Weekly Rundown: Tech Rules the World

As if it wasn’t clear enough already, the markets confirmed this week that tech, in fact, does rule the world. While many sectors like restaurants and leisure travel have had to shut down all together, others like entertainment, health and fitness, and retail have effectively migrated their business models to Instagram, Zoom and Shopify.

As most Americans have limited their trips to physical stores and increased their shopping online, Amazon reported a significant increase in consumer engagement and revenue. Taking into account the added costs for virus-preventative measures, however, the company missed its Q1 earnings target. Twitter also missed its earnings target due to decline in advertising revenue. Facebook’s earnings were up 18% as compared to Q1 of 2019, causing its shares to rise 10%. Tesla showed a modest profit, leading to a run up in stock price despite Elon Musk’s rant on the earnings call, criticizing lockdowns as ‘facist’. The upward price movements were subsequently undone by Elon tweeting “Tesla stock price is too high imo.” Microsoft reported $10 billion in earnings stating that coronavirus had ‘minimal impact’ on its revenues. Even Alphabet’s earnings were not as bad as anticipated, despite significant slowdown in ad sales.

As states begin to reopen in May, increased reliance on technology is unlikely to dissipate. We foresee significant revenue opportunities in digital education, communication, entertainment and even healthcare.

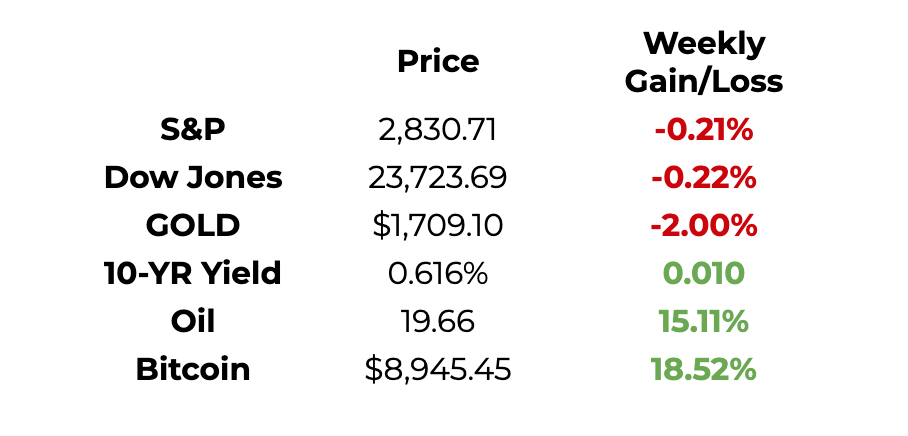

This Week By The Numbers

Stock markets rallied on Wednesday and Thursday, driven by positive earnings from Big Tech. Friday was a day of painful corrections as Fed Chairman, Jerome Powell, warned that "we are going to see economic data for the second quarter that is worse than any data we have seen for the economy." Bitcoin continues to be the best performing asset of the week, with double-digit gains.

Top Stories of the Week

Trump threatens new tariffs on China in retaliation for coronavirus

Trump’s sharpened rhetoric against China, reflected his growing frustration with Beijing over the pandemic, sparked an economic contraction and threatened his chances of re-election in November. Read Full Story.

Fed signals it will likely hold rates near zero for months

Economic output shrank at a 4.8% annual rate in the first three months of the year — the worst showing since the Great Recession struck near the end of 2008. This economic picture is expected to grow even more grim, with the economy forecast to contract at a shocking 30% - 40% annual rate in the April-June quarter. Read Full Story.

Job losses deepen with U.S. tally topping 30 Million

Millions more Americans filed for unemployment benefits last week, sending the six-week total above 30 million since the coronavirus pandemic began to shutter businesses across the country - almost 3 times the total unemployment at the height of the 2008 financial crisis. Read Full Story.

Unrest escalates in Lebanon as currency collapses and prospect of hunger grows

Violence escalated on Tuesday in the northern Lebanese city of Tripoli as protesters, angered by the collapse of the country's currency and spreading economic upheaval, burned down a series of banks and countered volleys of tear gas by pelting security forces with stones. The Lebanese pound, long pegged at around 1,500 to the dollar, has lost much of its value since October, reaching 4,500 to the dollar on black markets this week. Read Full Story.

A16z launches Crypto Fund II - $515M

“Consumers, particularly digitally native users and those in places where the currency isn’t stable, want a modern store of value that is scarce, secure, durable, portable, and censorship-resistant. Even those of us in stable economies are increasingly skeptical of the government’s ability to manage the money supply. Gold has long played the role of a fiat substitute, but Bitcoin is a digital alternative that is gaining acceptance and adoption around the world.” Read Full Announcement.

Starbucks strikes partnership with venture capital firm Sequoia to make tech investments in China

The coffee chain said that along with co-investments, it will look to form “commercial partnerships with next-generation food and retail technology companies.” The latest push from Starbucks aims to boost the digital aspect of its business in China, one of its most important markets. Read Full Story.

The Saudi’s are bargain shopping

Saudi Arabia buys $500 million stake in coronavirus-hit Live Nation, stock jumps nearly 10%. The purchase follows numerous reports of the Saudi wealth fund buying stakes in companies whose stock prices have been obliterated by the Covid-19 pandemic. Read Full Story.

Product of Week: Polymail

One of my favorite products is an email app that allows you to view all your inboxes in one place, track your emails by notifying you when someone reads them, downloads a document or clicks a link. Use my link to get your first month free with Polymail here.

As always, reach out on Twitter with any feedback.

Best,

Tatiana Koffman —> tatiana@tatianakoffman.com

[Received this email by accident? Unsubscribe below.]

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.