Your Guide to Tax-Advantaged Crypto Investing in 2025

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X below.

Nothing quite captures the essence of Thanksgiving like sidestepping political debates, indulging in too much pie, and attempting to explain Bitcoin to your uncle for the umpteenth time. Yes, Bob, Bitcoin is real. No, Bob, you can't physically hold it—just like you can't hold your iTunes library. It's digital property.

However, as more family and friends become technologically savvy, they begin to ask more sophisticated questions: What's the best way to allocate all this crypto? Should it be stored in a cold wallet under the proverbial mattress?

With one family-reunion holiday behind us and another just around the corner, it's an opportune moment to shift focus from what you're thankful for to what the future could hold if you plan carefully and invest wisely.

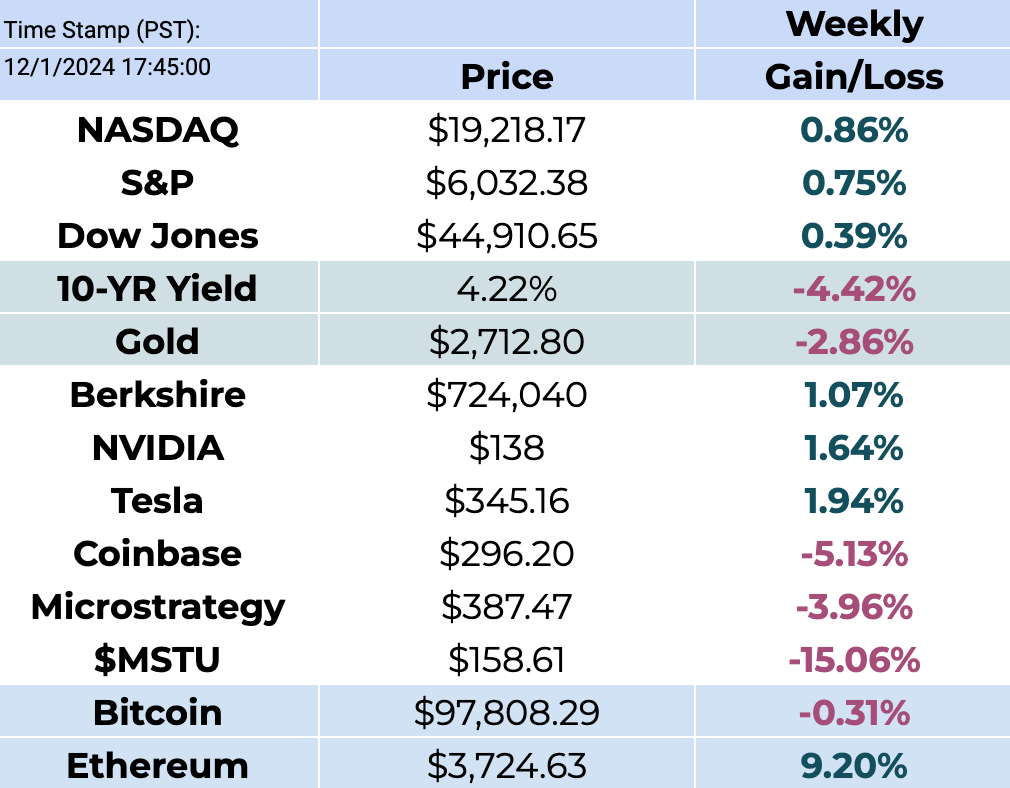

First, a review of this past week: markets showcased resilience amid a blend of upbeat and cautious developments. Major U.S. indices reached fresh record highs, with the S&P 500 closing above 5,800 for the first time, and all three indices on track for weekly gains exceeding 1%. Investor sentiment got a boost from a strong start to earnings season, led by robust results from JPMorgan Chase and Wells Fargo.

The cryptocurrency market also surged, with Bitcoin briefly touching $99,6550 and the total crypto market cap climbing to a record $3.4 trillion. Economic data painted a mixed picture: the NY Empire State Manufacturing Index signaled a remarkable rebound, while UK inflation accelerated faster than anticipated.

On the inflation front, the Federal Reserve’s preferred measure of underlying inflation rose in October, influenced partly by higher stock prices. The stubborn inflation data underscores policymakers’ cautious stance on lowering interest rates. However, there was some relief for homebuyers—mortgage rates declined, fueling an unexpected jump in pending home sales to a seven-month high last month.

Corporate headlines featured Tesla’s stock volatility following its robotaxi unveiling, while NVIDIA met earnings expectations but flagged softer fourth-quarter guidance. Meanwhile, European markets faced some challenges, with UK business activity sliding into contractionary territory.

As we enter into the final stretch of 2024, Bitcoin is once again making headlines, pinging off the $100,000 milestone after a remarkable November rally that saw its value climb nearly 40%. This surge comes amid shifting market dynamics, where institutional investors are leading accumulation while retail participation lags behind historical bull runs. Recent corrections have been moderate by Bitcoin’s standards, underscoring a maturing market with unique opportunities for investors.

Against this backdrop, and as retail investing picks up, we’re seeing innovations in how to incorporate crypto investing into existing vehicles, offering a new avenue for accessing these evolving assets.

Beyond Bitcoin ETFs: Smart Crypto Strategies for 2025

The crypto market has matured dramatically over the past year, with 2024’s regulatory milestones laying the groundwork for savvy investors to rethink their portfolios. From Bitcoin ETFs breaking into mainstream investment options to innovative products designed to manage crypto volatility, 2025 is shaping up to be the year where prudence meets opportunity. But how can investors navigate this complex and fast-evolving space? Let’s explore how you can protect against risks while positioning yourself for long-term growth in tax-advantaged accounts.

A Look Back to See Ahead: 2024’s Milestones

Last year, the SEC’s approvals of spot Bitcoin ETFs and Ethereum ETFs were game changers, introducing regulated exposure to digital assets that investors could incorporate into tax-advantaged accounts. Products like BlackRock’s iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust weren’t just about access—they were about legitimacy, paving the way for broader adoption.

This momentum extended to diversification products, with Bitwise filing for multi-asset crypto ETFs, and First Trust launching defined-outcome funds that offered a safety net against volatility. These strategies offered investors a way to gain exposure without diving headfirst into crypto’s wild price swings.

Strategies for 2025: Beyond Hype to Long-Term Wealth

The key to a successful 2025 crypto strategy lies in balancing innovation with risk management. Here are ways to strategically balance these crucial elements:

Leverage Defined-Outcome Products

Crypto volatility remains a top concern. Funds like First Trust’s Bitcoin Defined-Outcome ETF cap returns but offer downside protection—an appealing trade-off for risk-averse investors looking to ease into crypto. In 2025, similar products tied to altcoins like Solana or diversified indices are expected to launch, widening the scope for cautious exposure.Diversify Across Crypto and Traditional Assets

Crypto ETFs that blend assets, like the forthcoming Bitwise 10 Multi-Asset ETF, allow investors to spread risk across top-performing tokens. Coupled with traditional asset allocation in tax-advantaged accounts, this diversification strategy can dampen volatility while tapping into growth.Explore Income-Generating Strategies

Products like Grayscale’s Bitcoin Covered Call ETF present an innovative way to earn income from crypto holdings. By selling options on ETF positions, these funds can smooth returns, offering yield-focused investors a buffer against unpredictable markets.Add Mining Exposure for Stability

Crypto mining companies like Core Scientific (CORZ) and Marathon Digital Holdings (MARA) bring a different flavor of exposure. While these equities correlate with the broader crypto market, they offer operational stability and revenue streams that may be less volatile than direct token prices.

Galaxy Digital Holdings Ltd. is enhancing its high-performance computing capabilities at the Helios campus in West Texas. This expansion aims to support blockchain applications, potentially offering a stable revenue stream less tied to cryptocurrency price fluctuations.

Hut 8 Mining Corp. recently reached a 52-week high in its stock price, driven by strategic growth in Bitcoin mining. The company is expanding its digital infrastructure through initiatives such as GPU-as-a-Service and co-location agreements with BITMAIN.Stay Ahead of Innovation

The finalization of options trading on Bitcoin ETFs has spurred a wave of filings for 2025. Expect to see more products, including buffer funds and covered call strategies, that address specific investor needs. Firms like Hashdex and 21Shares are leading the charge in this next chapter of innovation.

Navigating Tax-Advantaged Accounts

The appeal of using IRAs or Roth IRAs for crypto investments lies in shielding gains from immediate taxation. Tax-advantaged accounts help defer or even eliminate capital gains taxes while simplifying reporting requirements. With new IRS rules for crypto reporting starting in 2025, this approach minimizes compliance headaches while optimizing returns.

Why 2025 Is the Year to Think Strategically

Crypto investing isn’t just about chasing the next bull market. It’s about playing the long game. With the SEC greenlighting more diverse ETFs, firms racing to launch cutting-edge products, and innovations designed to mitigate risk, 2025 is primed for prudent investors to rethink how crypto fits into their broader financial goals.

Whether it’s leveraging defined-outcome ETFs, capitalizing on income-generating funds, or diversifying with mining equities, the tools to manage risk while capturing upside are growing. By carefully integrating these vehicles into tax-advantaged accounts, investors can take a measured approach to crypto’s opportunities—without losing sleep over its infamous volatility.

As the year unfolds, staying informed and adaptable will be your best strategy for navigating the evolving landscape of digital asset investing.

This Week By the Numbers 📈

🏛️ Economic Policy & Markets

• Fed minutes point to slower pace of rate cuts

• JPMorgan bullish on S&P 500, sets 2025 year-end target of 6,500

• PCE price index inches up to 2.3%

• Jobless claims lower than expected

• Biden finalizes $7.86bn CHIPS Act grant for Intel

• Dell falls 11% after mixed Q3 earnings

🇺🇸 US Politics & International Relations

• Judge tosses Trump 2020 election case

• Paul Atkins emerges as leading candidate for SEC chair

• Trump wants CFTC to lead digital asset regulation

• Ex-CFTC chair Giancarlo in running for crypto czar

• Syrian rebels enter Aleppo three days into surprise offensive

💰 Cryptocurrency & Blockchain

• Microstrategy buys another 55,000 BTC averaging $97,862 each

• Trump's World Liberty gets $30M investment from Justin Sun

• Crypto miners must report power demand under new Texas rule

• Bitwise files to convert $1.4B crypto fund into diversified ETF

🌐 Global Crypto Developments

• Hong Kong to offer crypto tax exemptions for hedge funds, family offices

• Iran to launch digital CBDC to avoid sanctions

• Russia passes new crypto tax bill

• Taiwan fast-tracks stricter crypto AML rules to take effect Nov 30

• UK to deliver comprehensive crypto regulation

• President of El Salvador wants to rent volcanoes to Bitcoin miners

🚨 Crypto Security & Controversies

• XT exchange hacked for $1.7M

• Binance whistleblower brings forward bribery claims

• Crypto exchange Kraken will shut down its NFT marketplace

• Pump.fun suspends livestream feature indefinitely

• Cantor Fitzgerald's Tether ties raise concerns

Top Stories 🗞️

What we know about Israel-Hezbollah ceasefire deal

A ceasefire deal to end 13 months of conflict between Israel and the Lebanese armed group Hezbollah has taken effect. The US and France said the agreement would “cease the fighting in Lebanon, and secure Israel from the threat of Hezbollah and other terrorist organisations operating from Lebanon”.

Hezbollah has been given 60 days to end its armed presence in southern Lebanon while Israeli forces must withdraw from the area over the same period. This is what we know about the ceasefire from the agreement itself and official briefings.

Trump vows 25% tariffs on Mexico and Canada and deeper tariffs on China

Donald Trump has said that he will sign an executive order imposing a 25% tariff on all products coming in to the United States from Mexico and Canada, and additional tariffs on China, once he becomes US president again.

“On January 20th, as one of my many first Executive Orders, I will sign all necessary documents to charge Mexico and Canada a 25% Tariff on ALL products coming into the United States, and its ridiculous Open Borders,” Trump said in a post on Truth Social.

Trump said the tariffs would remain in place until the two countries clamp down on drugs, particularly fentanyl, and people crossing the border illegally.

In a follow-up post, Trump announced that the US “will be charging China an additional 10% Tariff, above any additional Tariffs, on all of their many products coming into the United States of America”.

He said that the reason for the additional tariff was China’s failure to curb the number of drugs entering the US. China is a major producer of precursor chemicals that are acquired by drug cartels, including in Mexico, to manufacture fentanyl, a highly potent synthetic opioid.

Tornado Cash Wins Legal Battle Against US Treasury Department

Tornado Cash, a crypto mixing service, won a legal battle against the US Treasury Department. The DOJ earlier added the crypto mixer to its sanctions list under the International Emergency Economic Powers Act (IEEPA). However, the 5th Circuit Court of Appeals has ruled in favor of the plaintiffs, determining that these immutable smart contracts do not constitute “property” and therefore cannot be sanctioned under IEEPA.

The landmark decision effectively overturned the Treasury Department’s previous action and set a new precedent in the ongoing debate surrounding the regulation of cryptocurrency and blockchain technology. Tornado Cash, a popular privacy-focused cryptocurrency mixing service, has been at the center of this controversy.

The court’s decision emphasizes the distinction between the smart contracts themselves, which are lines of code operating autonomously, and the entities or individuals who may utilize them. By recognizing the immutability of these contracts, the court has effectively limited the government’s ability to sanction them under IEEPA.

Tech companies put on notice as Australia passes world-first social media ban for under-16s

Australia’s parliament has passed a world-first law banning social media for children under 16, putting tech companies on notice to tighten security before a cut-off date that’s yet to be set.

The Senate approved the social media ban late on Thursday, the last sitting day of the year, following months of intense public debate and a rushed parliamentary process that saw the bill introduced, debated and passed within a week.

Under the new law, tech companies must take “reasonable steps” to prevent under-age users from accessing social media services or face fines of nearly 50 million Australian dollars ($32 million).

It’s the world’s toughest response yet to a problem that has seen other countries impose restrictions but not hold companies accountable for breaches of a nationwide ban. The ban is expected to apply to Snapchat, TikTok, Facebook, Instagram, Reddit and X, but that list could expand.

“Myth Of Money” Book - Available Now! 🤓

As many of you know, making financial education accessible has always been a passion of mine. After a year of hard work, I'm excited to announce that my new book, published by Wiley Publishing, is finally out!

This book is a thrilling blend of personal stories from the financial world, coupled with clear explanations of how things really work—from investment banking and stocks to venture capital, macroeconomics, and cryptocurrencies.

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman & Katherine MacLellan

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. Currently working as a proud General Partner at Moonwalker Capital.

(More about me 👉 here).

About the Author: Katherine MacLellan

Katherine holds an MA (Hons) in Economics and International Relations from the University of St. Andrews, and a JD from Osgoode Hall. She has been thinking and writing about Bitcoin and blockchain technology since 2012.