Weekly Rundown: A Crash is Coming

“Markets can stay irrational longer than you can stay solvent.”

Welcome to this week’s edition of the Weekly Rundown.

Former Presidential Candidate Andrew Yang recently tweeted, we have “a crisis on top of a crisis on top of a crisis.”

Let’s break this down. America is facing 3 major issues today:

The U.S. is by far the worst performing country in the COVID-19 pandemic. The U.S. currently has 2.4M reported cases and 121,000 deaths. Most countries simply assume the U.S. has given up. It is unclear why hot-zones are continuing to re-open, but here we are.

The U.S. unemployment numbers are around 40M, affecting those in lower income brackets the most.

America is facing a racial divide with an entire 4 weeks of protests. This is not going away.

And yet, our stock market, the ultimate measure of our economy and our collective optimism, remains unshaken. As of today, the total market cap of the American stock market is 146% of GDP. 🤯 🤯 🤯

The Federal Reserve has continued its mandate of ‘unlimited stimulus’ utilizing every trick in the book - from a $2.9 trillion monetary stimulus, to 0% interest rates, to 0% overnight reserve rates, to multiple repo and treasury buying operations, and now the expansion of its corporate buying program.

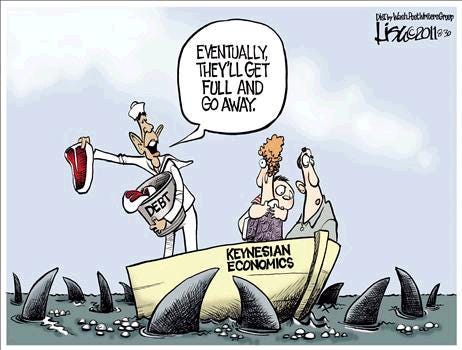

The Fed has manufactured an asset bubble in a recession.

Economic Bubble

Noun.

A bubble is an economic cycle characterized by the rapid escalation of asset prices followed by a contraction. It is created by a surge in asset prices unwarranted by the fundamentals of the asset and driven by exuberant market behavior.

The Fed is masking the economic crisis on the ground by flooding the market with liquidity. Those who blindly invested in the stock market at the bottom will be the beneficiaries, while those 45% of Americans living paycheck to paycheck will continue to struggle. In other words, the Fed’s artificial maneuvers are making the wealth gap even wider.

Is this sustainable? Probably not. Some experts argue that eventually we will face a market crash of epic proportions. But before you run to buy those 3x leveraged short ETFs, consider this classic Keynesian quote:

“Markets can stay irrational longer than you can stay solvent.”

I can say with absolute certainty that the market will experience another crash. But like so many, I am unclear as to how far the Fed is willing to go to delay that crash from happening.

This Week By The Numbers

Top Stories of the Week

Why the Fed’s new index approach to buying U.S. corporate debt ‘changes everything’

The pace of borrowing sped up again this week after the Federal Reserve unveiled changes to its $750 billion emergency corporate lending facility. Specifically, the Fed said that it would start buying eligible corporate bonds included in standard indexes used in the secondary market. Those purchases, importantly, will no longer require certification, a formal process where a company shows it is not insolvent, but also that it would otherwise lack adequate access to funding at reasonable rates. Read Full Story.

JPMorgan Says Bitcoin Crash Survival Shows It Has Staying Power

In March, Bitcoin -- like many other areas of the market -- underwent a stretch of severe disruption as world economies started to shut down and investors fled riskier assets due to the coronavirus outbreak. But Bitcoin emerged relatively unscathed, according to a report from the bank titled “Cryptocurrency takes its first stress test: Digital gold, pyrite, or something in between?” That cryptocurrencies largely survived the madness of March suggests “longevity as an asset class,” wrote strategists at the bank. Read Full Story.

Trump ‘Allegedly’ Told Treasury Secretary to ‘Go After’ Bitcoin

President Donald Trump ordered Treasury Secretary Steve Mnuchin to focus on a clampdown on bitcoin over negotiating a trade with China, former national security adviser John Bolton reportedly claims. The conversation is said to have happened in May 2018, around the time investors were cheering bitcoin on after it rose 33% against the dollar. It’s unclear from the excerpt what specifically led Trump to order Mnuchin to crack down on bitcoin and whether the two men had been talking about cryptocurrencies beforehand. Read Full Story.

Judge Rejects Trump Request for Order Blocking Bolton’s Memoir

President Trump’s former national security adviser John R. Bolton can go forward with the publication of his memoir, a federal judge ruled on Saturday, rejecting the administration’s request for an order that he try to pull the book back and saying it was too late for such an order to succeed. The judge also sharply criticized the former national security adviser, suggesting his $2 million book advance may be in jeopardy. Judge Lamberth also suggested that Mr. Bolton may be in jeopardy of forfeiting his $2 million advance. Read Full Story.

US attorney who investigated Trump associates refuses to step down after Barr tries to push him out

Attorney General William Barr tried to oust Geoffrey Berman, the powerful US attorney for the Southern District of New York who has investigated a number of associates of President Donald Trump, but Berman defied him by refusing to step down. The standoff opens up a fresh crisis at the Justice Department, places the leadership of the most prominent federal prosecutors office outside Washington in a precarious position and again raises questions about Barr's willingness to steer the department to suit Trump's political agenda. Read Full Story.

The whole world is watching America’s failure

As coronavirus cases surge in the U.S. South and West, health experts in countries with falling case numbers are watching with a growing sense of alarm and disbelief, with many wondering why virus-stricken U.S. states continue to reopen and why the advice of scientists is often ignored. “It really does feel like the U.S. has given up.” Read Full Story.

---

Thank you for reading the latest edition of the Weekly Rundown. As always, reach out with feedback or ideas for the next edition.

Best,

If you enjoyed your reading experience, say thanks here:

BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.