Weekly Rundown: It’s not the size of your stimulus, it’s how you use it.

There is no “right way” to issue fiscal and monetary stimulus during a sudden global pandemic. Some economic relief measures by other governments have included student loan forgiveness, monthly subsidies for 4-6 months, rent support for small businesses, free health care and more.

The U.S. government has taken by far the most expansive measures to support its economy. So far, the Federal Reserve has cut rates to 0% to stimulate borrowing and announced unlimited Quantitative Easing (QE) totaling $2.3 trillion in purchasing efforts.

The CARES Act made an additional $2 trillion available.

$1200 to most Americans

$250B for extended unemployment insurance

$130B for hospitals

$150B to local and state governments

$350B in Small Business Loans

$500B in bailouts for hard-hit industries (including $50B for airlines)

And yet, so much of these funds ended up in the wrong hands and did little to help the average American. Millions are still waiting for their checks, and those who received their $1200, quickly realized that it won’t cover even on month of expenditures.

Large public corporations like Ruth’s Steakhouse and ShakeShack have received multi-million dollar loans, leaving actual small businesses in the dust. Publicly traded companies received almost $600 million in PPP loans. Other recipients were educational institutions like Harvard with $9M in stimulus.

The VIP Lane: Recent reports show that the big banks administrating the ‘small business’ loans gave priority processing to existing wealthier corporate clients such as private equity shops, hedge funds, law firms and other corporates with under 500 employees. Loans of $1 million or more accounted for 45% of total PPP distributions, but ended up in the hands of just 4% of recipients. Class actions are already being filed against participating lenders. Fed has issued a statement that it will publicly name all participants in the PPP program. The Treasury Department asked public companies to return their loans before May 7 or face charges they weren’t acting “in good faith.”

To follow up on relief efforts, the house passed another $484B in aid to boost small business and hospitals on Friday. It is unclear whether this new set of funding will be able to make its way to more deserving applicants.

If the pandemic has shown us anything, it is that there are no shortage of funds for public welfare. The money printer is working just fine, it's the distribution machine that is severely broken.

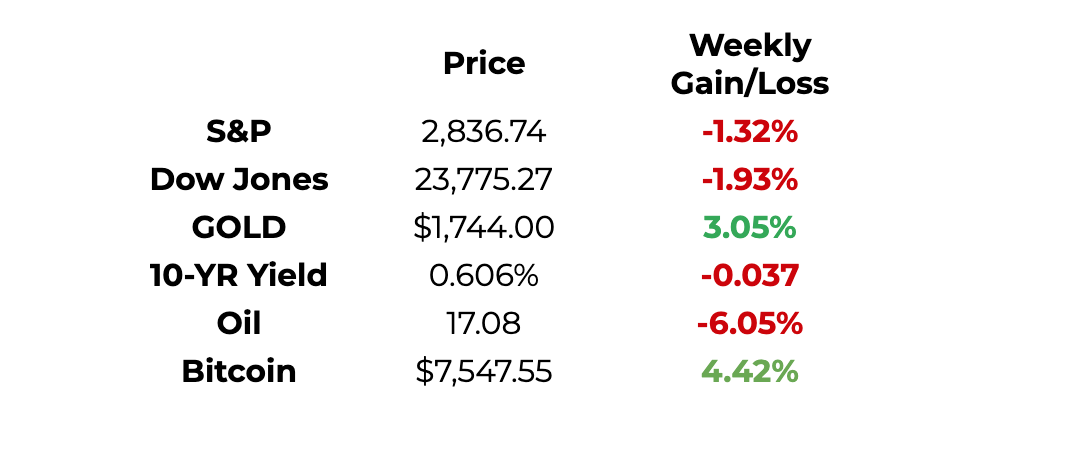

This Week By The Numbers

Both the S&P and the Dow showed modest corrections downward as negative earnings reports continue to pile in. WTI Crude futures fell below 0%, pushing oil prices lower. Bears in the market have begun to stock up on gold, with an analyst price expectation of $3000. Finally, Bitcoin continues its trajectory upward as we near the ‘halving’ on May 12th.

Top Stories of the Week

House passes $484 billion bill to boost small businesses and hospitals

The bill includes: $310B in new funds for the Paycheck Protection Program, $60B specifically for small lenders, $60B for Small Business Administration disaster assistance loans and grants, $75B in grants to hospitals overwhelmed by a rush of Covid-19 patients, and $25B to bolster coronavirus testing. Read Full Story.

US Weekly Jobless Claims Hit 4.4 Million

Jobless claim filings continued at a historically unprecedented pace last week with 4.4 million new signups for unemployment insurance, bringing the total of the past five weeks to 26.4 million, the Labor Department said Thursday. The five-week total has now surpassed all of the job gains since the Great Recession. Read Full Story.

Coronavirus drives U.S. deficit to $3.7 trillion

Driven in part by the response to the coronavirus pandemic, America's federal debt is expected to exceed 100% of GDP for the first time since World War II, according to estimates from the nonpartisan Congressional Budget Office. US debt is expected to eclipse the size of the economy. Read Full Story.

Georgia, Tennessee and South Carolina Say Businesses Can Reopen Soon

Residents of Georgia will be allowed on Friday to return to the gym and get haircuts, pedicures, massages and tattoos. Next Monday, they can dine again in restaurants and go to the movies, despite signs that the outbreak is just beginning to strike some parts of the country. Read Full Story.

WTI Oil futures contract expiring Tuesday went negative

A future contract for WTI crude for May delivery fell more than 100% to settle at negative $37.63 per barrel, meaning producers would pay traders to take the oil off their hands, illustrating just how much demand has collapsed due to the coronavirus pandemic. However, traders cautioned that this descent into negative territory was not reflective of the true reality in the beaten-up oil market. Read Full Story.

Trump puts a pause on Green Cards for 60 Days

In a tweet Monday night, the president attributed the suspension to an “attack from the Invisible Enemy” and the “need to protect the jobs of our GREAT American Citizens.” The 60-day temporary halt on Green Cards will includes both family-based and skill-based immigration. Although visas are not being targeted at this time, Trump has stated an impending review of all immigration categories. Read Full Story.

Coronavirus pandemic 'will cause famine of biblical proportions'

More than 30 countries in the developing world could experience widespread famine, and in 10 of those countries there are already more than 1 million people on the brink of starvation. Read Full Story.

Starbucks and McDonald's to Test China’s Digital Yen

The move signals China's wider efforts to test the digital currency project, with state-owned commercial banks already developing wallet applications for the digital yuan, also known as DC/EP. China's four state-owned commercial banks, Ant Financial, Tencent as well as 19 restaurants, entertainment and retail shops will participate in the test. Read Full Story.

Stablecoin market capitalization reaches $9B

Digital currencies are becoming more commonplace, reaching a market cap of $9B (that’s greater than any other cryptocurrency aside from Bitcoin and Ethereum). There are currently at least nine major stablecoins operating globally such as USDC, USDT, and BUSD. Read Full Story.

Everyone you know just signed up for Netflix

More than 15.7 million people signed up for Netflix in the first three months of the year, when the coronavirus began to truly disrupt daily life around the world. That was a record for the streaming service, according to its first quarter earnings announcement on Tuesday. Netflix has 182.8 million subscribers, making it one of the world’s largest entertainment services. Read Full Story.

Kanye West is officially a billionaire, and he really wants the world to know

After months of requests, the hip-hop superstar shared financial records, revealing details about his wildly popular Yeezy sneaker empire. Read Full Story.

Product of Week

Many of you have reached out on social media asking what I use to trade. For beginners, I always recommend Robinhood - it’s intuitive and costs $0 to trade. If you use my REFERRAL LINK HERE, you will get a free stock to get your portfolio started :)

Stay safe and have a great week. As always, reach out on Twitter with any feedback.

Best,

Tatiana Koffman —> tatiana@tatianakoffman.com

[Received this email by accident? Unsubscribe below.]

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.