls close on Tuesday, Nov. 5. That has happened before, and if it happens again, stock and bond investors both might not be happy.

Here are three ways things might play out in 2024. A winner could be called relatively early on election night. Or, we could learn the winner a few days later, after vote counting has taken place in several swing states. Under a third scenario, a winner might be called but the loser might contest the result, launching a process that could play out for several weeks.

History is our best guide to each of these scenarios, and to the markets’ response.

US crypto industry expects friendlier Washington, whoever wins White House

The cryptocurrency industry has spent years clashing with Democratic President Joe Biden's administration over regulatory issues, but executives expect an easier ride from Washington, regardless of who wins the White House next week.

Crypto asset managers including Bitwise and Canary Capital are planning new products ahead of what many executives expect to be a more crypto-friendly administration, while others including Ripple are planning a fresh push for crypto legislation in the new Congress, said executives and lawyers.

Republican candidate Donald Trump has pledged to be a "crypto president," and executives also expect Vice President Kamala Harris, the Democratic candidate, to take a softer stance than Biden.

Harris surrogate and billionaire entrepreneur Mark Cuban, a crypto enthusiast, has also criticized a crypto crackdown under Securities and Exchange Commission Chair Gary Gensler, a Biden appointee.

"Absolutely it will be friendlier under a Harris admin," Cuban wrote in an email to Reuters, adding her promise to protect crypto users was "important."

OpenAI launches ChatGPT search, competing with Google and Microsoft

OpenAI on Thursday launched a search feature within ChatGPT, its viral chatbot, that positions the high-powered artificial intelligence startup to better compete with search engines like Google, Microsoft's Bing and Perplexity.

ChatGPT search offers up-to-the-minute sports scores, stock quotes, news, weather and more, powered by real-time web search and partnerships with news and data providers, according to the company. It began beta-testing the search engine, called SearchGPT, in July.

The release could have implications for Google as the dominant search engine. Since the launch of ChatGPT in November 2022, Alphabet investors have been concerned that OpenAI could take market share from Google in search by giving consumers new ways to seek information online.

Shares of Alphabet were down about 1% following the news.

China is tightening its grip on the world’s minerals

To decarbonise the global economy and build the data centres needed for ever smarter artificial-intelligence models, the world will need lots of minerals. China wants first dibs. Last year its companies ploughed roughly $16bn into mines overseas, not including minority investments.

That is the highest figure in a decade, up from less than $5bn the year before (see top chart). On October 8th a Chinese state-owned enterprise disclosed plans to invest more than $5bn in a copper mine in Afghanistan. The next day Zijin Mining, China’s most valuable listed miner, said it would spend $1bn on a gold mine in Ghana. On October 14th a group of Chinese firms committed $5bn to Zambian mining over the next five years. Chinalco, another Chinese state-owned company, reportedly wants a stake in the Philippines’ biggest copper mine.

A stockpile will not do much to relieve America’s reliance on Chinese minerals. Somewhat more usefully, America and a group of its allies, through the Mineral Security Partnership, are trying to co-ordinate their support for critical-minerals projects around the world. Speeding up the construction of new mines at home would be even better. On October 24th America’s federal government approved a big lithium mine in Nevada—only the fourth new site for critical minerals in America since 2002. That same day it approved tax credits for some mining firms to encourage them to boost the production of critical minerals.

That is a start, but more will be needed if America wants to shake its reliance on Chinese minerals.

“Myth Of Money” Book - Shipping this week! 🤓

As many of you know, making financial education accessible has always been a passion of mine. After a year of hard work, I'm excited to announce that my new book, published by Wiley Publishing, is finally out!

This book is a thrilling blend of personal stories from the financial world, coupled with clear explanations of how things really work—from investment banking and stocks to venture capital, macroeconomics, and cryptocurrencies.

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. Currently working as a proud General Partner at Moonwalker Capital.

(More about me 👉 here).

About the Author: Katherine MacLellan

Katherine holds an MA (Hons) in Economics and International Relations from the University of St. Andrews, and a JD from Osgoode Hall. She has been thinking and writing about Bitcoin and blockchain technology since 2012.

Amazing synopsis, shared and thank you!!! ♥️☀️☮️🌈🏁