Myth Of Money: The Power of Social Media

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

In this week’s episode of American political theater, Reddit and YouTube trading star known as “Roaring Kitty” and “DeepFuckingValue” defending his actions on Thursday before the U.S. House of Representatives’ Committee on Financial Services.

Keith Gill used his testimony to again make the case for why he is still bullish on GameStop.

“GameStop’s stock price may have gotten a bit ahead of itself last month, but I’m as bullish as I’ve ever been on a potential turnaround. In short, I like the stock,” Gill said in the comments. “I believed – and I continue to believe – that GameStop has the potential to reinvent itself as the ultimate destination for gamers within the thriving $200 billion gaming industry.”

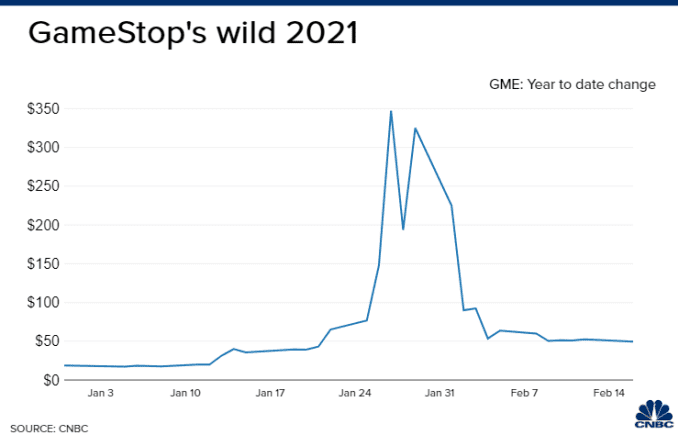

GameStop’s share price ballooned to $483 per share, before spiraling down more than 90% to around $46 per share currently.

Gill’s Reddit posts received scrutiny for price manipulation and undermining “the integrity of the stock market.”

Robinhood and Citadel Securities faced most of the scrutiny from lawmakers, along with Melvin Capital. Lawmakers were looking into whether Robinhood who temporarily restricted trading in GameStop shares and other stocks were in compliance with federal regulations.

Robinhood CEO Vlad Tenev was pressed to answer whether Robinhood had liquidity problems in a tense back-and-forth. Tenev maintained that he “always felt comfortable with our liquidity,” and that the “additional capital we raised wasn’t to meet capital requirements.”

Keith Gill, who was able rile up 8.5 million Redditors to join him in his quest for a short squeeze, didn’t simply comment on the market as an influencer, he moved the market.

His actions raise an important question - if someone with enough social media followers, like Elon Musk and Chamath Palihapitiya, can simply move the market by posting, why should we conduct any fundamental investing analysis?

In the last two weeks we have witnessed a meteoric rise in Doge Coin and Bitcoin as a direct result of Musk’s erratic tweets.

Are we now in the age where Twitter and Reddit statements determine our entire investment strategy?

This Week By the Numbers 📈

Bitcoin continues to be the best performing asset in the market for the third week in a row, hitting another milestone —a $1 trillion market capitalization. Despite Biden’s aggressive $1.9 trillion stimulus plan, the stock market remains flat.

Still looking to make your first Bitcoin purchase? Here are a few of the resources I put together to start your Bitcoin journey:

Forbes: Your Mom’s Guide to Bitcoin

Why You Should Allocate 5% of Your Portfolio into Bitcoin

The Only Bitcoin Resources List You Will Ever Need

Top Stories 🗞

Elon Musk’s SpaceX raised $850 million, jumping valuation to about $74 billion

SpaceX completed an equity funding round of $850 million last week, people familiar with the financing told CNBC, sending the company’s valuation to about $74 billion. The company raised the new funds at $419.99 a share, those people said, or just 1 cent below the $420 price that Elon Musk made infamous in 2018. SpaceX’s latest funding round represents a jump of about 60% in the company’s valuation from its previous round in August, when SpaceX raised near $2 billion at a $46 billion valuation. Read Full Story.

MicroStrategy Raises $1.05B in Latest Debt-for-Bitcoin Offering

MicroStrategy CEO Michael Saylor said Friday the firm had completed a $1.05 billion debt offering, a raise that will allow the business intelligence company to buy another $1 billion in bitcoin. The raise is part of MicroStrategy’s dual business strategy of developing business intelligence software and also literally just buying as much bitcoin as it possibly can. MicroStrategy already has 71,039 of the coins. Read Full Story.

First Bitcoin ETF in North America is launching in Canada

The first exchange-traded fund tracking Bitcoin in North America begins trading in Toronto on Thursday, in a potential milestone moment for both the cryptocurrency and ETF industries. The Purpose Bitcoin ETF (ticker BTCC) provides exposure to the world’s largest cryptocurrency by investing directly in “physical/digital Bitcoin,” issuer Purpose Investments Inc. said in a statement. The fund will be available both in Canadian dollar and U.S. dollar units. Read Full Story.

Most Finance Chiefs Still Balk at Bitcoin on the Balance Sheet

Bitcoin’s march onto corporate balance sheets could be hampered by the crypto’s legendary volatility, according to a survey by Gartner released Tuesday that found only 5% of business executives intended to invest in bitcoin as a corporate asset this year. Eighty-four percent of polled executives (representing 77 firms) told Gartner in February they were spooked by "financial risk due to volatility of bitcoin" when considering whether to invest in the crypto. Bitcoin adoption could prove more fruitful in the long term – but not by much. By 2024 or later, 16% of polled executives said they expect their corporations to be investing in the crypto. Gartner found no difference between large and small organizations. Read Full Story.

VIP Investor List

I will start sending out occasional investment opportunities to those on my VIP investor list. Some of these will be fund investments, start-up investments, pre-IPO deals, crypto and digital assets opportunities, exclusive allocations… you get it. If you are an accredited investor and want to be on this list, send me a note.

Product of the Week 👀

Lolli.com lets you earn Bitcoin while you shop at your favorite online retailers like Bloomingdales, Nike, Expedia and thousands more. Check it out here and start accumulating Bitcoin today. [Available only in the U.S.]

Interested in joining the Myth Of Money as a sponsor? Reply to this email to learn more :)

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.