Dear Investors,

The biggest news this week is the continued run on the banks.

UBS Buys Credit Suisse

According to Reuters, UBS has agreed to purchase Credit Suisse for CHF 3 billion ($3.23 billion) and will absorb up to $5.4 billion in losses to prevent a crisis of confidence from impacting the broader financial system. The deal is expected to close by the end of 2023, and the Swiss central bank will provide substantial liquidity assistance of CHF 100 billion ($108 billion) to both banks. Credit Suisse shareholders will receive 1 UBS share for every 22.48 Credit Suisse shares, equivalent to 0.76 Swiss francs per share. Swiss regulators have stated that there will be no restrictions or interruptions to the banks' business activities, and Credit Suisse's Additional Tier 1 shares will be written off.

First Republic Bank secures $30 billion rescue from large banks

Meanwhile, regional favorite FRB, which was facing a crisis of confidence among investors and customers, is set to receive a lifeline of $30 billion from a consortium of the largest banks in the US. The Treasury Department released a statement on Thursday expressing appreciation for the banks' support, which it believes demonstrates the resilience of the banking system.

The consortium of major banks includes JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and Truist.

186 banks are at risk of failure…

When did depositing your money in a bank become a high-risk activity?

The Wall Street Journal published a somewhat alarming article this week.

According to a new report on the Social Science Research Network, entitled 'Monetary Tightening and US Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?', 186 banks in the US are at risk of failure due to increasing interest rates and a high number of uninsured deposits. The report estimated the market value loss of assets held by individual banks during the Federal Reserve's rate hike campaign, with assets such as Treasury notes and mortgage loans being at risk of decreasing in value due to higher rates. The study also examined the percentage of funding from uninsured depositors with accounts over $250,000.

"Even if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to insured depositors, with potentially $300 billion of insured deposits at risk. If uninsured deposit withdrawals cause even small fire sales, substantially more banks are at risk," the report noted.

How did we get here?

America (and most of the world) runs on fractional reserve banking.

Established in 1913 by the Federal Reserve, fractional reserve banking is a system where banks keep only a fraction of their deposits in reserve and loan out the rest. This creates a multiplier effect, where the initial deposit can be used to create more money through loans. The term "fractional” refers to the fact that this multiplier effect can occur at multiple levels. For example, a bank might receive a deposit of $100, keep $10 in reserve, and loan out $90. The borrower then deposits the $90 in another bank, which keeps $9 in reserve and lends out $81.

Fractional reserve banking can lead to the rapid expansion of the money supply, which can be good for economic growth. However, it also creates the risk of bank runs, where depositors all try to withdraw their money at once and the bank doesn't have enough reserves to meet the demand. If too many people withdraw their deposits at once (a bank run), the bank may not have enough money to cover it, leading to potential bank failures. When at risk, a bank may borrow from other banks or from the central bank. Most banks are required to hold 5-10% in reserve, but this requirement was dropped to nearly 0% during COVID-19, creating further risk in the system.

Why would everyone want to withdraw their deposits?

The Silicon Valley Bank failure has revealed a crucial broken lever in the system. Many of the investments made by banks were in long-term securities such as 10-year mortgage bonds, which were devalued up to 30% due to rising interest rates. The Federal Reserve essentially caused this problem and hoped no one would notice. Special accounting rules allowed the securities to be reported at book value rather than at market value, hiding the mismatched assets and liabilities.

Evidence is mounting that the Fed actually knew what they were doing.

What about FDIC Insurance?

Currently, FDIC insurance protects depositors up to $250,000 per account. The FDIC limit has been raised every few years to keep up with inflation. The current limit, however, has not been raised since 2008. Many have speculated that a raise is coming imminently.

But here is the next problem - can the FDIC run out of money?

According to Investment Banker Caitlin Long, the FDIC doesn’t have anywhere near enough capital to backstop a run on the banks.

So how can the Fed guarantee deposits going forward?

The money printer has to be turned back on.

U.S. National Debt

Then is there another more subtle motive behind increasing the monetary base. The U.S. National Debt is almost $31.5 TRILLION. Nearly all of that debt is subject to the statutory debt limit, leaving only $25 million in unused borrowing capacity (as of February 2023). America’s national debt exceeds GDP.

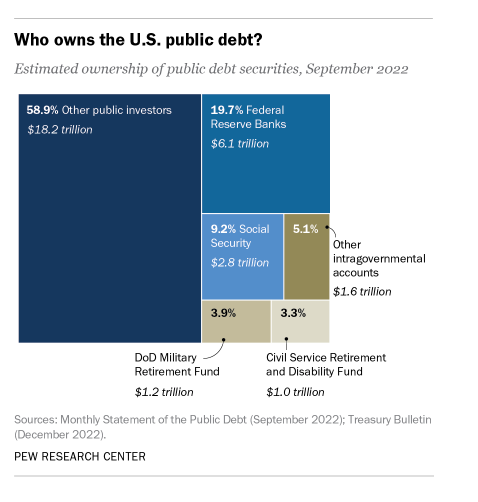

The Federal Reserve actually holds 20% of this debt.

This means the Federal Reserve has to pay interest on this debt, which currently amounts to $395.5 billion this fiscal year, or 6.8% of all federal outlays.

Why does this matter?

Many of the talking heads are hypothesizing that the current plan is to “monetize” the debt. Monetizing debt is the act of borrowing from the central bank rather than issuing more bonds to private investors. In this process, central banks create new money by purchasing government debt… aka print more money. This practice is prohibited in several countries as it is deemed risky due to the possibility of triggering uncontrollable inflation.

Balaji’s $1M Bitcoin Bet

Balaji Srinivasan is a prominent Silicon Valley entrepreneur and investor who has worked at several technology companies, including Coinbase and formerly GP at A16Z. He is a vocal advocate for decentralization and Bitcoin.

His tweets this week have caused a stir in the community. On March 18th, investor Balaji Srinivasan bet $1 million on hyperinflation in the United States.

Many misconstrued the bet to be on Bitcoin rising to $1M in 90 days, and perhaps the second iteration of the bet is being changed to that. The original bet, however, was on US hyperinflation, defined as 50% month-over-month price increases.

Srinivasan warns of massive bank withdrawals starting Monday and encourages investors to consider Bitcoin as the only global safe haven. However, some Bitcoin proponents urge caution and advise investors not to take the bet seriously, and that it may be more of a marketing stunt.

You guys already know my views, as Bitcoin has always be the biggest investment in my portfolio.

This Week By the Numbers 📈

This week, the crypto markets are showing strong momentum, with Bitcoin, Microstrategy, and Coinbase emerging as the prominent gainers. Meanwhile, the banking sector is facing significant setbacks, with Credit Suisse and First Republic among the institutions facing steep declines in stock price.

Top Stories 🗞️

Stripe nearly halves valuation to $50 bln following $6.5 bln raise

Payments processor Stripe on Wednesday raised $6.5 billion in a funding round led by existing and new investors at a sharply reduced valuation of $50 billion, down nearly 50% from two years ago. Stripe said it would use the cash to cover a large tax bill associated with stock granted to employees and to provide liquidity to employees. About $3.5 billion of the newly-raised capital will be used to cover the tax bill, with the rest being used to buy shares from employees, according to a person familiar with the matter, who requested anonymity as these discussions were confidential. After years of signing big checks for high-flying startups, investors have turned more cautious as the U.S. Federal Reserve's monetary tightening drains out excess liquidity. Startup metrics such as profitability and cash burn are being scrutinized more closely. Last year, Swedish buy now, pay later giant Klarna also raised capital at a significantly lower valuation.

Founders Fund slashes size of its flagship VC fund

Founders Fund has quietly cut the size of its eighth venture capital fund in half, from around $1.8 billion to around $900 million. This is a shot across the VC industry's bow by firm founder Peter Thiel, and will force peers to explain why they're not doing the same. It also puts added pressure on firms that currently are in market. This isn't a pure fund size reduction. Instead, the "extra" $1 billion will be pushed into a ninth venture capital fund that will activate whenever Fund VIII is fully committed (at which point management fees will kick in). Multiple sources say the firm's argument is that Fund VIII was raised just prior to the tech market correction, which could persist for years. If deal volume and prices decrease, then so should VC fund size. The bottom line: Thiel has decided that venture capital is due for a slimdown, and is pulling his money where his mouth is.

Half of Sequoia Capital's VC funds since 2018 have posted losses for the University of California's endowment

The University of California has invested in 20 funds launched by Sequoia Capital since 2018 as a limited partner, half of which have seen a markdown in value, per documents seen by Business Insider. Since the data was from June 2022, a further decline in valuations is expected as private tech markets deteriorated more in the second half of the year. Despite the decline in valuations, the funds could potentially provide satisfactory returns by the end of their respective tenures since Sequoia is "widely considered to be one of the most successful venture firms of all time.” Sequoia's 2020 U.S. Growth IX Fund, 2018 China seed-stage fund, 2021 U.S. fund, and 2022 fund have seen valuation markdowns of 5%, 9%, 10%, and 15%, respectively.

Y Combinator to End Late-Stage Startup Fund, Lays Off Staff

Silicon Valley startup accelerator Y Combinator won’t raise another continuity fund, which backs mature private tech companies, two people familiar with the matter said. The partners who led the fund, Anu Hariharan and Ali Rowghani, plan to leave the firm. The decision comes during a sharp pullback in venture funding, particularly for late-stage companies, in which investors have been reluctant to write big checks for startups after the value of comparable public tech companies have fallen. The move was not connected to the recent implosion of Silicon Valley Bank. Instead, Y Combinator wants to focus on its core accelerator, which backs early stage companies.

Amazon Is Launching an NFT Marketplace This Spring

Amazon is set to launch its own NFT marketplace, as it continues to broaden its e-commerce empire. Amazon was initially planning to launch its NFT marketplace last year, however, the collapse of FTX delayed the launch. Although some details are yet to be fleshed out, what is known is that the launch is set for April 2023 and Amazon will initially offer 15 NFT collections for U.S. customers to start. Consumers will be able to purchase these digital collectibles via a credit or debit card using their Amazon account. This will also give consumers, who don’t have a digital wallet, to the ability to purchase an NFT without having to purchase cryptocurrencies.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).

Hi,,, to all,,,,

What about Schwab ?