Myth of Money: The Economics of War

Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 10,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

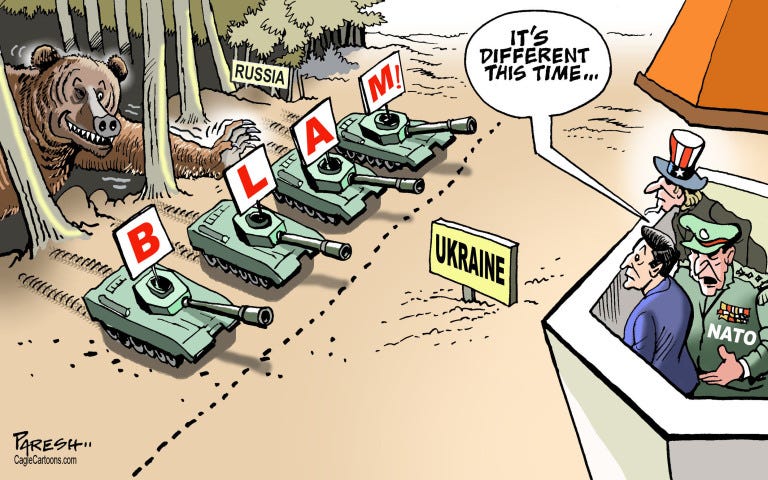

I want to take this week and take a look at the economic effects of the Russia-Ukraine conflict, and its global effect.

(1) Wheat Prices: Ukraine is one of the largest suppliers of wheat globally. Prices are skyrocketing due to the pending shortage which will affect North America, Europe and the Middle East.

(2) Gas Prices: Gas prices have also reached record highs. Most countries are trying to maintain normalized relations with Russia when it comes to Oil and Natural Gas, despite numerous other sanctions. If this is the beginning of a larger trend, it’s a good time to buy a Tesla.

(3) Crypto: Although volatility is expected in the coming months, I have entered accumulation mode again, particularly when it comes to Bitcoin. I’m following a buying scheduling and only buying on the really bloody days as I think we have some time before the ultimate parabolic move. The SWIFT sanctions and Mastercard/Visa stopping service in Russia, have been a reminder to all of us that money controlled by the government is not your money, and only reaffirmed my belief in Bitcoin.

The war has clarified crypto’s opportunity, particularly bitcoin.

I expect the appeal of Bitcoin to accelerate and push central banks across the world toward greater diversification.

The freezing of Russia’s central bank has blunted one of the Kremlin’s most potent weapons.

To the surprise of many, and apparently Putin himself, many of the world’s largest economies have collaborated to freeze Russia’s central bank’s stash of foreign currencies, which it had grown to the world’s 4th largest by 2020. This has severely hampered Russia’s ability to withstand the costs imposed by the various sanctions that are isolating it from the global economy.

The freeze has also eroded an international assumption, however, that governments will respect the financial sovereignty of central banks. As a result, it serves as a warning to all countries around the world that someday the same could happen to them.

There is a newfound appeal to governments and central banks for having a diversified portfolio, in order to weaken the effect of any such coordinated financial attack against them in the future.

Nevertheless, the appeal of a universal currency remains.

It’s much easier and far more efficient to live in a world with fewer currencies.

The U.S. dollar has served this function for decades. As an example of its endurance, one estimate shows that despite Russia’s efforts to wean off the U.S. influence, 60% of its imports from China are still paid for in dollars.

Should the dollar’s dominance decline due to the newly understood pitfalls of over-relying on it, Bitcoin is well-positioned as an alternative.

Other options include commodities, gold, CBDCs, and other currencies.

One potential candidate is the Chinese yuan, subject to the rule of China, an authoritarian government, which will continue to be a deterrent to its widespread adoption. Only about 3% of the world’s FX reserves are currently denominated in yuan.

Bitcoin offers the benefits of a universal currency, without the risk of being used as a geopolitical weapon.

Experts have increasingly pushed back on the narrative that crypto is too easily exploited by bad actors, which is often cited as a policy concern that could bring regulation that thwarts its growth.

Though illicit activity is all but impossible to eliminate fully, it’s become clear now that bitcoin is not “the free-for-all, anything-goes” marketplace that cannot hold bad actors accountable.

Inherently borderless and decentralized, Bitcoin’s appeal to central banks, sovereign wealth funds, companies, and families offices motivated to diversify remains strong. There is still an abundance of capital waiting on the sidelines, and we are about to see Bitcoin’s final push.

This Week By the Numbers 📈

Oil supplies are shrinking amid sanctions and refusals from companies to purchase energy from Russia, skyrocketing prices at one point this week to their highest since 2013. Inflation is likely to get worse before it gets better, as consumers feel the reverberations of cutting off Russia’s oil, gas, fertilizer inputs, and industrial metals from the global sphere. Central bankers must walk a tightrope between managing inflation by tightening and avoiding hitting the brakes too hard on economies that may yet fall into recession. A flight to safety drove up gold and brought down Treasury yields.

Top Stories 🗞

US Treasury Dept Lists Digital Currencies as Part of Effort to Sanction Russia's Government

Early last week the U.S. Treasury called out digital currencies in its sanctions on Russia, precluding their use to circumvent the sanctions. Experts, including a Treasury official, implied that evading sanctions via digital currencies would not necessarily be easy, but the inclusion nevertheless indicates an increasing awareness from governments of the growing relevance of crypto.

Ukraine Has Raised More than $54 Million as Bitcoin Donations Pour in to Support the War Against Russia

The crypto asset donations have primarily gone to the Ukrainian government and Come Back Alive, an NGO providing support to the military. As of Friday Ukraine had reportedly spent $15 million of the crypto donations on military supplies. Donating via the blockchain enables funds to arrive quickly, though the volumes are small compared to the hundreds of millions Ukraine has received via war bonds and support from the U.S., not to mention its $4 billion defense budget.

eBay to Add Crypto Payment Options Soon, Says CEO

In an apparent move to position itself as an e-commerce platform for Gen Z and Millennials, the nearly 27-year-old online marketplace has been looking to integrate crypto payment options and may make an official announcement as soon as its upcoming investor’s day on March 10.

In One of Africa's Largest Crypto Raises, South African Exchange Takes In $50M

Another step in Africa’s increasing crypto presence, South African exchange VALR raised a $50 million Series B at a $240 million valuation. The round was oversubscribed and included participation from Alameda Research, Cadenza, CMT Digital, Coinbase Ventures, Distributed Global, GSR, Third Prime, Avon Ventures, alongside prior investors Bittrex and 4Di Capital.

NFT Mania Show Signs of Cooling as Average Price and Sales Decline

“The average selling price of a nonfungible token has declined to under $2,000, compared with an all-time high of almost $6,900 on Jan. 2, according to industry data tracker NonFungible. The daily total sales average was about $26.2 million on March 3, the data show. The tally was $160.2 million on Jan. 31. Since Feb. 24, when Russia attacked Ukraine, the average selling price has dropped by about 30%.”

Event of the Week:

A dear friend and former Princess of Luxembourg, Tessy De Nassau, is hosting an NFT next week in Dubai (March 8th) with purchases available online.

RSVP for the in-person event - CLICK HERE.

About the Project: Human Highness, a luxury sustainable women’s brand, collaborates with artist and creative icon Thomas Iser to launch its first Human Highness X Thomas Iser NFT collection. The NFT collection consists of 22 unique and exclusive NFTs. The first NFT is launched on March 8, 2022, and a new drop will go live every day until the end of the month. All NFTs are auctioned online on the NFT marketplace (www.makersplace.com). In addition to the digital creation, NFT owners get the option to claim within the next 14 days post-purchase from the primary market, an exclusive and unique Human Highness 90x90 silk scarf that has the same print as the owned NFT (scarf is priced separately).

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.