Myth Of Money: Bitcoin is the cure to a growing wealth divide.

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

The biggest financial story this week was Elon Musk allocating $1.5 billion or approximately 7.5% of Tesla’s treasury into Bitcoin. The news caused the asset to spike in price, pushing near a new all time high of $50,000 over the weekend.

Bitcoin is continuing to gain traction as a hedge in an inflationary environment, particularly as the U.S. government finalizes and implements the next $1.9 trillion stimulus package, increasing the monetary supply by 40% within 12 months.

This increase in money supply is sending both start-up and public market valuations sky-rocketing. Combined with low interesting rates, the housing market has also seen a rise of 17% over the last year.

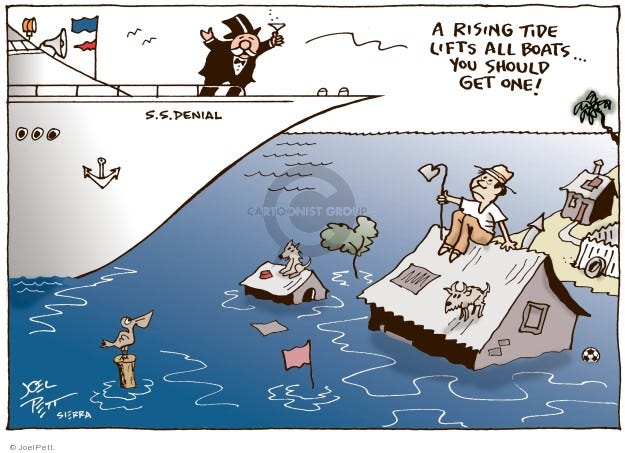

The distribution of funds, however, is not equal. While the wealthy with investable assets are reaping most of the gains, many of the working class continue to struggle.

The additional stimulus is devaluating salaries while inflating assets.

As both companies and individuals are recognizing the growing gap, we can expect more of them to flee to stocks, real estate and, of course, Bitcoin. We are likely to hear of several notable companies in the S&P 500 allocating to Bitcoin in the next few weeks.

This is the time to educate yourself and invest in at least a small portion of your net-worth into inflation-protected assets.

Here are a few of the resources I put together to make it easy:

Forbes: Your Mom’s Guide to Bitcoin

Why You Should Allocate 5% of Your Portfolio into Bitcoin

The Only Bitcoin Resources List You Will Ever Need

This Week By the Numbers 📈

Top Stories 🗞

Miami Pushes Crypto With Proposal to Pay Workers in Bitcoin

Miami Mayor Francis Suarez wants to allow the City of Miami’s workers to choose to receive all or a portion of their pay in Bitcoin, according to a resolution passed by the city’s governing commission. In addition, the mayor proposed allowing people to pay all or part of property taxes or city fees in crypto. Although the commission approved the resolution 4-1, it significantly dialed back its original wording. It only agreed to study the practicality of such steps, rather than taking action, as the original proposal had suggested. Read Full Story.

Mastercard Will Let Merchants Accept Payments in Crypto This Year

Mastercard (MA) is planning to give merchants the option to receive payments in cryptocurrency later this year. According to a source familiar with the matter, the functionality will see Mastercard customers’ digital currency payments settled in crypto at participating merchants, a first for the financial giant. The company has not yet disclosed which digital currencies it intends to support, or where. Read Full Story.

Bitcoin Hits New All-Time High as BNY Mellon Announces Crypto Custody

Bitcoin set a new record highs on Thursday after BNY Mellon, America’s oldest bank, announced crypto custody for institutional clients. The cryptocurrency set a new high of $48,297 during the U.S. trading hours, surpassing the previous peak price of $48,226 registered on Tuesday. Buyers stepped in around $46,700 after BNY Mellon said it will hold, transfer and issue bitcoin and other cryptocurrencies on behalf of its asset-management clients. Read Full Story.

Canadian Crypto Lender Ledn Raises $2.7M for Emerging Markets Expansion

Canadian cryptocurrency lender Ledn is aiming to do in other emerging markets what it did in Latin America, with funding and advice from a new set of global venture capitalists, the company announced Monday. The lender has raised a $2.7 million second seed round led by White Star Capital with participation from Coinbase Ventures, Global Founders Capital, CMT Digital, Kingsway and Darrow Holdings, an affiliate of Susquehanna International Group. Read Full Story.

VIP Investor List

I will start sending out occasional investment opportunities to those on my VIP investor list. Some of these will be fund investments, start-up investments, pre-IPO deals, crypto and digital assets opportunities, exclusive allocations… you get it. If you are an accredited investor and want to be on this list, send me a note.

Join Us On Clubhouse 🎤

We are skipping this Sunday’s clubhouse in honor of Valentine’s Day.

Next week’s clubhouse will feature friend and investor Marc Weinstein. We’ll be discussing capital allocation strategies, Bitcoin, meme stocks and so much more :)

Join us @ 11am PST, 2pm EST, 7pm GMT, 11pm UAE - CLUBHOUSE LINK

Product of the Week 👀

Lolli.com lets you earn Bitcoin while you shop at your favorite online retailers like Bloomingdales, Nike, Expedia and thousands more. Check it out here and start accumulating Bitcoin today. [Available only in the U.S.]

Interested in joining the Myth Of Money as a sponsor? Reply to this email to learn more :)

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.