Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 13,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your research.

Dear Investors,

Crypto markets are PUMPING this week with Bitcoin and Ethereum up 20%+ on the recent news that Fed may finally be slowing down interest rate hikes.

CPI numbers for December came in at 6.5%, down from 7.1% the month prior, indicating that the current quantitative tightening has been working.

The current federal funds rate sits at 4.25-4.50% and is expected to go up to 5.-5.25% but in slower increments of 0.25%, creating a soft landing for the economy.

The job market remains strong, while commodities are down across the board, and housing is NOT facing the collapse we feared, since most folks were smart and refinanced at ultra-low rates for 30 years.

Generally, it seems that we will continue to see a slow contraction over 2023, and a new bull cycle in 2024.

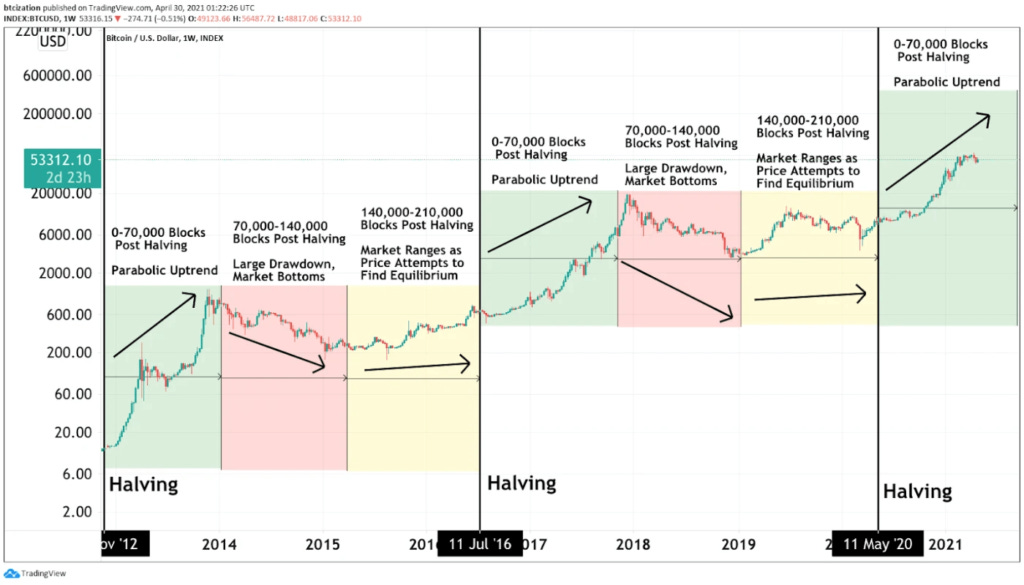

(P.S. Bitcoin halving is scheduled for March 2024, which usually kick-starts a new bull cycle in the metaverse 😉.)

Beware of current market activity in crypto… We are likely in a repeat of the 2019 pattern where we have a little bit of a relief rally, but are not out of the woods just yet. 2023 is a great year to accumulate Bitcoin on the ultra-red days (translation - don’t buy assets that just pumped 20%).

This Week By the Numbers 📈

AI Tools to Rock Your World

As AI continues to advance, it is becoming increasingly integrated into our daily lives. From website creation to content writing, AI is making tasks easier and more efficient.

One of the most advanced AI tools currently available is GPT-3, developed by OpenAI. It is capable of developing human-like text and engaging in conversations, making it useful for a wide range of tasks such as responding to inquiries, generating texts, and coding. Additionally, GPT Zero is currently in beta and attempts to detect if a text is human-written or AI-generated.

While GPT-4, expected to release in late 2023, is expected to be vastly superior, trained on over 1 trillion parameters, versus GPT-3’s 175 billion.

Our Top AI Picks:

GPT-3: AI that can generate human-like text and do tasks such as chat, translate, summarize, code, and create content.

Uizard IO: A website-building tool that allows users to choose a template that fits their business style and image and add their own content or upload a screenshot and the AI program will automatically build it for them.

SEO AI: An AI that helps websites rank higher on Google by analyzing content and recommending optimized titles and keywords, and also analyzing competitors to improve search engine rankings.

Quillbot: An AI tool that generates written content, checks for grammatical errors, detects plagiarism and provides plagiarism reports.

Writer: An AI tool that checks if the content is AI-generated.

Midjourney: An independent research lab that creates AI images using text prompts.

Looka: An AI tool that generates logos for businesses.

Synthesia IO: An AI video generation platform that allows users to create videos with different avatars and voices in 65 languages.

Veed IO and Pictory AI: AI video editing tools.

Ocoya: Platform for social media management that allows users to post on multiple social media at once.

GitHub Copilot: AI virtual programmer that generates code by learning from previously written codes.

Top Stories 🗞️

Silvergate Bank loaded up on $4.3 billion in Home Loan bank advances

When depositors began pulling money out of Silvergate Capital Corp. following the collapse of the cryptocurrency exchange FTX, the California bank shored up its liquidity by tapping a quasi-government agency not typically known as a lender of last resort. Silvergate received $4.3 billion from the Federal Home Loan Bank of San Francisco late last year, company filings show. The billions in liquidity provided by the FHLB in the fourth quarter alone helped La Jolla, Calif.,-based Silvergate stave off a further run on deposits. The crypto-friendly bank now holds roughly $4.6 billion in cash — the bulk of which came from Home Loan Bank advances, according to select financial metrics that Silvergate released last week. The lifeline that Silvergate got from the Home Loan Bank System shows one way in which the crypto industry has managed to find its way into the mainstream banking system.

El Salvador passes landmark crypto bill, paving way for Bitcoin-backed bonds

El Salvador has passed landmark legislation providing the legal framework for a Bitcoin-backed bond — known as the “Volcano Bond” — that will be used to pay down sovereign debt and fund the construction of its proposed “Bitcoin City”. The bill passed on Jan. 11 with 62 votes for and 16 against, and is set to become law after it is ratified by President Bukele. The National Bitcoin Office of El Salvador announced the passage of the bill in a Jan. 11 Twitter thread, noting that it would begin issuing the bonds soon.

Gemini and Genesis were charged by SEC with selling unregistered securities

The United States Securities and Exchange Commission (SEC) on Jan. 12 charged cryptocurrency lending firm Genesis Global Capital and crypto exchange Gemini with offering unregistered securities through Gemini's “Earn” program. In December 2020, Genesis, a subsidiary of crypto conglomerate Digital Currency Group (DCG) entered into a deal with Gemini to offer the exchange’s customers the yield-bearing crypto product. This was then launched in February 2021. Under the agreement, Gemini customers could loan their crypto to Genesis under the promise the latter would repay the loan with interest. Genesis had full control over how it would earn a yield to repay Gemini creditors. In a statement, the SEC said its complaint alleges that the Gemini Earn program constitutes an offer and sale of securities and should have been registered with the commission.

Skybridge eyes stake buyback from FTX, as Galaxy CEO says he would like to ‘punch’ SBF

SkyBridge Capital CEO Anthony Scaramucci said that his firm can buy back the stake of the company it sold to FTX back in September last year. Meanwhile, Galaxy Digital CEO Mike Novogratz has indicated that he would be tempted to “punch” SBF right in the jaw. FTX Ventures acquired a 30% stake in the alternative asset manager SkyBridge for an undisclosed fee on Sept. 9, just a couple of months before FTX filed for bankruptcy in November. Speaking to CNBC on Jan. 13, Scaramuci noted that in light of FTX’s troubles, SkyBridge is making progress in buying back that stake but suggested the move wouldn’t be able to get sorted “until probably the end of the first half of this year.” Speaking on former FTX CEO and founder Sam Bankman-Fried, Scaramucci outlined his thoughts that there has likely been some foul play there. The CEO’s comments provide a stark contrast to his previous statements to CNBC from November, in which Scaramucci refused to use the “fraud” word due to its legal ramifications and urged “Sam and his family to tell the truth to their investors, get to the bottom” of the whole debacle.

US House Republicans plan to establish crypto-focused subcommittee: Report

Republicans in the United States House of Representatives reportedly plan to step up their oversight of the crypto industry with the creation of a new subcommittee. According to a Jan. 12 report from Politico, North Carolina Representative Patrick McHenry, chair of the House Financial Services Committee, said he planned to set up the subcommittee in part due to “a big hole” in how the committee is currently structured. The new panel will focus on issues related to digital assets, financial technology, and financial inclusion, and be chaired by Arkansas Representative French Hill, with Ohio Representative Warren Davidson serving as vice chair. “We’ve got to respond for oversight and policymaking on a new asset class,” McHenry reportedly said.

Further Reading 🤓

Last week, SBF wrote an article titled "FTX PRE-MORTEM OVERVIEW" on his personal substack. In it, he discussed the major factors that led to the implosion of FTX, including the Alameda balance sheet, Alameda's failure to hedge its market exposure and the crash that was precipitated by the CEO of Binance, which made Alameda insolvent. He also noted how Alameda's issues spread to FTX and other places, similar to how Three Arrows and other factors ultimately impacted Voyager, Genesis, Celsius, BlockFi, Gemini, and other companies.

Read more in SBF’s post here.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (my portfolio).

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.

The latest edition of Myth of Money delivers insightful analysis on the crypto market's recent surge and its implications. The newsletter highlights the role of the Fed's interest rate policy in driving Bitcoin and Ethereum gains, while cautioning investors about potential volatility. Additionally, it introduces powerful AI tools like GPT-3, Uizard IO, and SEO AI that are transforming various industries.