Weekly Rundown: The Big Short - Part 2

The idea of yet another bank collapse akin to 2008 isn’t shocking. It is the cause, and its eerie similarities to the mistakes of 2008, that are starting to raise eyebrows. And this one could be worse.

Let me introduce you to the CLO. No, this is not a typo.

The financial crisis of 2008 was about mortgages - loans to home buyers that were repackaged into collateralized debt obligations (“CDOs”). CDOs were intended to shift risk away from banks. The bank would make the home loan and then sell the debt to another investor through a CDO, passing on the risk. In reality, banks bet on their own product, retaining much of that risk, leading to the crash.

After the financial crisis, Congress passed the Dodd-Frank Act. Banks were required to borrow less, make fewer long-shot bets, and be more transparent about their holdings. The Federal Reserve began conducting “stress tests” to keep the banks in line. Congress also tried to reform the credit-rating agencies, since more than 13,000 CDO investments that were rated AAA defaulted.

A CLO walks and talks like a CDO, but in place of loans made to home buyers are loans made to troubled businesses. CLOs bundle together the subprime loans to the corporate world. Like a CDO, a CLO has multiple layers, which are sold separately. The bottom layer is the riskiest, the top the safest. Defaults at the bottom can be contained, but as defaults increase and climb to the top, the entire CLO market is at risk of default.

In 2018, the CLO market was estimated at $750 billion, bigger than the height of the CDO market. That number is expected to increase as more troubled businesses borrow during the pandemic AND default on their loans. The scary part is that many of these CLO’s actually live on the balance sheets of the banks.

Of the 30 global systemically important banks, the average exposure to leveraged loans and CLOs was roughly 60% of capital on hand. Citigroup reported $20 billion worth of CLOs as of March 31; JPMorgan Chase reported $35 billion (along with an unrealized loss on CLOs of $2 billion). AIG is now exposed to more than $9 billion in CLOs. Pension funds, mutual funds, and exchange-traded funds are also heavily invested.

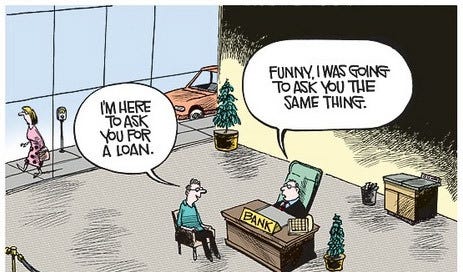

It seems the banks find themselves standing on yet another house of cards, unsure of what to do next.

To learn more, read Frank Partnoy’s in-depth discussion on CLO’s in the Atlantic here.

This Week By The Numbers

Stocks continued to move downwards amid news of rising COVID-19 cases and fears of a second wave of lockdowns. It seems the V-shaped recovery was wishful thinking and we are likely to go through another downturn before a real economic recovery - in a W-shaped pattern.

Top Stories of the Week

Fed caps bank dividend payments and suspends share-buybacks for third quarter after stress tests

The Federal Reserve on Thursday voted to require large banks to preserve capital by suspending share repurchases and cap dividend payments in the third quarter. The stress tests cover 34 banks, including five foreign firms. The Fed released two studies — a traditional stress test set in February before the pandemic and an analysis of bank capital under three ways the economy might evolve in coming quarters amid the public-health crisis, roughly a V-shaped, U-shaped and W-shaped scenarios. Read Full Story.

5 states reported their highest number of coronavirus cases in one day

At least five states Friday reported single-day records of Covid-19 cases, adding to the growing concern over case tally spikes that has sent many states backpedaling on their reopening plans. Florida, Georgia, Idaho, Tennessee and Utah all reported their highest-ever daily caseloads, according to their state's health departments. And Florida, seen possibly as the next US epicenter, beat that record again Saturday with 9,585 cases. Texas, the nation's second most populous state, "paused" his state's phased reopening plan and ordered further restrictions on businesses including bars. Read Full Story.

Trump signs executive order limiting immigration Wednesday

The order suspends new immigrant visas for 60 days, according to the text, which was released Wednesday. The order applies to people who are currently outside the U.S. seeking entry and do not currently have a valid visa, but does not apply to those people who are already lawful permanent residents or health care professionals seeking an immigrant visa to help combat coronavirus in the U.S., for example. Read Full Story.

Microsoft to close its physical stores, take $450 million charge

Microsoft Corp. said Friday it will close all of its physical store locations, as part of the software and cloud giant's new approach to retail. The company expects to record a charge of $450 million, or 5 cents a share, during the current fiscal fourth quarter, for asset write offs and impairments. The new approach comes after the company had closed its Microsoft Store locations in late March as a result of the COVID-19 pandemic. The company said its retail employees will continue to work at corporate facilities and remotely. Read Full Story.

PayPal, Venmo to Roll Out Crypto Buying and Selling: Sources

Fintech giant PayPal plans to roll out direct sales of cryptocurrency to its 325 million users, according to three people familiar with the matter. Currently, PayPal can be used as an alternative means for withdrawing funds from exchanges such as Coinbase, but this would be a first in terms of offering direct sales of crypto.It is unclear which or how many cryptocurrencies would be available. Read Full Story.

---

Thank you for reading the latest edition of the Weekly Rundown. As always, reach out with feedback or ideas for the next edition.

Best,

If you enjoyed your reading experience, say thanks here:

BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.