Weekly Rundown: U.S. Moves Closer To Digital Dollar

Happy Independence weekend and welcome to another edition of the Weekly Rundown, the go-to newsletter for 10,000+ investors globally.

This week, the Senate Banking Committee held a hearing on the future of the digital dollar. The pressures to create a digital USD are mounting as China recently began testing its own digital currency - the DC/EP, which will be included in popular applications like WeChat and AliPay. Of particular concern is widespread adoption of a digital yuan in emerging markets and in international trade.

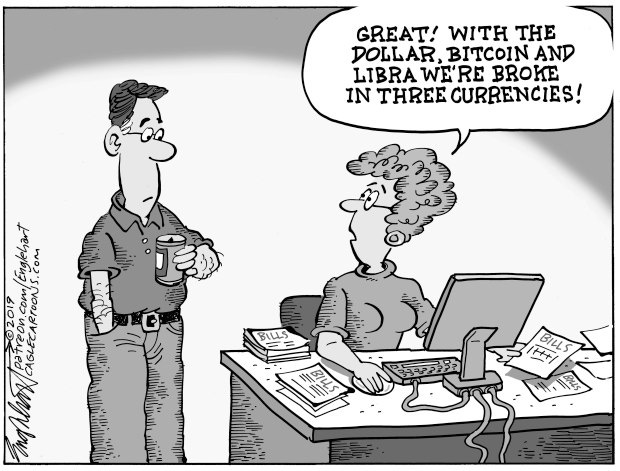

The idea of a dollar-backed digital currency gained mainstream media attention last year during the Libra congress hearings, where Facebook introduced a new type of digital unit backed by a basket of currencies and commodities.

In December, Libra released a new roadmap, proposing several digital-fiat currencies deriving their values from the USD, British Pound, Swiss Franc and others, thus creating an efficiency layer on top of the current financial system. Users would be able to access these digital currencies through a wallet installed on their phone, and potentially through WhatsApp chat and Facebook Messenger.

Distribution issues of the $1200 COVID stimulus checks, created new momentum for the digital dollar (and a more efficient financial distribution machine). Building on this momentum, the Senate Banking Committee continued the discussion of the digital dollar.

This Week By The Numbers

This week investors saw green across the board, largely driven by a positive employment report. July will test the market further as we see Q2 earnings reports and new COVID statistics come in.

Top Stories of the Week

NAFTA is officially gone

The US-Mexico-Canada Agreement (“USMCA”) took effect Wednesday, fulfilling President Donald Trump's 2016 campaign pledge to replace the North American Free Trade Agreement -- which he's often referred to as "the worst trade deal ever made." It's expected to create 176,000 jobs after six years and increase US GDP by 0.35%. Key provisions address auto manufacturing, labor laws in Mexico, US dairy farming, new benefits for the technology sector and environmental protections. Read Full Story.

Epstein scandal widens with arrest of Ghislaine Maxwell for conspiracy

A year after the Epstein scandal jolted moneyed Manhattan, Epstein’s longtime friend was arrested Thursday by federal agents and charged with conspiracy and enticing minors to engage in sex, among other allegations in a six-count indictment. It comes a year after Epstein, whose death in a federal jail last August was ruled a suicide, was arrested on sex-trafficking charges. Read Full Story.

Putin wins term-limit exemption with 78% voting for plan

The Kremlin hailed as “a triumphant vote of confidence in President Putin” the overwhelming approval by voters of his bid to extend his two-decade-long rule potentially to 2036. Vladimir Putin, in his first public comments on the vote, said Russia remains “very vulnerable” given the relatively short period since the 1991 Soviet collapse. “We need internal stability and time to strengthen the country and all its institutions, so I thank everyone who supported the amendments.” 78% of Russians backed the package of amendments, with turnout of 65%. Read Full Story.

Record jobs gain of 4.8 million in June smashes expectations; unemployment rate falls to 11.1%

Non-farm payrolls soared by 4.8 million in June and the unemployment rate fell to 11.1% as the U.S. continued its reopening from the coronavirus pandemic, the Labor Department said Thursday. Economists surveyed by Dow Jones had been expecting a 2.9 million increase and a jobless rate of 12.4%. The report was released a day earlier than usual due to the July Fourth holiday. The jobs growth marked a big leap from the 2.7 million in May, which was revised up by 190,000. The June total is easily the largest single-month gain in U.S. history. Read Full Story.

Kim Kardashian West's KKW cosmetics line is worth $1 billion

After buying Kylie Jenner's beauty business last January, Coty (COTY) announced on Monday that it would acquire a 20% stake in KKW, Kim Kardashian West's cosmetics line, for $200 million. The deal values KKW at $1 billion — slightly less than the $1.2 billion valuation of Jenner's company, Kylie Cosmetics. Under the agreement, Kardashian West would retain creative control of the company, while leveraging her more-than 300 million social media followers for "products and communications initiatives." Read Full Story.

Apple, AT&T, Jack Daniel's: Fed Issues Details on Bond Buys

The Federal Reserve has released a list of roughly 750 companies, including Apple, Walmart and ExxonMobil, whose corporate bonds it will purchase in the coming months in an effort to keep borrowing costs low and smooth the flow of credit. The central bank also said it has, so far, purchased nearly $429 million in corporate bonds from 86 of those companies, including AT&T, Walgreen's, Microsoft, Pfizer and Marathon Petroleum. The Fed announced in March that it would, for the first time in its history, purchase corporate bonds as the intensifying viral outbreak caused panicked investors to dump most types of securities in a rush to hold cash. Read Full Story.

---

Thank you for reading the latest edition of the Weekly Rundown. As always, reach out with feedback or ideas for the next edition.

Best,

If you enjoyed your reading experience, say thanks here:

BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK Disclaimer: This email does not contain financial advice and was created solely for informational purposes.