Wall Street Leads Crypto: Solana and Ethereum ETFs

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X (formerly Twitter) below.

The next stage of the bull market appears to be spearheaded by Wall Street, with significant developments in the realm of cryptocurrency ETFs. The journey toward making Ethereum ETFs a reality has encountered another twist. The U.S. Securities and Exchange Commission (SEC) recently returned the S-1 forms to prospective Ethereum ETF issuers with light comments. These issuers have been instructed to address the comments and refile by July 8, marking another step in the intricate process of launching these ETFs.

The Path to Approval

Initially, there were reports suggesting that the ETFs could go live as early as July 4, but this is no longer feasible. Issuers are awaiting a clearer timeline from the SEC, which will be provided once a deadline for the final filings is set. SEC Chair Gary Gensler has hinted that Ethereum ETF approvals could happen "sometime over the course of this summer," but a specific date remains elusive.

The S-1 forms are part of a two-step process for the ETFs to go live. The first step saw the approval of the issuers' 19b-4 forms in May. Unlike the 19b-4 forms, S-1 filings do not adhere to a specific deadline, adding to the uncertainty of the Ethereum ETFs' launch timeline.

Several major financial institutions have filed updated versions of their S-1 spot Ethereum ETF applications, including:

- Bitwise

- Fidelity

- VanEck

- Franklin

- 21Shares

- Grayscale

- BlackRock

These issuers are now waiting for the SEC's feedback to move forward with the next stage of filings.

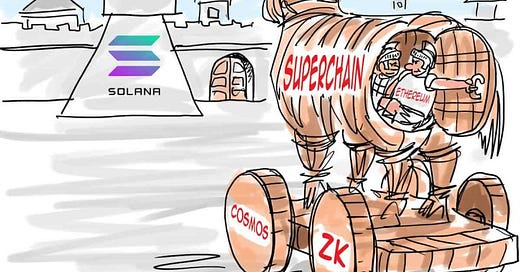

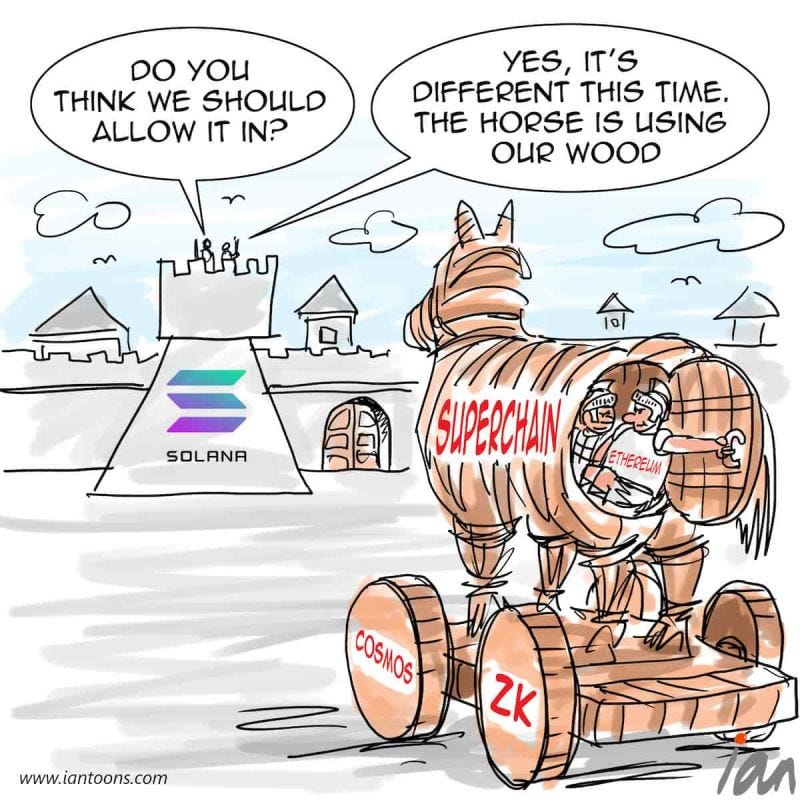

Solana ETF on the Horizon

Investment manager VanEck recently filed to list the first U.S. exchange-traded fund (ETF) tied to the spot price of Solana, following regulatory approval for a similar Bitcoin product. Meanwhile, on June 28, 21Shares submitted an S-1 application for a spot Solana ETF. The proposed 21Shares Core Solana ETF will trade on the Cboe BZX Exchange, with Coinbase serving as the custodian for the fund's Solana holdings. These holdings will be insured privately and kept in segregated wallets on the Solana blockchain.

21Shares, headquartered in Zurich, Switzerland, is a trailblazer in the crypto ETF arena. The company already offers futures Ether and both spot and futures Bitcoin ETFs in the United States in partnership with ARK Invest. Recently, 21Shares applied for a spot Ethereum ETF after ARK Invest ended its partnership for that application. The SEC approved the ARK 21Shares spot ETH ETF 19b-4 filing on May 23, with separate approval required for the S-1 filings.

ETFs allow investors to gain exposure to cryptocurrencies without directly holding them. This market has garnered significant interest from major financial institutions, including BlackRock, which operates the largest spot Bitcoin ETF. The increasing focus on Ethereum and Solana ETFs suggests that the next leg of the bull run could be more concentrated, led by large-cap coins set to be included in financial products.

Market Reactions and Future Outlook

Despite recent selling pressure, Ethereum has fared relatively well compared to Bitcoin, with ETH falling below $3,400—a 3.5% weekly drop versus Bitcoin’s 5.8% decline. Technical charts indicate that the ETH/BTC pair is on the verge of a significant breakout, aligning with the anticipated launch of the spot Ethereum ETF.

As the process unfolds, investors and market watchers alike are keen to see how these developments will shape the future of cryptocurrency investments. The approval and launch of these ETFs could signal a new era of institutional involvement and broader adoption of digital assets. It also means the next leg of the bull run will potentially be much more concentrated, led by the large-cap coins poised to be packaged into financial products.

This Week By the Numbers 📈

Quick Facts:

US 1Q GDP slowed faster than expected

PCE inflation in line with expectations

JP Morgan still predict 23% fall in S&P

Buffet to donate fortune to charity

SpaceX set to be valued at $210bn

BTC activity drops to lowest level in 10 years

BlackRock says Bitcoin is a hedge against geopolitical uncertainty and monetary risk

Someone buys $450m BTC in one transaction

ETH gas hits lowest level since 2016

$820 billion Standard Chartered Bank to establish a spot trading desk for buying and selling Bitcoin and Ethereum

SOL flips ETH again for 24hr DEX volume

Steve Cohen shuts down crypto arm of hedge fund

Coinbase files with CFTC for coin futures

UAE regulations may lead to crypto payment ban

Crypto unmentioned in Presidential debate

Kraken co-founder donates $1m to Trump

NYT calls on Biden to leave race

Odds of Biden dropping out rise to 41%

Top Stories 🗞️

The US housing market has entered bizarro world

The law of supply and demand is a basic principle of any free market, and right now, it's being subverted by strange happenings in the real estate market. The supply of homes for sale is rising while demand for homes is falling. And yet housing prices continue to hit record highs. "When it comes to the housing market, the laws of supply and demand don't seem to apply any longer," economist David Rosenberg said in a note this week. Existing home sales dropped to a four-month low in May to 4.11 million units, representing a year-over-year decline of 2.8%, while existing homes available for sale soared 18.5% year-over-year in May. Yet, despite falling demand as measured by the drop in existing home sales and rising supply, the median home price jumped 5.8% year-over-year to a record $419,300 in May.

Julian Assange returns home as free man to Australia, after plea deal with US

WikiLeaks founder Julian Assange has landed back home in Australia, a free man for the first time in 12 years, after a US judge signed off on his unexpected plea deal on Wednesday morning. Cheers erupted from supporters gathered at Canberra Airport in the Australian capital as Assange disembarked the aircraft. He waved to the crowds as he walked across the tarmac. Speaking outside the court, Assange’s US lawyer Barry Pollack said he had “suffered tremendously in his fight for free speech and freedom of the press.” “The prosecution of Julian Assange is unprecedented in the 100 years of the Espionage Act,” Pollack told reporters. “Mr. Assange revealed truthful, newsworthy information … We firmly believe that Mr. Assange never should have been charged under the Espionage Act and engaged in (an) exercise that journalists engage in every day.” In a stunning turn of events, the 52-year-old Australian was released from a high-security prison in London on Monday afternoon and had already boarded a private jet to leave the United Kingdom before the world even knew of his agreement with the US government.

SEC sues Consensys over its staking service

The U.S. Securities and Exchange Commission on Friday sued Ethereum software provider Consensys, alleging that the company operated as an unregistered broker through its MetaMask Staking service and MetaMask Swaps. The SEC alleged, among other things, that Consensys has offered and sold unregistered securities on behalf of liquid staking program providers Lido and Rocket Pool, which create and issue liquid staking tokens in exchange for staked assets. Staking refers to a process where investors lock up their crypto holdings to secure a blockchain to gain rewards. While staked tokens are typically locked up, liquid staking tokens can be bought and sold freely.

Winklevoss twins donate $2 million in bitcoin to support Trump

The billionaire Winklevoss twins, founders of cryptocurrency company Gemini, said on Thursday they had each donated $1 million in bitcoin to support Donald Trump, the latest crypto executives to get behind the Republican presidential candidate. Tyler and Cameron Winklevoss, whose crypto firm in February entered settlement agreements with U.S. and New York state financial regulators after accusations of wrongdoing, announced the donations in posts on social media site X. Tyler Winklevoss posted that President Joe Biden's Democratic administration had "openly declared war on crypto" and that Trump was "pro-Bitcoin, pro-crypto, and pro-business." Trump has presented himself as a champion for crypto, including at a San Francisco fundraiser this month with tech executives during which he slammed Democrats' attempts to regulate the crypto sector.

$9 Billion in Bitcoin: Mt. Gox to Start Repayments in July

Defunct Bitcoin exchange Mt. Gox said it would begin distributing assets stolen from clients in a 2014 hack starting in July, after years of postponed deadlines. Mt. Gox was once the world's largest Bitcoin exchange, handling over 70% of all Bitcoin transactions in its early years. In 2014, hackers stole around 740,000 bitcoin, worth $15 billion today, in one of many attacks on the exchange from 2010-2013. After declaring bankruptcy in 2014, Mt. Gox has faced numerous delays in repaying victims. Last year, the Tokyo court set an October 2024 deadline for the exchange's civil rehabilitation plan. In May, Mt. Gox moved over 140,000 BTC, worth around $9 billion, from cold wallets for the first time in five years. The transactions were likely preparations for repayments.

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).